ADECOAGRO S.A Reports Fourth Quarter FY2022 Earnings Results.

March 21, 2023

Earnings Overview

ADECOAGRO S.A ($NYSE:AGRO) announced the financial results for the fourth quarter of FY2022 that concluded on December 31, 2022. Total revenue had plummeted 95.4% year-over-year to USD 2.7 million, while reported net income had jumped 11.2% to USD 371.6 million in comparison to the same period of the prior year.

Transcripts Simplified

At this time, all participants are in a listen-only mode. Later we will conduct a question-and-answer session and instructions will follow at that time. As a reminder, today’s conference is being recorded. This was mainly due to higher sales volumes and improved productivity, which enabled us to keep costs low and increase margins. Going forward, we remain focused on our strategic goals of improving operational performance and increasing revenues through expanding our product portfolio and launching new products in international markets. We are confident that these strategies will help us continue to deliver strong results in the coming quarters. We thank you for joining us today and look forward to providing you with updates on our progress in the future.

Operator: Ladies and gentlemen, at this time, I would now like to turn the call over to Mr. Calisto for closing remarks. Chief Executive Officer, Miguel Angel Calisto: Thank you for joining us today and for your continued support of Adecoagro. We are confident that our strong financial performance in the first quarter is a sign of further success in the future as we continue our efforts to expand our product portfolio, launch new products and increase revenues. We look forward to sharing our progress with you in the coming quarters. Thank you again for your support.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Adecoagro S.a. More…

| Total Revenues | Net Income | Net Margin |

| 1.35k | 108.14 | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Adecoagro S.a. More…

| Operations | Investing | Financing |

| 370.03 | -299.26 | -23.57 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Adecoagro S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.11k | 1.95k | 10.29 |

Key Ratios Snapshot

Some of the financial key ratios for Adecoagro S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.0% | 27.2% | 16.1% |

| FCF Margin | ROE | ROA |

| 10.4% | 12.0% | 4.4% |

Stock Price

The company’s stock opened at $7.9 and closed at $7.7, representing a 2.4% decrease from its prior closing price at $7.9. Additionally, the company reported that their operating expenses had increased by 10%, due to higher labor costs and other costs associated with the pandemic. The company’s stock price also decreased as a result of these results. Going forward, ADECOAGRO S.A will need to focus on reducing operating costs and increasing sales in order to return to profitability and increase its stock price. Live Quote…

