Cardinal Health Reports 13.5% YOY Revenue Increase in FY2023 Q4 Earnings

August 17, 2023

☀️Earnings Overview

CARDINAL HEALTH ($NYSE:CAH) announced its fourth quarter FY2023 earnings results on August 15 2023, with total revenue of 53453.0 million, a 13.5% year-over-year increase. Unfortunately, the reported net income was -64.0 million, a decrease from the 138.0 million reported in the prior year.

Analysis

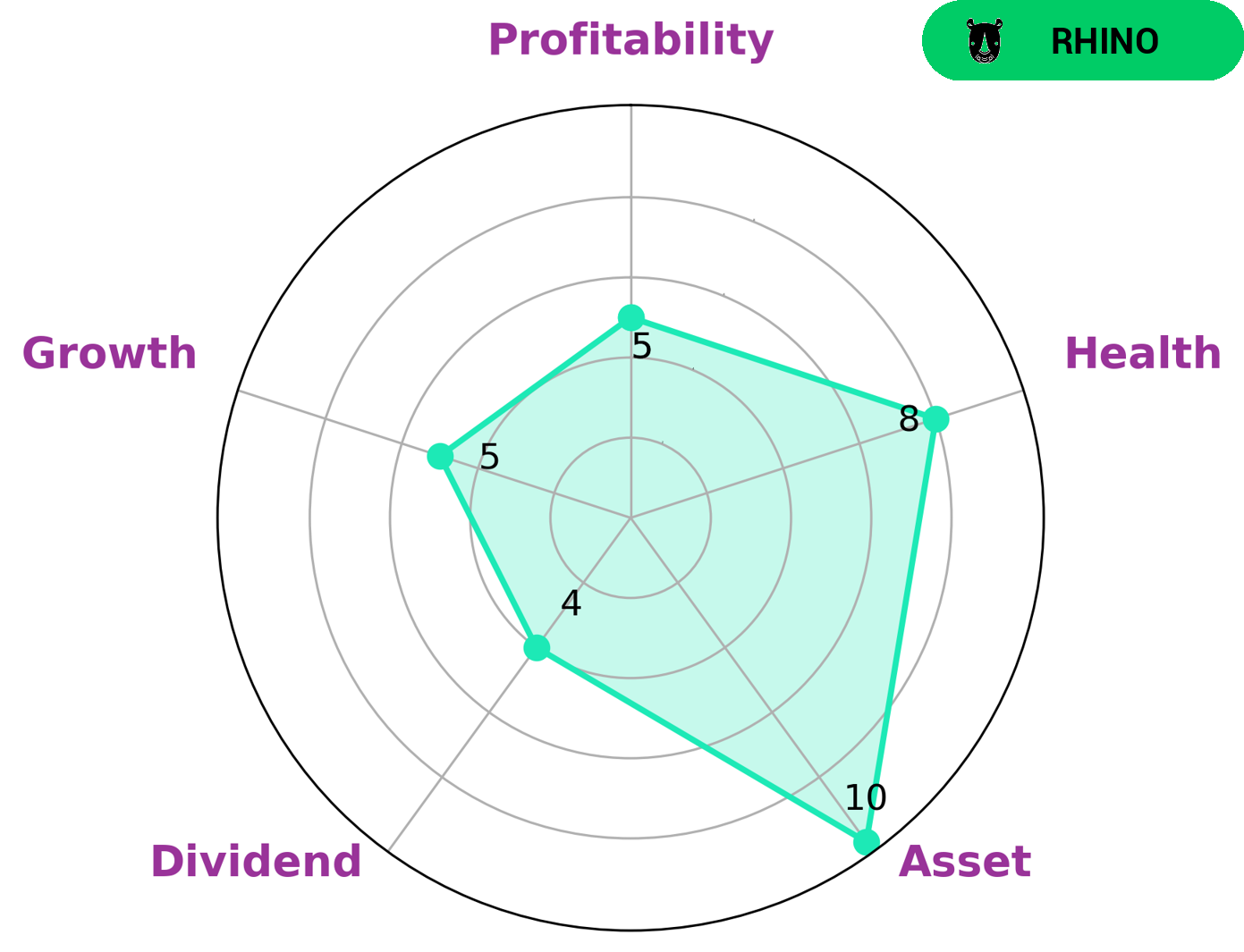

GoodWhale’s analysis of CARDINAL HEALTH reveals that the company is strong in asset and medium in dividend, growth, and profitability according to its Star Chart. CARDINAL HEALTH also has a high health score of 8/10, indicating that the company is capable to sustain future operations in times of crisis through its cashflows and debt. We classify CARDINAL HEALTH as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. This type of company may be of interest to investors who are looking for moderate growth with a secure financial foundation. Investors who are focused on long-term capital appreciation may also find value in the stability of CARDINAL HEALTH. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cardinal Health. More…

| Total Revenues | Net Income | Net Margin |

| 205.01k | 261 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cardinal Health. More…

| Operations | Investing | Financing |

| 2.84k | -454 | -3.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cardinal Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.42k | 46.27k | -11.2 |

Key Ratios Snapshot

Some of the financial key ratios for Cardinal Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | -0.0% | 0.4% |

| FCF Margin | ROE | ROA |

| 1.2% | -18.0% | 1.1% |

Peers

Its competitors are AmerisourceBergen Corp, McKesson Corp, and Sigma Healthcare Ltd.

– AmerisourceBergen Corp ($NYSE:ABC)

AmerisourceBergen Corp is a drug wholesaler that was founded in 1985. The company has a market cap of 32.4B as of 2022 and a return on equity of 417.0%. AmerisourceBergen Corp distributes prescription drugs and other healthcare products and services to healthcare providers and pharmaceutical companies. The company operates in two segments, Pharmaceutical Distribution and Other.

– McKesson Corp ($NYSE:MCK)

McKesson Corp is a healthcare services and information technology company. It has a market cap of 55.96B as of 2022 and a Return on Equity of -74.43%. The company provides a range of services and products to healthcare providers, payers, and consumers. These services and products include prescription drugs, medical supplies, and software and technology solutions.

– Sigma Healthcare Ltd ($ASX:SIG)

Sigma Healthcare Ltd is a pharmaceutical company with a market cap of 683.23M as of 2022 and a ROE of 0.46%. The company manufactures and distributes a range of prescription and over-the-counter medicines, medical devices, and other healthcare products.

Summary

CARDINAL HEALTH reported its FY2023 Q4 earnings results on August 15 2023 with total revenue of USD 53453.0 million, a year-over-year increase of 13.5%. Net income decreased from the prior year’s USD 138.0 million to USD -64.0 million, indicating a negative overall performance for investors. While the company did experience revenue growth, the significant decline in net income is concerning and may signal opportunities for short-term investors. Those looking for long-term returns may want to view the company’s performance over time before investing.

Recent Posts