Arrow Electronics Intrinsic Value – ARROW ELECTRONICS Reports Second Quarter FY2023 Earnings on August 3, 2023

August 15, 2023

🌥️Earnings Overview

On August 3 2023, ARROW ELECTRONICS ($NYSE:ARW) reported their earnings results for the second quarter of FY2023 (ended June 30 2023). Total revenue was USD 8514.5 million, representing a 10.0% decrease year-on-year. Meanwhile, net income for the quarter was USD 236.6 million, declining by 36.1% in comparison to the same quarter of the previous year.

Share Price

On Thursday, August 3, 2023, ARROW ELECTRONICS reported its second-quarter earnings for the fiscal year 2023. When the stock opened that morning, it was priced at $136.4 per share.

However, by the end of the trading day, the price had dropped by 9.6% to $127.7 per share. This was a decrease from the previous closing price of $141.3. This latest earnings report marks yet another quarter of declining profits for ARROW ELECTRONICS. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arrow Electronics. More…

| Total Revenues | Net Income | Net Margin |

| 35.84k | 1.2k | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arrow Electronics. More…

| Operations | Investing | Financing |

| 346.75 | -68.15 | -335.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arrow Electronics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.54k | 14.88k | 100.36 |

Key Ratios Snapshot

Some of the financial key ratios for Arrow Electronics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.4% | 31.6% | 5.2% |

