Applovin Corporation Intrinsic Stock Value – APPLOVIN CORPORATION Reports Second Quarter Earnings Results for FY2023

August 12, 2023

🌥️Earnings Overview

APPLOVIN CORPORATION ($NASDAQ:APP) reported total revenue of USD 750.2 million and net income of USD 80.4 million for the second quarter of Fiscal Year 2023, ending June 30 2023.

Share Price

APPLOVIN CORPORATION reported its second quarter financial results for this fiscal year on Wednesday. The company’s stock opened at $30.0 and closed at $29.4, representing a decrease of 2.1% from the previous closing price of $30.0. APPLOVIN CORPORATION has seen a steady increase in revenue in recent quarters, which has been attributed to the growth in its core advertising business.

Additionally, the company reported an increase in operating profits for the second quarter of FY2023, due to improved efficiency. APPLOVIN CORPORAION’s gross margin also saw a notable increase over the same period. The company’s cash flow was boosted by its strong performance in the current quarter, with cash from operations increasing compared to the prior year. As the company moves into the third quarter of FY2023, APPLOVIN CORPORATION is looking to capitalize on its improved financial performance and continue to grow its core advertising business. The company has also announced plans to invest heavily in developing new technologies that will help it stay competitive in the marketplace. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Applovin Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.88k | 19.8 | 0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Applovin Corporation. More…

| Operations | Investing | Financing |

| 856.14 | -74.92 | -859.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Applovin Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.48k | 3.96k | 4.36 |

Key Ratios Snapshot

Some of the financial key ratios for Applovin Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.5% | – | 8.9% |

| FCF Margin | ROE | ROA |

| 29.3% | 9.4% | 2.9% |

Analysis – Applovin Corporation Intrinsic Stock Value

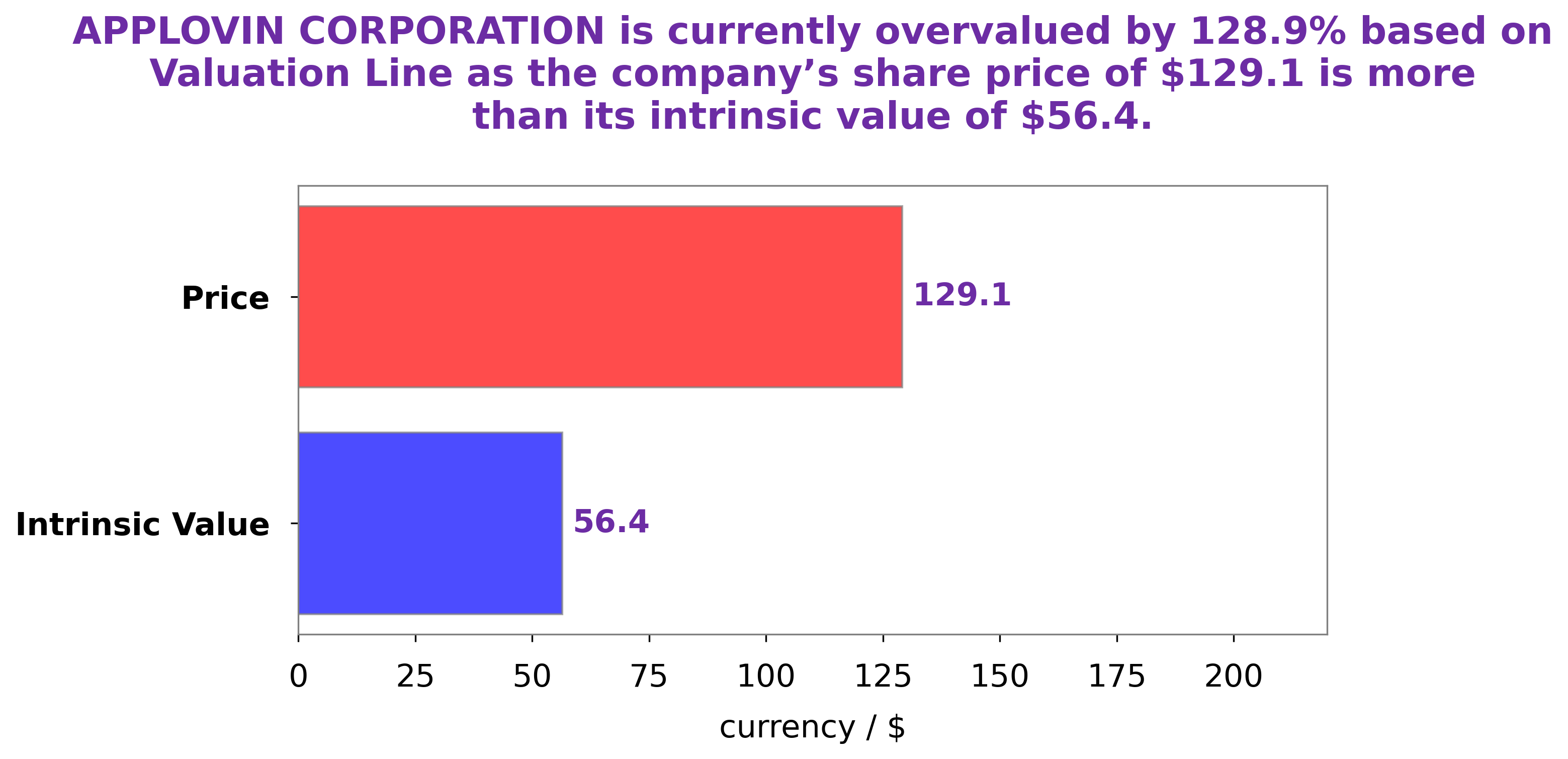

At GoodWhale, we have conducted an analysis of APPLOVIN CORPORATION‘s wellbeing. Our proprietary Valuation Line has determined that the fair value of APPLOVIN CORPORATION share should be around $51.4. However, the current stock is being traded at $29.4, representing a 42.8% undervaluation. As such, this presents an excellent opportunity for investors to buy and benefit from a potential future return on investment. More…

Peers

Its competitors include NeoMedia Technologies Inc, Artificial Life Inc, and Kange Corp.

– NeoMedia Technologies Inc ($OTCPK:NEOM)

NeoMedia Technologies, Inc. is a global leader in barcode scanning solutions for mobile devices. Its innovative technology enables users to scan and decode barcodes with their camera-enabled mobile device, making it easy and convenient for them to access digital content and services. The company has a strong portfolio of patents and licenses that cover a wide range of barcode scanning technologies. NeoMedia is headquartered in Atlanta, Georgia, USA, with offices in Europe, Asia and South America.

– Artificial Life Inc ($OTCPK:ALIF)

Artificial Life Inc is a publicly traded company with a market capitalization of 4.14 million as of 2022. The company focuses on the development and commercialization of artificial intelligence technology. Artificial Life’s return on equity is 6.65%.

– Kange Corp ($OTCPK:KGNR)

Kange Corp is a publicly traded company with a market capitalization of 125.47M as of 2022. The company has a Return on Equity of 51.01%.

Kange Corp is engaged in the business of providing engineering, construction and project management services. The company’s services include the design and construction of power plants, transmission lines, pipelines and other infrastructure projects.

Summary

APPLOVIN CORPORATION reported strong second quarter earnings results for FY2023, with total revenue of USD 750.2 million and net income of USD 80.4 million. This is a decrease in revenue of 3.4% year over year, but a significant increase in net income from -21.8 million in the previous year. For investors, the strong performance indicates APPLOVIN CORPORATION is a sound investment for the future, with reliable profits and potential growth in revenue.

Recent Posts