ADVANCED ENERGY INDUSTRIES Reports FY2022 Q4 Earnings Results for Quarter Ended December 31 2022

March 19, 2023

Earnings Overview

On February 8 2023, ADVANCED ENERGY INDUSTRIES ($NASDAQ:AEIS) released their earnings report for the 4th quarter of FY2022, which ended on December 31 2022.

Transcripts Simplified

Advanced Energy Industries reported strong fourth quarter financial results, with revenue of $491 million and an EPS of $1.70. Revenue in the semiconductor market was up 30% year-over-year, though backlog declined to $875 million due to changes in ordering patterns and export control regulations. Revenue in the industrial and medical market was up 21% year-over-year, while data center computing, telecom, and networking revenue were up 18%, 15%, and 8% respectively. Gross margin was 36.6% and operating expenses were $101 million.

Operating margin was 16%, while adjusted EBITDA was $87 million. Non-GAAP other expense was $1.1 million on better interest earnings, partially offset by foreign exchange losses.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AEIS. More…

| Total Revenues | Net Income | Net Margin |

| 1.85k | 199.66 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AEIS. More…

| Operations | Investing | Financing |

| 183.59 | -208.27 | -61.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AEIS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.99k | 925.9 | 28.49 |

Key Ratios Snapshot

Some of the financial key ratios for AEIS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.7% | 59.2% | 13.0% |

| FCF Margin | ROE | ROA |

| 6.8% | 14.6% | 7.5% |

Market Price

AEI’s stock opened at $96.1 and closed at $97.2, representing a 0.4% decrease from the previous closing price of 97.7.

Additionally, its services and solutions segment saw a 13% jump in revenue, as a result of higher demand for its services in the first half of the year. AEI also reported strong margins, with gross margin coming in at 37%. Overall, AEI’s strong performance in the fourth quarter of 2022 is indicative of their continued success in the energy industry. The company’s technological advancements and strategic acquisitions have enabled them to remain competitive and capitalize on growth opportunities, which indicates that their future prospects remain promising. Live Quote…

