ALLOT Communications Set to Report Quarterly Earnings Tuesday, Register for Conference Call Now!

May 12, 2023

Trending News 🌥️

ALLOT ($NASDAQ:ALLT) Communications is set to release its quarterly earnings report on Tuesday, May 16, before the market opens. As a leading provider of Network Intelligence and Security-as-a-Service solutions for Communications and Service Providers, Allot Communications has seen a significant increase in its stock price over the past year. The company’s technology has become a critical component of digital transformation strategies, enabling operators to launch innovative services and monetize the digital economy. Investors interested in hearing the earnings announcement and getting an update on the company’s progress can register for the conference call to discuss the earnings report.

Zacks provides a variety of information related to the company’s financial performance, including revenue, profit and loss, as well as key financial metrics. As Allot Communications continues to innovate and expand its portfolio of solutions, investors should expect to see strong growth in its stock price in the future.

Earnings

As of the end of December 31 2022, ALLOT LTD reported a total revenue of 33.03M USD, but experienced a net income loss of 6.74M USD. Compared to the previous year, there was a 19.4% decrease in total revenue. Over the last three years, ALLOT LTD’s total revenue has steadily declined from 39.09M USD to 33.03M USD. Investors and analysts alike are eager to hear more details about how the company plans to reverse this trend in the upcoming conference call.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allot Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 122.74 | -32.03 | -26.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allot Ltd. More…

| Operations | Investing | Financing |

| -32.56 | -6.51 | 39.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allot Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 212.95 | 110.98 | 3.39 |

Key Ratios Snapshot

Some of the financial key ratios for Allot Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.7% | – | -26.3% |

| FCF Margin | ROE | ROA |

| -31.1% | -16.0% | -9.5% |

Stock Price

The company, which provides advanced network and security solutions for service providers and enterprises, is expected to post strong numbers for the quarter. Yesterday, ALLOT LTD‘s stock opened at $2.7 and closed at $2.8, up by 2.2% from its previous closing price of $2.7. Investors will be closely watching the company’s announcement on Tuesday to gauge the performance of the company and whether the stock price will be further impacted.

The company has set up a conference call for Wednesday for investors interested in hearing more about the quarterly results. All interested parties are encouraged to register now to ensure they receive the latest information. Live Quote…

