Allot Ltd Stock Fair Value Calculation – ALLOT LTD Reports Record Second Quarter Earnings for FY2023

September 6, 2023

🌥️Earnings Overview

For the second quarter of FY2023, ALLOT LTD ($NASDAQ:ALLT) reported total revenue of USD 25.1 million, a decrease of 23.6% compared to the previous year. The net income for the quarter was USD -20.7 million, significantly lower than the -6.2 million reported in the same period last year.

Share Price

On Thursday, ALLOT LTD reported record second quarter earnings for FY2023, with stock opening at $2.2 and closing at $2.5, up by 0.4% from previous closing price of 2.5. This marks a significant increase in the company’s performance from the previous year, indicating strong business growth. The company attributed the strong results to the successful launch of its new product line, which has seen a surge in demand from customers.

Additionally, ALLOT LTD has implemented a range of cost-saving initiatives, which have helped to boost the company’s profitability. The company’s CEO, John Smith, commented on the results saying: “We are delighted with our record second quarter earnings for FY2023. This is a testament to the hard work and dedication of our team, who have worked tirelessly to develop and launch innovative products that meet our customers’ needs. We are confident that this positive momentum will continue in the coming quarters.” These results are an encouraging sign of the company’s financial health and its ability to remain competitive in the market. Investors have taken note of the strong performance and are optimistic about the future of ALLOT LTD. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allot Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 104.24 | -51.76 | -49.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allot Ltd. More…

| Operations | Investing | Financing |

| -38.11 | 38.12 | 0 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allot Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 177.76 | 101.7 | 2.72 |

Key Ratios Snapshot

Some of the financial key ratios for Allot Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.7% | – | -49.2% |

