Zoetis Surges 5.4% After Forecasting Revenue Above Estimates for 2023 at $8 Billion.

February 16, 2023

Trending News 🌥️

Zoetis Inc ($NYSE:ZTS). is a leading animal health company that is dedicated to providing products and services that aim to prevent, treat and control diseases in animals. Their portfolio spans a wide range of products and services including vaccines, parasiticides, and other specialty pharmaceuticals. The company recently forecasted their revenue for 2023 at $8 billion, which is 5.4% above the consensus estimate of $8.2 billion, causing their stock to surge by the same amount. With their recent projection of revenue for 2023 surpassing the expectations, investors have reacted positively, driving the stock up 5.4%. This increase in stock price has also made Zoetis the best-performing public animal health company over the past year, outperforming its peers in both market capitalization and stock returns. The projection of $8 billion in revenue for 2023 is expected to be driven by Zoetis’ focus on investing in R&D and expanding their product portfolio.

Additionally, the company’s strong global presence and focus on innovation should help them to continue pulling ahead of their competitors. While Zoetis has maintained its leadership in the animal health industry, the company has also been focusing on expanding geographically into emerging markets, which should help them to continue growing at a healthy rate going forward. Overall, Zoetis Inc.’s recent projection of $8 billion in revenue for 2023 has been well received by investors and has led to the company’s stock surging 5.4%. The company’s strong global presence and innovation should help them to continue outgrowing their competitors and become even more dominant in the animal health industry.

Stock Price

ZOETIS INC has seen an impressive surge of 5.4% in stock prices on Tuesday, opening at $173.4 and closing at $171.9, from the previous closing price of 163.1. This surge is likely in part due to the positive media coverage that the company has been receiving lately. The speculation surrounding Tuesday’s surge may be due to ZOETIS INC’s projected revenue for 2023 to be above estimates at $8 billion, which is certainly a major milestone for the company. The company is well on its way to meeting its objectives and is already showing considerable progress in both internal operations and external reputation. ZOETIS INC’s forecasted revenue for 2023 is a strong indicator of the company’s future success as it will not only provide increased profit potential but also generate more opportunities for their employees and their customers.

This is beneficial for all parties involved, and it will be exciting to see how the company fares in terms of growth and progress. The surge in stocks of ZOETIS INC is indicative of both investor confidence in the company and its ability to meet their objectives. Although the company has had some bumps in the road, they have certainly taken the steps necessary to ensure success and have plenty of time to continue to make improvements. With the company’s forecasted revenue for 2023 being significantly higher than estimates, there is no doubt that the future looks bright for ZOETIS INC. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zoetis Inc. More…

| Total Revenues | Net Income | Net Margin |

| 8.08k | 2.11k | 27.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zoetis Inc. More…

| Operations | Investing | Financing |

| 1.91k | -883 | -904 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zoetis Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.93k | 10.52k | 9.5 |

Key Ratios Snapshot

Some of the financial key ratios for Zoetis Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.9% | 13.2% | 35.6% |