Analysis

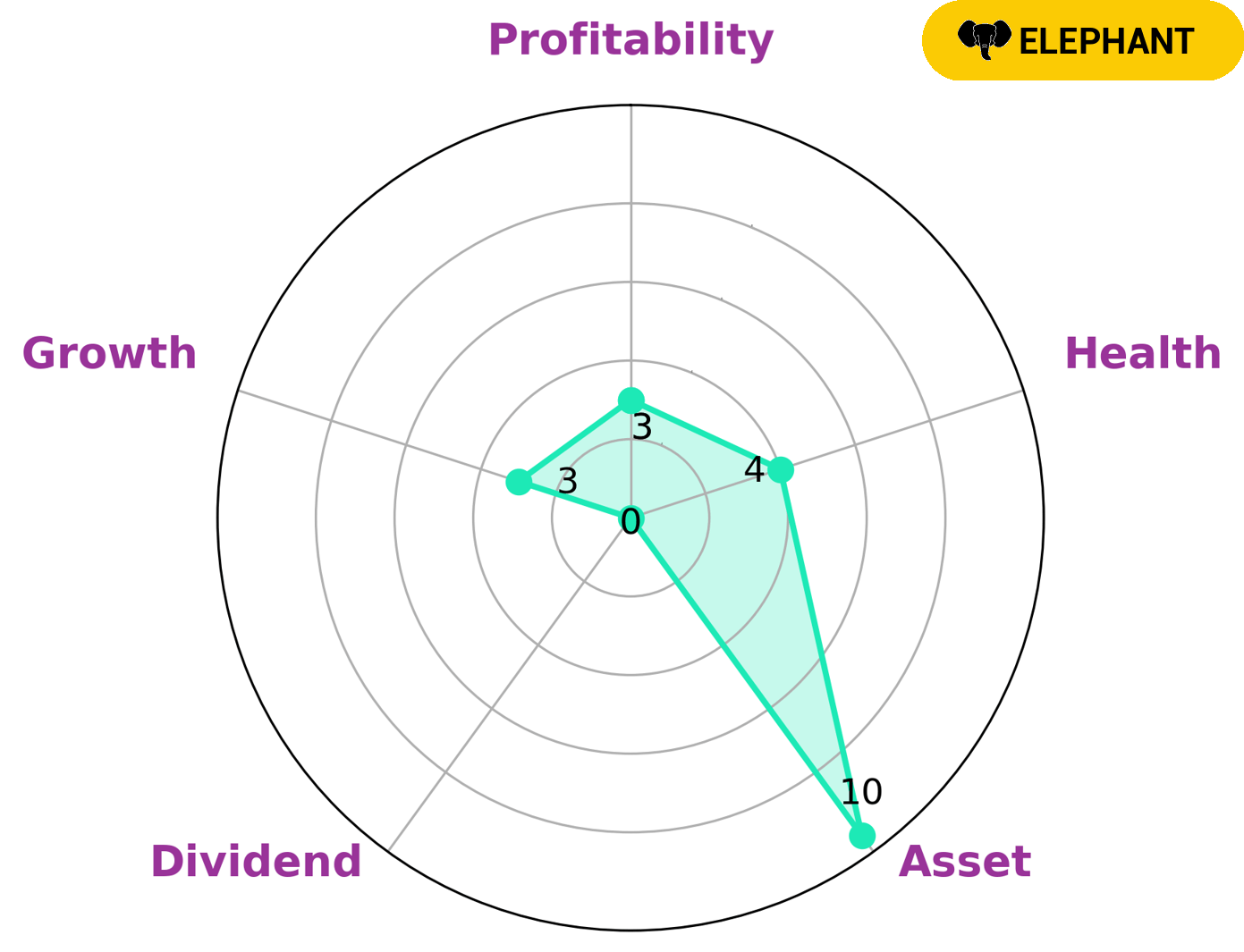

GoodWhale has conducted an analysis of ALLOT LTD‘s wellbeing and the results show that the company has been classified as an ‘elephant’ type, meaning that it is rich in assets after deducting off liabilities. This type of company may be of interest to investors who want to capitalize on the strong asset base but may not be as motivated by dividends, growth, and profitability. The Star Chart reveals that ALLOT LTD has an intermediate health score of 4/10 considering its cashflows and debt. While this indicates that the company may not be performing exceptionally well, it also suggests that it may still be able to pay off debt and fund future operations. Overall, this analysis shows that ALLOT LTD is strong in asset but weak in dividend, growth, and profitability – making it an attractive option for certain types of investors. More…

Peers

In the cyber security market, Allot Ltd competes with Corero Network Security PLC, Hillstone Networks Co Ltd, and Nsfocus Technologies Group Co Ltd. Allot Ltd provides software-based solutions that enable service providers and enterprises to protect and personalize the Internet experience. The company’s solutions are used by over 1,700 customers in more than 80 countries.

– Corero Network Security PLC ($LSE:CNS)

Corero Network Security PLC is a network security company that provides DDoS protection solutions. The company has a market cap of 54.55M as of 2022 and a Return on Equity of 10.96%. Corero Network Security PLC’s DDoS protection solutions help organizations to defend against DDoS attacks and minimize the impact of these attacks.

– Hillstone Networks Co Ltd ($SHSE:688030)

The company’s market cap has grown significantly over the past few years, reaching $3.77 billion by 2022. This is due in part to the company’s strong financial performance, with a return on equity of 3.64%.

Stone Networks is a leading provider of network security solutions. The company’s products are used by some of the largest organizations in the world, including banks, governments, and military organizations.

– Nsfocus Technologies Group Co Ltd ($SZSE:300369)

Nsfocus Technologies Group Co Ltd is a Chinese multinational cybersecurity and anti-virus provider. The company has a market cap of 7.9B as of 2022 and a Return on Equity of 3.03%. Nsfocus provides cybersecurity solutions for enterprise, government, and SMB customers. The company’s products and services include network security, application security, and endpoint security. Nsfocus was founded in 2003 and is headquartered in Beijing, China.

Summary

Allot Ltd. Analysts are expecting mixed results from the company, with some expecting growth and others predicting a decline in earnings. Investors will be closely examining the company’s performance in comparison to previous quarters and industry standards to gauge its future potential.

Additionally, analysts will be looking at the company’s cash flow, debt levels, and investment activity to determine whether or not the stock is a worthwhile investment in the current market. Allot Ltd. has demonstrated strong performance in the past and analysts will be watching to see if the company can continue its success going forward.

Recent Posts