Analysis

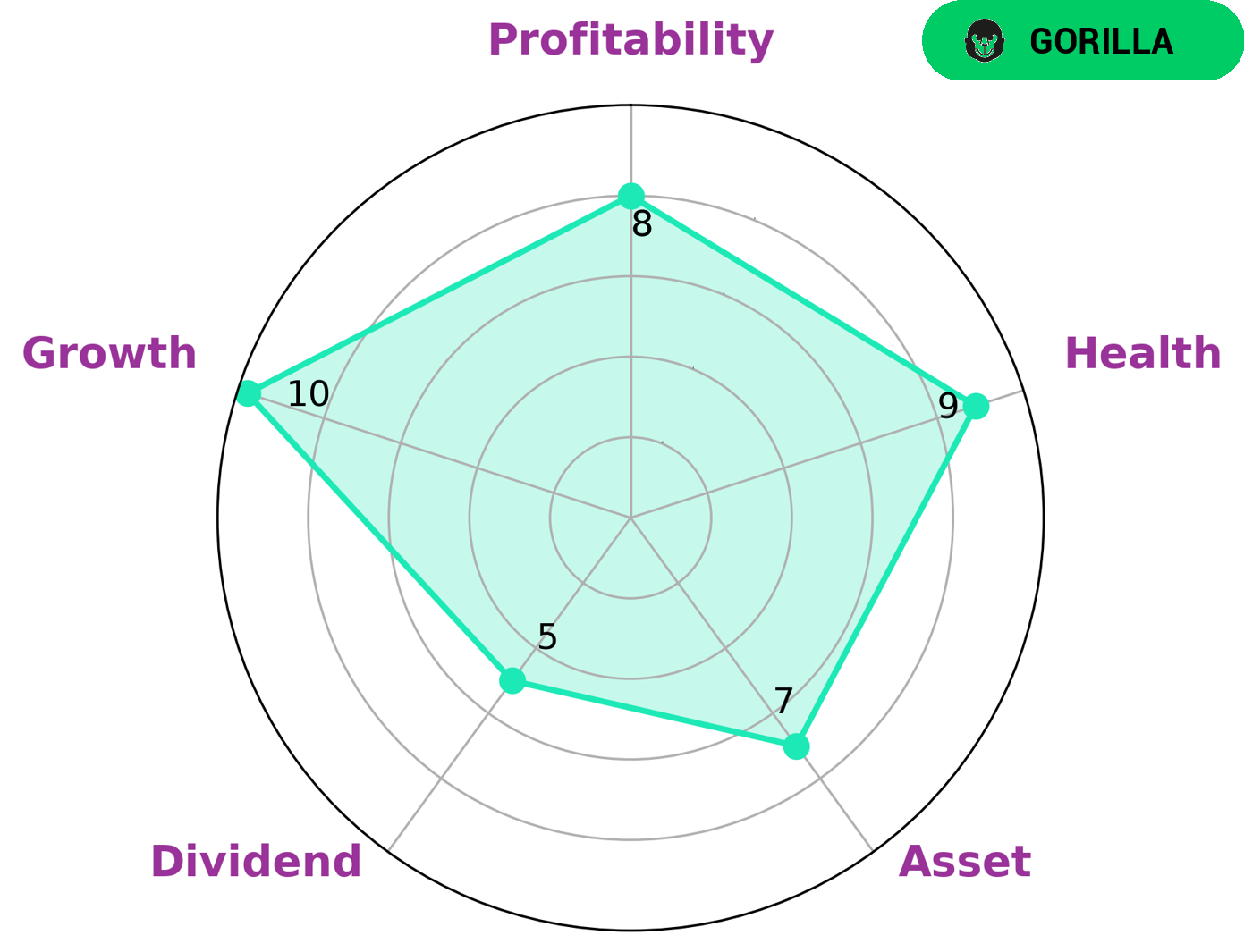

GoodWhale has conducted an in-depth analysis of ADVANCED ENERGY INDUSTRIES’s wellbeing, based on Star Chart. Our findings indicate that ADVANCED ENERGY INDUSTRIES is strong in asset growth, profitability and medium in dividend. Additionally, the company has a high health score of 9/10 due to its strong cashflows and debt and is able to sustain future operations in times of crisis. Based on this analysis, ADVANCED ENERGY INDUSTRIES is classified as a ‘gorilla’, a term we use to describe companies that have achieved stable and high revenue or earnings growth due to their strong competitive advantage. Investors who are looking for investments with a strong competitive edge and excellent financial health may be interested in this type of company. More…

Peers

The competition between Advanced Energy Industries Inc and its competitors is fierce. All of the companies are vying for market share in the highly competitive solar industry. Advanced Energy Industries Inc has a strong product portfolio and a strong presence in the market.

However, its competitors are also strong and have their own strengths.

– Hiwin Mikrosystem Corp ($TWSE:4576)

Hiwin Mikrosystem Corp is a technology company that specializes in the manufacture of micro-precision products and components. The company has a market cap of 7.85 billion as of 2022 and a return on equity of 8.73%. Hiwin Mikrosystem Corp is a publicly traded company listed on the Taiwan Stock Exchange. The company’s products are used in a variety of industries including automotive, aerospace, electronics, and medical.

– Kinergy Corp Ltd ($SEHK:03302)

Kinergy Corp. Ltd., through its subsidiaries, engages in the exploration and production of oil and gas in the United States. The company was founded in 2004 and is headquartered in Perth, Australia.

– Sinfonia Technology Co Ltd ($TSE:6507)

Sinfonia Technology Co., Ltd. is a Japanese company that manufactures and sells electronic and electrical products. It has a market capitalization of 38.5 billion as of 2022 and a return on equity of 11.24%. The company’s products include semiconductors, printed circuit boards, and electronic components. It also provides contract manufacturing services.

Summary

ADVANCED ENERGY INDUSTRIES recently reported their FY2022 Q4 earnings results, showing improvement both in revenue and net income. Total revenue for the quarter was USD 43.7 million, a 10.3% increase compared to last year, while net income was USD 490.7 million, up 23.6% year over year. This indicates a strong financial performance and suggests that the company may be a good investment opportunity. Investors should take into consideration the company’s growth and profitability trends, as well as its competitive positioning in the industry and its future strategies, when making their decision.

Recent Posts