“ARCEOLMITTAL SA Reports Fourth Quarter FY2022 Earnings Results with 93.6% Decrease in Total Revenue”.

March 25, 2023

Earnings Overview

ARCELORMITTAL ($BER:ARRJ): ARCEOLMITTAL SA announced their fourth quarter earnings results for FY2022 on December 31, 2022. Net income decreased by 18.8% year over year to USD 16.9 billion.

Stock Price

On Thursday, ARCELORMITTAL SA reported its fourth quarter fiscal year 2022 earnings results and the figures were not encouraging. The company’s total revenue for the quarter was down by a dramatic 93.6% compared to the same period last year. This was reflected in the stock market, with ARCELORMITTAL SA’s stock opening at €27.4 and closing at €27.2. The drastic drop in revenue was attributed to weak global demand for the steel products that the company manufactures and distributes, which in turn has caused a decrease in their production output.

Additionally, reduced capital expenditures, cost-cutting measures, and a significantly weaker euro have all been contributing factors to the dismal earnings report. In order to combat these issues, ARCELORMITTAL SA has taken steps to reduce costs while also increasing efficiency. They have also implemented a strategy of diversifying their product portfolio by expanding into new markets, including renewable energy. This has been successful in helping to boost the company’s overall profitability. Despite the difficult economic conditions, ARCELORMITTAL SA remains confident in their ability to weather the storm and come out stronger on the other side. The company has stated that they are focusing on their long-term strategy and remain committed to delivering value for their shareholders and customers alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Arcelormittal Sa. More…

| Total Revenues | Net Income | Net Margin |

| 79.84k | 9.3k | 11.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Arcelormittal Sa. More…

| Operations | Investing | Financing |

| 10.2k | -4.48k | -477 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Arcelormittal Sa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 94.55k | 38.96k | 66 |

Key Ratios Snapshot

Some of the financial key ratios for Arcelormittal Sa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | 37.4% | 14.7% |

| FCF Margin | ROE | ROA |

| 8.4% | 14.0% | 7.7% |

Analysis

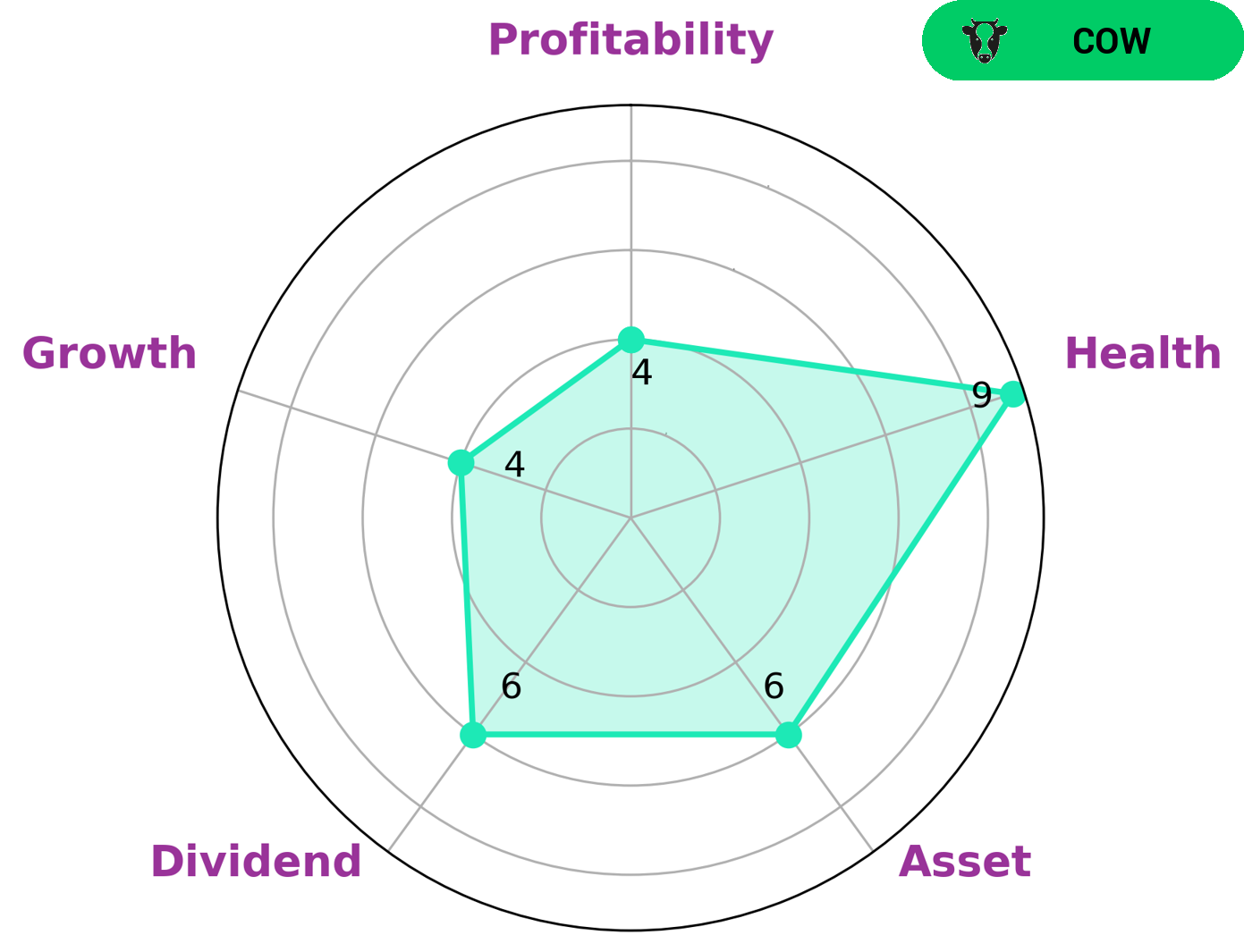

At GoodWhale, we have conducted an analysis of ARCELORMITTAL SA‘s fundamentals and have concluded that it is a ‘cow’ type of company. This means that it has a track record of paying out consistent and sustainable dividends. We believe that investors looking for a reliable source of income from dividend payments may be interested in this company. In addition, ARCELORMITTAL SA is considered to have a strong credit health score of 9/10 with regard to its cashflows and debt. This indicates that the company is capable of sustaining its operations in times of crisis. According to our Star Chart, ARCELORMITTAL SA is strong in liquidity, and medium in terms of asset, dividend, growth, and profitability. More…

Summary

ArcelorMittal SA‘s fourth quarter earnings results for FY2022 showed a significant decline in both revenue and net income year-over-year. Total revenue was down 93.6%, and net income decreased by 18.8%. Although the results were not what investors had expected, it is still important to take a closer look at the company’s fundamentals and analyze the long-term potential of investing in ArcelorMittal SA.

Investors should consider factors such as management, growth prospects, competitive position, financials and liquidity, and other risks associated with the stock, as well as the potential rewards. By doing so, investors can make an informed decision about whether investing in ArcelorMittal SA is right for them.

Recent Posts