Arcos Dorados Reports FY2023 Q2 Earnings Results on August 17

August 23, 2023

🌥️Earnings Overview

On August 17, 2023, Arcos Dorados ($NYSE:ARCO) reported their financial results for the second quarter of FY2023, ending June 30th. Compared to the same period in the prior year, total revenues dropped to USD nan million and net income decreased to USD 0.0 million from 14.48 million.

Share Price

Arcos Dorados, the world’s largest McDonald’s franchisee, reported its earnings results for the second quarter of fiscal year 2023 on Thursday, August 17. The announcement caused the company’s stock to open at $10.3 and close at $9.9, a 6.8% drop from the previous closing price of 10.6. The earnings report highlighted areas of growth and improvement from the previous year, with a focus on increasing profits and expanding their customer base.

Overall, Arcos Dorados reported strong quarterly earnings and has positioned itself to continue to grow and succeed in the coming years. The company continues to focus on increasing profits and expanding their customer base with plans to open hundreds of new locations in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arcos Dorados. More…

| Total Revenues | Net Income | Net Margin |

| 3.82k | 140.34 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arcos Dorados. More…

| Operations | Investing | Financing |

| 307.79 | -284.67 | -62.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arcos Dorados. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.8k | 2.4k | 1.92 |

Key Ratios Snapshot

Some of the financial key ratios for Arcos Dorados are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.5% | 148.2% | 7.5% |