Analysis

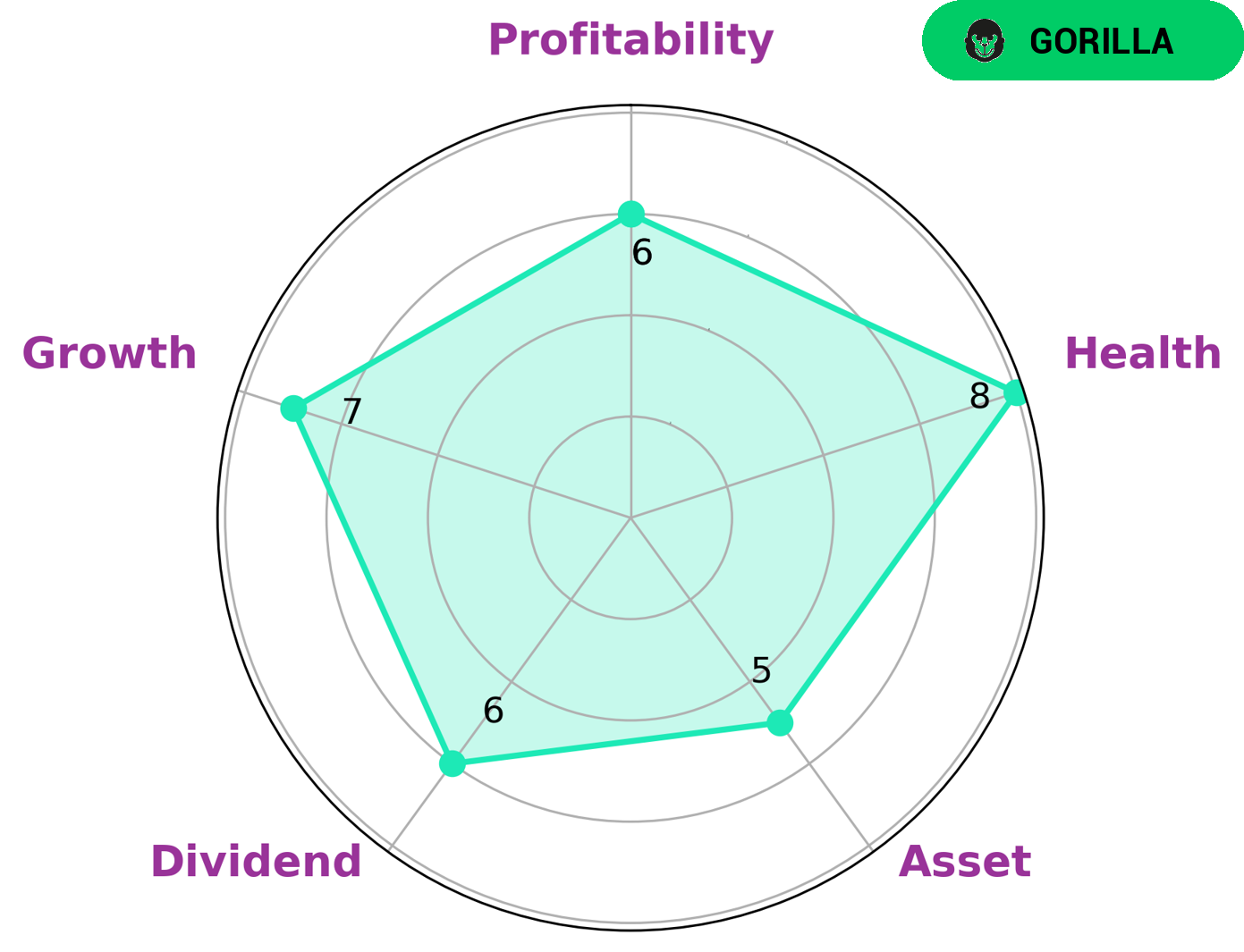

At GoodWhale, we have conducted a thorough analysis of the fundamentals of ADECOAGRO S.A. Our Star Chart indicates that ADECOAGRO S.A has a high health score of 8/10 with regard to its cashflows and debt, which is indicative of its ability to sustain future operations in times of crisis. Furthermore, we have classified ADECOAGRO S.A as a ‘gorilla’, meaning that the company has achieved stable, high revenue or earnings growth due to its strong competitive advantage. Due to this strong growth, ADECOAGRO S.A is likely to be of interest to growth-oriented investors, such as venture capitalists or angel investors. Additionally, the company is strong in growth and medium in asset, dividend, and profitability, making it an attractive investment for those who are looking for a more balanced portfolio. More…

Peers

The company faces competition from ASTARTA Holding NV, PT Aman Agrindo Tbk, and Magadh Sugar & Energy ltd, all of which are engaged in similar agricultural activities. With a presence in Brazil, Argentina, Uruguay, Paraguay and other countries, Adecoagro SA has managed to remain competitive in a highly dynamic sector.

– ASTARTA Holding NV ($LTS:0O0C)

ASTARTA Holding NV is an agricultural holding company based in Ukraine. It operates in the agribusiness sector, processing and selling agricultural products produced by its subsidiaries. As of 2022, the company has a market capitalization of 495.91M, making it one of the largest agricultural companies in Ukraine. Its Return on Equity (ROE) of 14.43% indicates that the company is generating returns that are higher than its cost of capital. This suggests that ASTARTA Holding NV is creating value for its shareholders.

– PT Aman Agrindo Tbk ($IDX:GULA)

Magadh Sugar & Energy Ltd is an Indian-based sugar, ethanol, and power generation company. It operates nine sugar mills in the state of Bihar, and has a total sugarcane crushing capacity of over 11,500 tons per day. The company also produces ethanol from molasses and has an installed capacity of 6.2 MW of power generation from bagasse. As of 2022, Magadh Sugar & Energy Ltd has a market capitalization of 4.44 billion and a return on equity of 10.61%. This data indicates that the company is performing well financially and has a strong presence in its industry. Its ability to produce sugar, ethanol, and power from its sugar mills makes it a unique player within its sector.

Summary

ADECOAGRO S.A has presented its earnings results for the fourth quarter of FY2022. The total revenue for the quarter had decreased by 95.4% year over year, to USD 2.7 million, while net income had increased by 11.2% to USD 371.6 million compared to the same quarter a year before. Investors should consider the company’s financial performance and industry outlook when making any investing decisions. ADECOAGRO S.A’s current financial position is a factor to consider as well, including liquidity and cash flow.

Additionally, investors should consider the potential risks and opportunities associated with the company’s market sector when making investment decisions.

Recent Posts