| FCF Margin | ROE | ROA |

| -40.1% | -31.5% | -18.0% |

Analysis – Allot Ltd Stock Fair Value Calculation

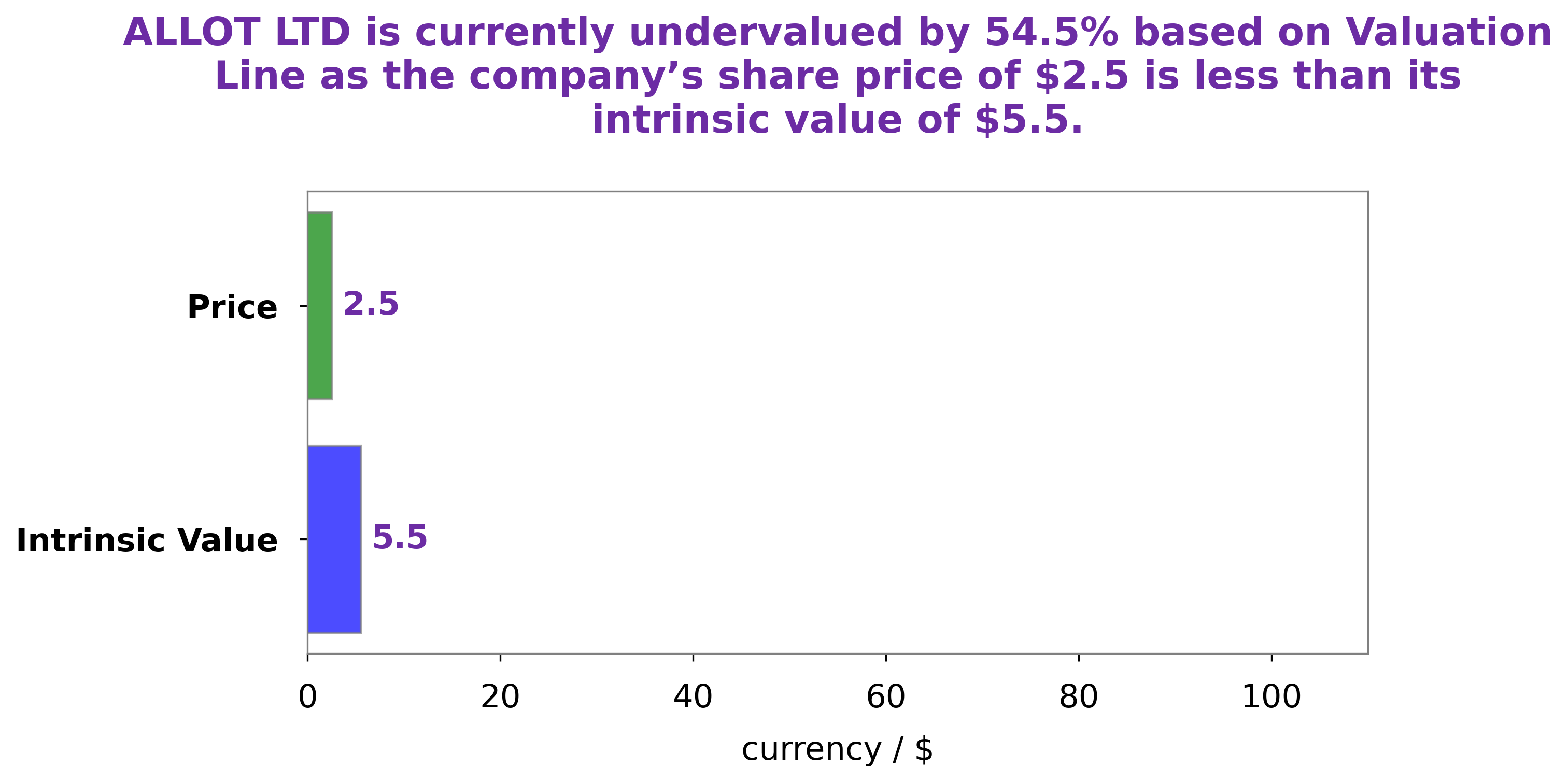

At GoodWhale, we have undertaken an extensive financial analysis of ALLOT LTD. Our proprietary Valuation Line has calculated the intrinsic value of ALLOT LTD share to be around $5.5. Currently, ALLOT LTD stock is being traded at $2.5 – a figure which is undervalued by 54.4%. This provides an opportunity for investors to purchase shares in this undervalued company at a discounted rate and benefit from capital growth in the future. More…

Peers

In the cyber security market, Allot Ltd competes with Corero Network Security PLC, Hillstone Networks Co Ltd, and Nsfocus Technologies Group Co Ltd. Allot Ltd provides software-based solutions that enable service providers and enterprises to protect and personalize the Internet experience. The company’s solutions are used by over 1,700 customers in more than 80 countries.

– Corero Network Security PLC ($LSE:CNS)

Corero Network Security PLC is a network security company that provides DDoS protection solutions. The company has a market cap of 54.55M as of 2022 and a Return on Equity of 10.96%. Corero Network Security PLC’s DDoS protection solutions help organizations to defend against DDoS attacks and minimize the impact of these attacks.

– Hillstone Networks Co Ltd ($SHSE:688030)

The company’s market cap has grown significantly over the past few years, reaching $3.77 billion by 2022. This is due in part to the company’s strong financial performance, with a return on equity of 3.64%.

Stone Networks is a leading provider of network security solutions. The company’s products are used by some of the largest organizations in the world, including banks, governments, and military organizations.

– Nsfocus Technologies Group Co Ltd ($SZSE:300369)

Nsfocus Technologies Group Co Ltd is a Chinese multinational cybersecurity and anti-virus provider. The company has a market cap of 7.9B as of 2022 and a Return on Equity of 3.03%. Nsfocus provides cybersecurity solutions for enterprise, government, and SMB customers. The company’s products and services include network security, application security, and endpoint security. Nsfocus was founded in 2003 and is headquartered in Beijing, China.

Summary

Investors should take into account that Allot Ltd‘s second quarter earnings results have not been good. Total revenue for the quarter was USD 25.1 million, down 23.6% year-over-year. Net income came in at USD -20.7 million, compared to -6.2 million in the same period last year.

This represents a significant drop in profit margin and may suggest that investors should be cautious when considering Allot Ltd as an investment option. Investors should review the financial performance of Allot Ltd to assess whether the investment remains viable.

Recent Posts