ARCOS DORADOS Reports FY2022 Q4 Earnings Results on December 31, 2022

March 22, 2023

Earnings Overview

ARCOS DORADOS ($BER:AD8) reported total revenue of USD 54.5 million and net income of USD 1018.6 million for the fourth quarter of fiscal year 2022, a 19.6% and 30.5% increase, respectively, compared to the same period in the previous year. The results were reported at the end of December 2022.

Market Price

On Wednesday, December 31, 2022, ARCOS DORADOS, the world’s largest McDonald’s franchisee, reported its financial results for the fourth quarter of FY2022. The report showed that ARCOS DORADOS stock opened at €7.4 and closed at €7.4, representing a 1.4% increase from the last closing price of 7.4. Ultimately, the company reported strong financial results for Q4 FY2022, indicating robust performance for the period. The results also demonstrate ARCOS DORADOS’ commitment to delivering shareholder value in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arcos Dorados. More…

| Total Revenues | Net Income | Net Margin |

| 3.38k | 45.49 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arcos Dorados. More…

| Operations | Investing | Financing |

| 345.44 | -259.65 | -59.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arcos Dorados. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.64k | 2.31k | 1.54 |

Key Ratios Snapshot

Some of the financial key ratios for Arcos Dorados are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.5% | 17.7% | 4.8% |

| FCF Margin | ROE | ROA |

| 3.8% | 38.1% | 3.4% |

Analysis

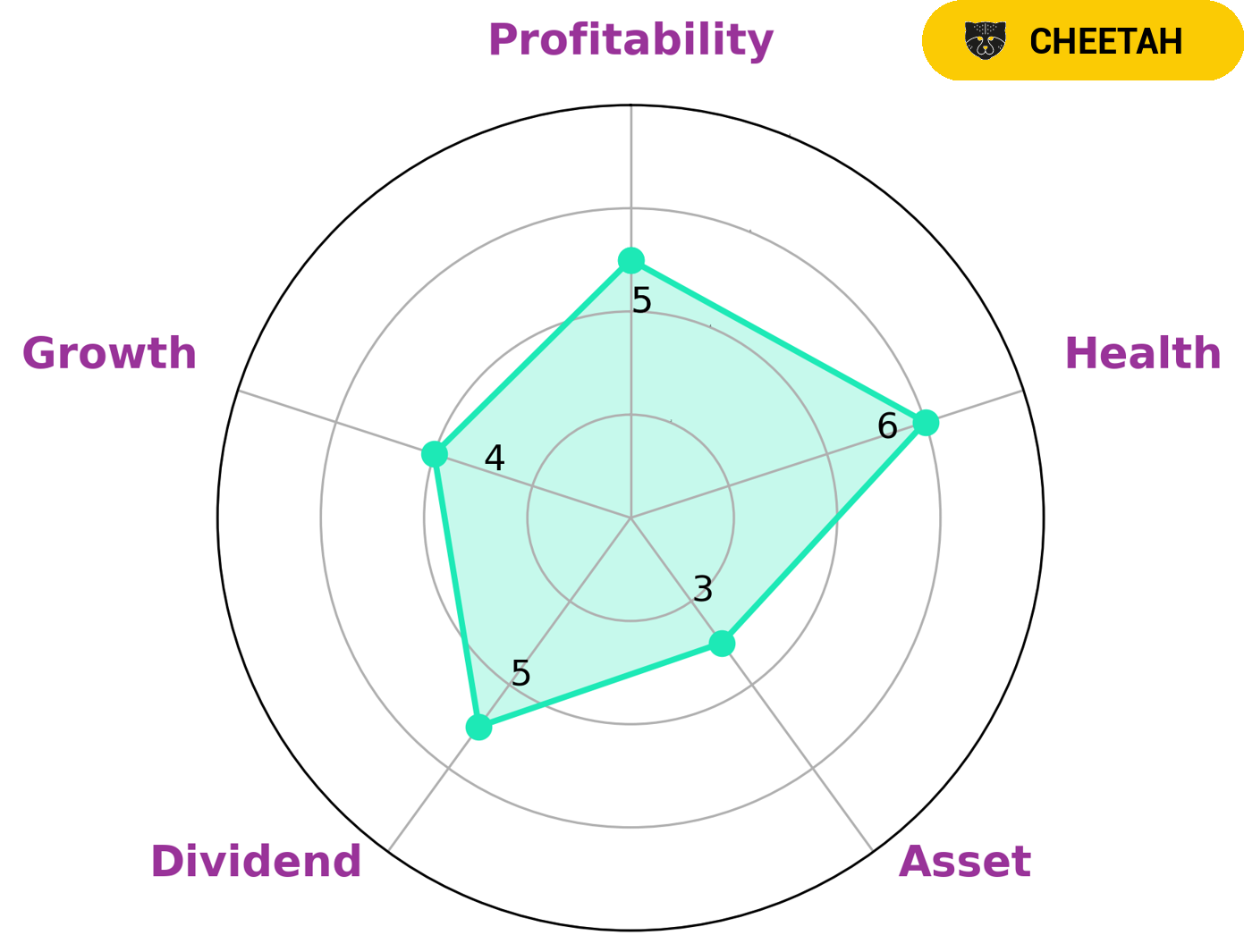

At GoodWhale, we conducted an analysis of ARCOS DORADOS‘s wellbeing. According to our Star Chart, ARCOS DORADOS is classified as ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. As a result, this could appeal to investors who are looking for fast growth and are willing to accept a certain level of risk. Furthermore, ARCOS DORADOS stands out in terms of medium dividend, growth, profitability and weak in asset. It also has an intermediate health score of 6/10 considering its cashflows and debt, suggesting that it might be able to sustain future operations in times of crisis. More…

Summary

ARCOS DORADOS reported strong financial results for the fourth quarter of FY2022, with total revenue of USD 54.5 million, representing a year-over-year increase of 19.6%. Net income for the period was USD 1018.6 million, up 30.5% year-over-year. The company’s impressive earnings growth indicates potential for investors, who should consider the company’s position in the market and its future plans in order to assess the best way to capitalize on their investments.

Recent Posts