AICHI STEEL Reports Earnings Results for Third Quarter of FY2023, As Of December 31 2022.

April 5, 2023

Earnings Overview

AICHI STEEL ($TSE:5482) announced the financial results for the third quarter of the fiscal year ending December 31 2022, showing total revenue of JPY -10.0 million, a decline of 102.7% year-over-year. Net income was JPY 69876.0 million, up 3.4% compared to the same period in the previous year.

Share Price

The company’s stock opened at JP¥2223.0 and closed at JP¥2219.0, up by 0.8% from its last closing price of 2202.0. This marks a strong quarter for AICHI STEEL, which saw its stock price increase despite the turbulent market conditions. Going forward, the company will continue to focus on creating value for its shareholders and pursuing profitable growth initiatives. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aichi Steel. More…

| Total Revenues | Net Income | Net Margin |

| 279.26k | -793 | -0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aichi Steel. More…

| Operations | Investing | Financing |

| 11.4k | -15.08k | 16.94k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aichi Steel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 383.44k | 169.43k | 10.39k |

Key Ratios Snapshot

Some of the financial key ratios for Aichi Steel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.3% | -34.5% | 0.2% |

| FCF Margin | ROE | ROA |

| -1.3% | 0.2% | 0.1% |

Analysis

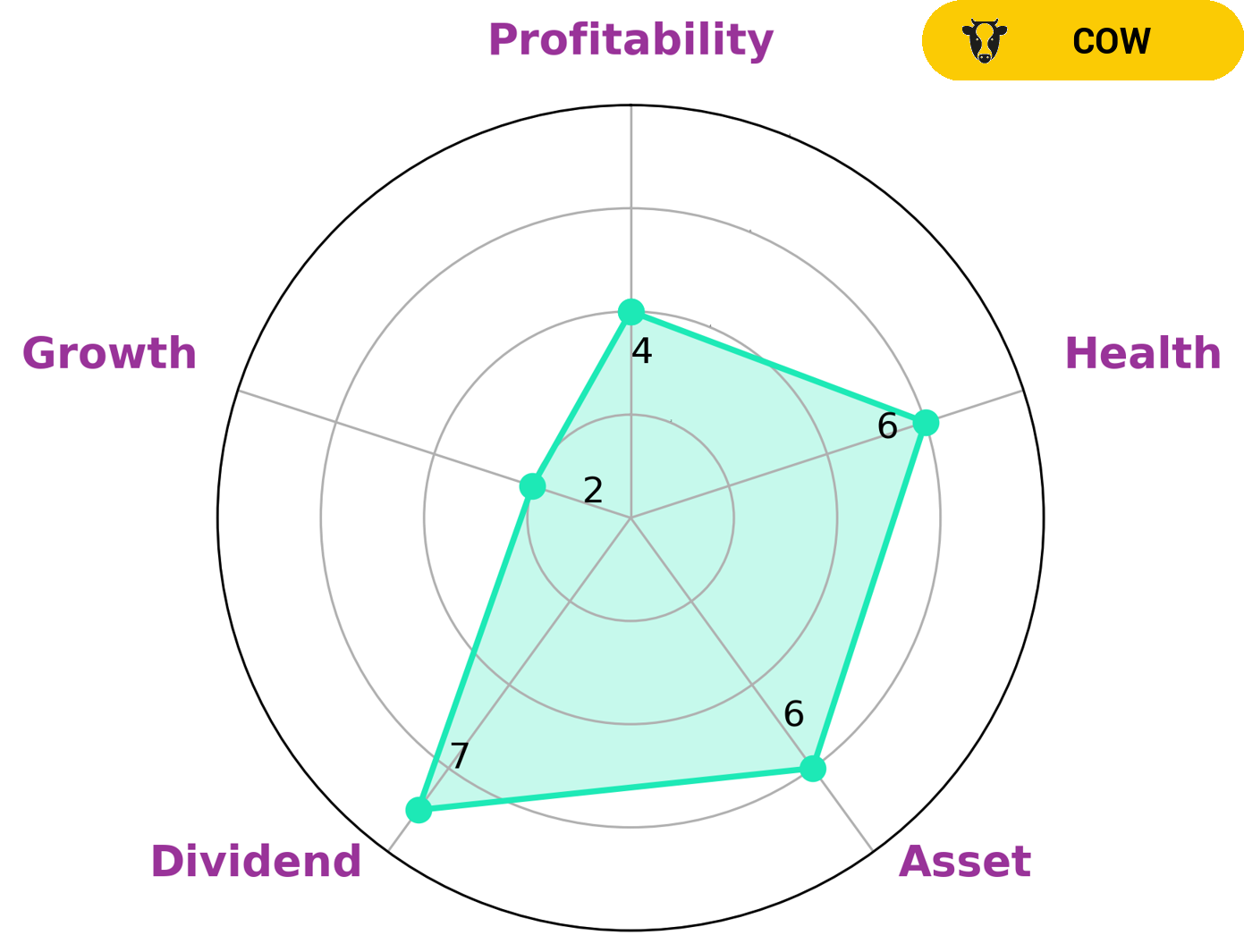

At GoodWhale, we have conducted an analysis of AICHI STEEL‘s wellbeing. According to our Star Chart, AICHI STEEL is strong in dividend, medium in asset, profitability and weak in growth. We have given AICHI STEEL an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that the company is likely to safely ride out any crisis without the risk of bankruptcy. We have classified AICHI STEEL as a ‘cow’, meaning it has a track record of paying out consistent and sustainable dividends. This type of company would be attractive to investors who are looking for long-term investments, such as retirees and those seeking income stability. Furthermore, AICHI STEEL may also be attractive to value investors who are looking to buy companies that are undervalued or out of favor but may have strong long-term prospects. Investors who are looking for capital appreciation may also be interested in AICHI STEEL as its stock price may increase if the company is able to improve its profitability and growth. More…

Peers

Aichi Steel Corp’s main competitors include Yieh United Steel Corp, Dai Thien Loc Corp, and Sheng Yu Steel Co Ltd. All these companies strive to stay ahead of their competition by developing innovative steel products and services.

– Yieh United Steel Corp ($TPEX:9957)

Yieh United Steel Corp is a leading steel producer based in Taiwan. The company specializes in the production of cold-rolled and hot-rolled steel sheets, galvanized steel sheets, stainless steel and other related products. With a market cap of 23.51B as of 2023, Yieh United Steel Corp is well-positioned to continue to expand its operations and capitalize on growth opportunities. The company’s Return on Equity (ROE) of 19.87% also indicates a positive financial performance. This is a strong indication of Yieh United Steel Corp’s ability to generate profits for its shareholders. In addition, the company’s strong financial position should enable it to make strategic investments and acquisitions that can further strengthen its market presence.

– Dai Thien Loc Corp ($HOSE:DTL)

Sheng Yu Steel Co Ltd is a leading steel producer with a market cap of 8.37B as of 2023. The company specializes in manufacturing carbon steel, alloy steel, stainless steel, and other related products. Sheng Yu Steel Co Ltd is a highly profitable company with a Return on Equity (ROE) of 4.22%. This indicates that the company is effectively using its equity to generate returns for its shareholders.

Summary

AICHI STEEL has seen an overall improvement in performance for the third quarter of FY2023. Total revenue for the quarter decreased dramatically by 102.7% compared to the same period a year ago, however net income increased by 3.4%. This signals potential for investors looking to get involved in AICHI STEEL, particularly if the company is able to maintain similar levels of growth in the future. However, investors should use caution when making any decision to invest in AICHI STEEL, as economic conditions could always change and impact the company’s performance.

Recent Posts