| FCF Margin | ROE | ROA |

| 1.0% | 62.1% | 6.4% |

Analysis

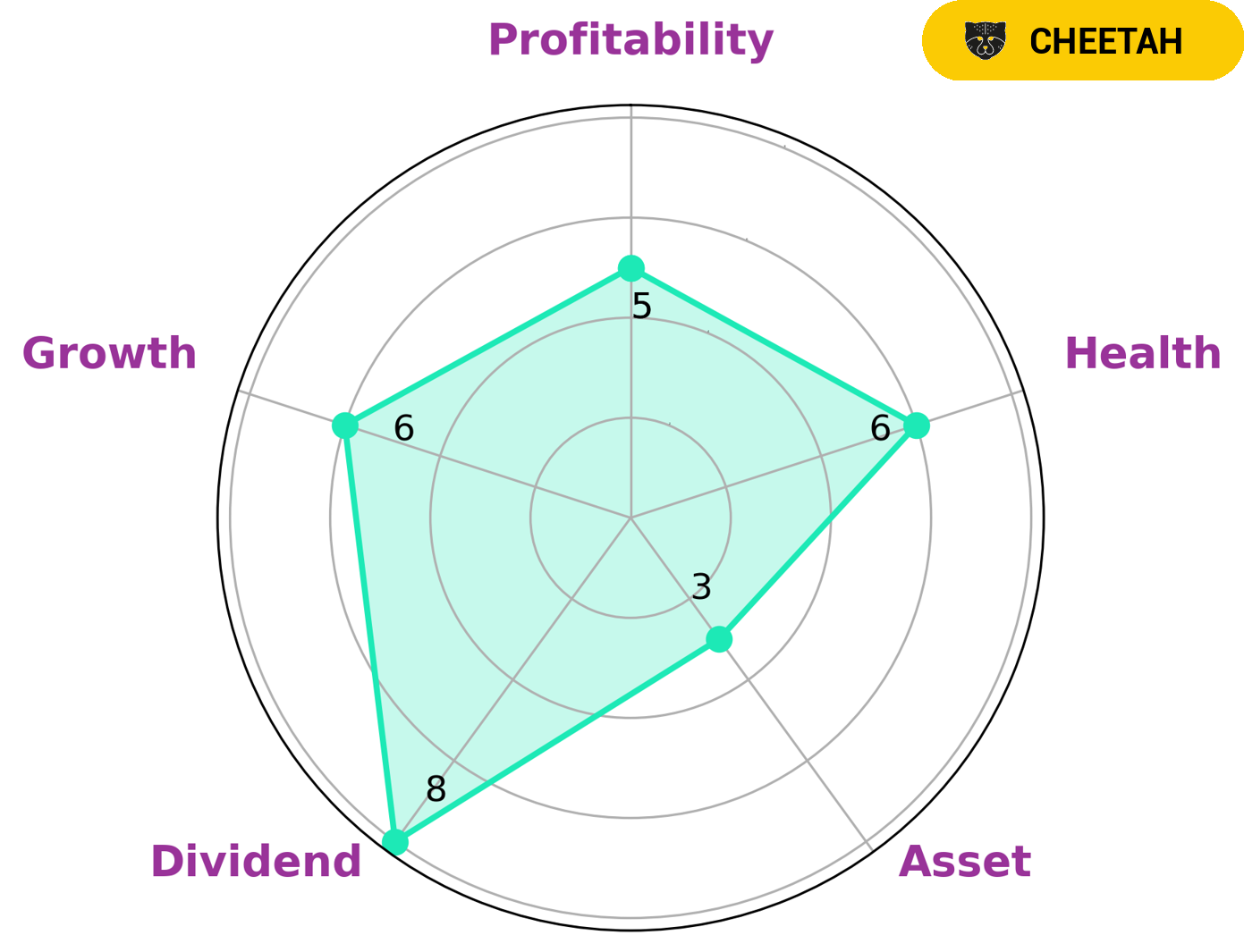

GoodWhale is analyzing the financials of ARCOS DORADOS and has classified it as a ‘cheetah’ on our Star Chart. This means that the company has achieved high revenue or earnings growth, however it is considered less stable due to lower profitability. Given this, what type of investors may be interested in such a company? ARCOS DORADOS has an intermediate health score of 6/10, which indicates that it is capable of sustaining future operations in times of crisis. In terms of the company’s individual performances, ARCOS DORADOS is strong in dividend payment, medium in growth and profitability, and weak in asset management. More…

Peers

Arcos Dorados Holdings Inc is the world’s largest franchisor of McDonald’s restaurants. The company operates or franchises over 1,700 McDonald’s restaurants in 20 countries and territories in Latin America and the Caribbean. Arcos Dorados is headquartered in Buenos Aires, Argentina. The company’s primary competitors are Del Taco Restaurants Inc, Amrest Holdings SE, and Alsea SAB de CV.

– Del Taco Restaurants Inc ($LTS:0OGQ)

Amrest Holdings SE is a holding company that operates in the restaurant and retail industry. It has a market cap of 4B as of 2022 and a return on equity of 14.44%. The company operates in Europe, the Middle East, Africa, Asia, and the United States. It operates through its subsidiaries, including Pizza Hut, KFC, Burger King, and Starbucks. The company was founded in 1993 and is headquartered in Warsaw, Poland.

– Amrest Holdings SE ($OTCPK:ALSSF)

Alsea SAB de CV is a Mexican holding company that operates in the food and beverage industry. Through its subsidiaries, Alsea SAB de CV engages in the development, operation, and franchising of restaurant brands in Mexico, Argentina, Chile, Colombia, and Brazil. As of 2022, Alsea SAB de CV had a market capitalization of 1.59 billion and a return on equity of 52.23%. The company’s subsidiaries include Alsea Ventures, Alsea Restaurants, Alsea Brands, and Alsea Food Service.

Summary

ARCOS DORADOS, a Latin American fast food restaurant chain, reported its earnings results for the second quarter of FY2023, ending June 30th, 2023. The company saw a decrease in total revenues compared to the same quarter of the previous year, amounting to USD nan million. Net income also declined, from USD 14.48 million to USD 0.0 million. The stock price suffered a decrease as a result on the same day.

For investors, this could be a sign of a potential downturn in the company’s performance. It is important to do further research on the company to understand why the decline in revenues and net income occurred and what the outlook is for future quarters. If it is clear that this could be the beginning of a downward trend, investors should consider selling their stock and looking for more promising opportunities.

Recent Posts