| FCF Margin | ROE | ROA |

| 0.7% | 20.9% | 5.7% |

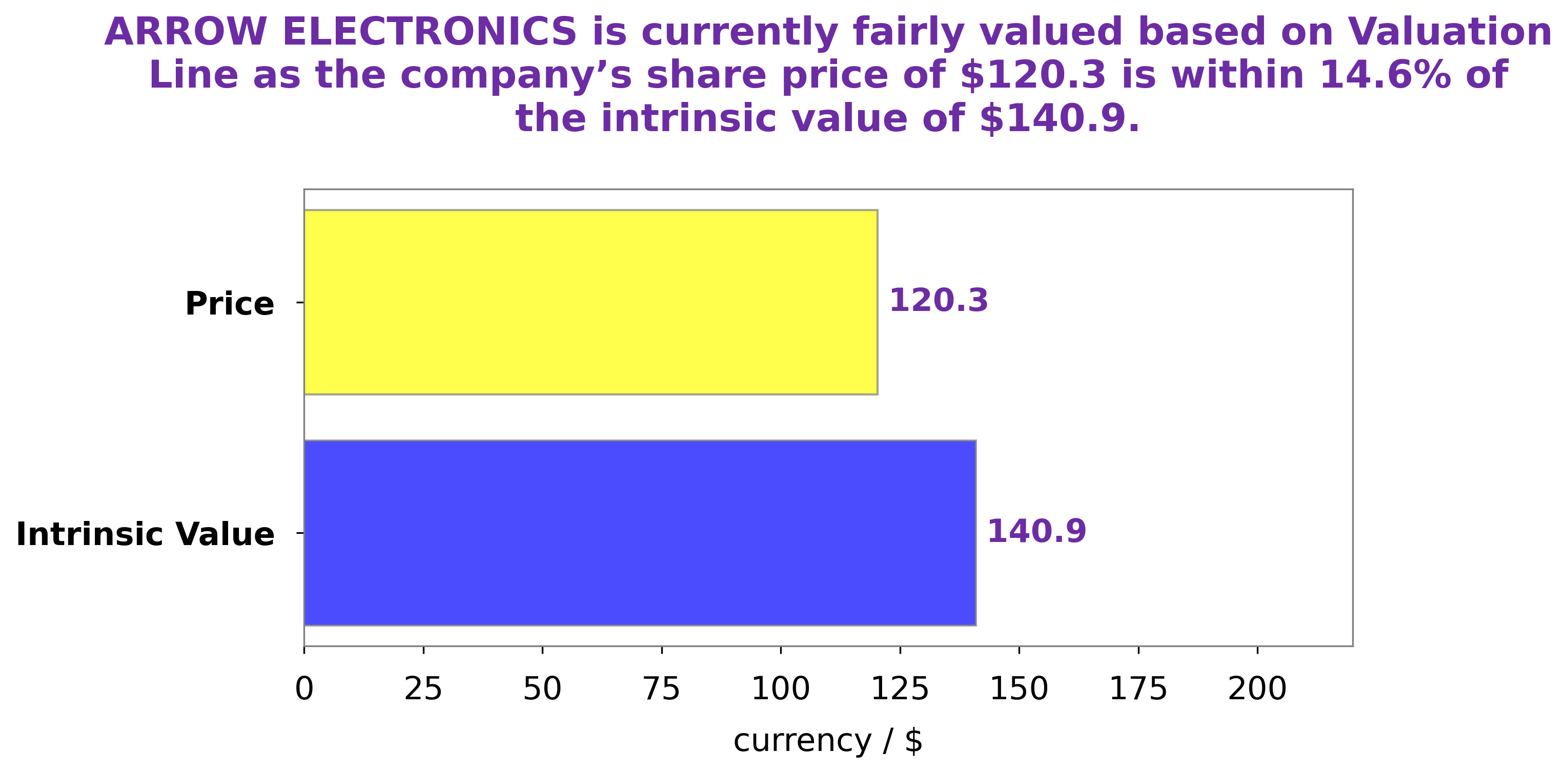

Analysis – Arrow Electronics Intrinsic Value

At GoodWhale, we take a deep dive into financials to provide our clients with the most accurate and up-to-date information. Our analysis of ARROW ELECTRONICS has revealed a fair value of around $142.8, calculated by our proprietary Valuation Line algorithm. This implies that the current market price of $127.7 is undervalued by 10.6%. We therefore believe ARROW ELECTRONICS presents an opportunity for investors to benefit from an attractive upside potential. Our analysis of ARROW ELECTRONICS is constantly being updated, so make sure to stay up to date with the latest news and insights. More…

Peers

Arrow Electronics Inc is one of the leading global distributors of electronic components and enterprise computing solutions. Its main competitors are Avnet Inc, Samsung Electro-Mechanics Co Ltd, and WPG Holding Co Ltd.

– Avnet Inc ($NASDAQ:AVT)

Avnet Inc is an American technology company headquartered in Phoenix, Arizona. The company is a distributor of electronic components, computer products and embedded technology. Avnet was founded in 1921 and has been publicly traded on the New York Stock Exchange since 1963.

As of 2021, Avnet has a market capitalization of $4.14 billion and a return on equity of 16.09%. The company is a distributor of electronic components, computer products and embedded technology. Avnet was founded in 1921 and has been publicly traded on the New York Stock Exchange since 1963.

– Samsung Electro-Mechanics Co Ltd ($KOSE:009150)

Samsung Electro-Mechanics Co Ltd is a South Korean electronics company that specializes in the manufacture of electronic components and devices. The company has a market capitalization of 10.31 trillion as of 2022 and a return on equity of 14.53%. Samsung Electro-Mechanics is a subsidiary of the Samsung Group and its products are used in a wide range of electronic devices, including mobile phones, televisions, computers and digital cameras.

– WPG Holding Co Ltd ($TWSE:3702)

WPG Holding Co Ltd is a leading electronics manufacturer and distributor in Greater China. The company has a market cap of $78.92 billion as of 2022 and a return on equity of 14.11%. WPG Holding Co Ltd is a vertically integrated company with a strong presence in the upstream and downstream segments of the electronics manufacturing value chain. The company has a diversified product portfolio that includes semiconductors, passive components, displays, and assembly and test services. WPG Holding Co Ltd is a major supplier to global electronics brands such as Apple, Huawei, and Xiaomi.

Summary

ARROW ELECTRONICS reported their Q2 FY2023 earnings on August 3 2023, revealing total revenue of USD 8514.5 million; a 10.0% decrease year-on-year. Net income for the quarter was USD 236.6 million, a 36.1% drop from the previous year. This caused investor concern and the stock price fell the same day.

Investors considering ARROW ELECTRONICS must assess the potential for long-term growth against the company’s current performance and risk profile, including its ability to drive down costs and return to profitability in future quarters. It is also important to consider the company’s financial strength and size relative to its competitors, as well as any additional risks associated with its industry.

Recent Posts