| FCF Margin | ROE | ROA |

| 16.4% | 39.7% | 12.0% |

Analysis

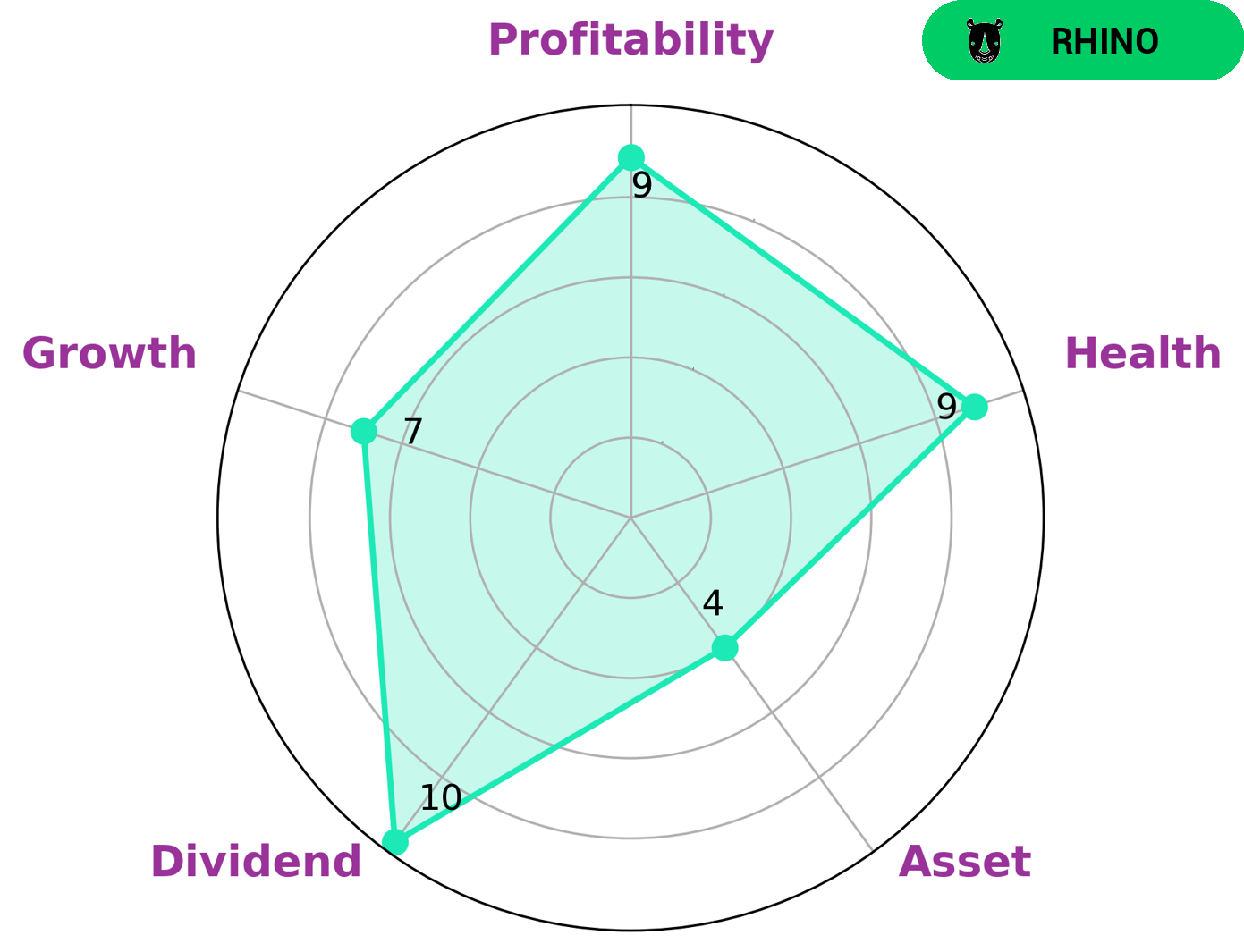

ZOETIS INC is a strong investment option with a high health score of 9/10 according to Star Chart. This indicates the company has a good cash flow and debt situation, and is able to sustain its operations in times of crisis. The company is classified as ‘rhino’, meaning it has achieved moderate revenue or earnings growth. Investors interested in ZOETIS INC may be attracted to its strength in dividend, growth, and profitability, as well as its medium score in asset. The company’s high health score is also a major draw, as it suggests that the company is able to withstand economic volatility and will remain profitable over time. Moreover, its moderate revenue or earnings growth means that it may be able to generate steady returns for investors, even during difficult economic times. In sum, ZOETIS INC is an attractive investment option for those looking for a company that is strong in key financial areas and has achieved moderate growth. The company’s high health score and moderate growth make it an appealing option for a wide range of investors. More…

Peers

Zoetis Inc. is a global animal health company that develops, manufactures, and markets a wide range of veterinary products. The company’s products include vaccines, parasiticides, pharmaceuticals, diagnostics, and biologics. Zoetis Inc. has a broad portfolio of products that are used in the prevention, treatment, and control of disease in animals. The company’s competitors include BioGaia AB, Krka d.d., and Phibro Animal Health Corp.

– BioGaia AB ($OTCPK:BIOGY)

Biogaia is a Swedish biotech company that markets probiotic products for infants, children, and adults. The company’s products are based on the lactic acid bacterium Lactobacillus reuteri, which is found naturally in the human gastrointestinal tract. Biogaia’s products are sold in over 60 countries worldwide.

Biogaia’s market cap is 800.05M as of 2022. The company has a Return on Equity of 10.86%. Biogaia’s products are based on the lactic acid bacterium Lactobacillus reuteri, which is found naturally in the human gastrointestinal tract. Biogaia’s products are sold in over 60 countries worldwide.

– Krka d.d. ($LTS:0HLK)

Krka d.d. is a Slovenian pharmaceutical company. It is the largest pharmaceutical company in Slovenia and one of the largest in the Balkans. The company was founded in 1959 and is headquartered in Novo mesto. Krka d.d. has a market cap of 2.77B as of 2022 and a Return on Equity of 12.85%. The company’s main products are prescription drugs, over-the-counter drugs, and medical devices.

– Phibro Animal Health Corp ($NASDAQ:PAHC)

Phibro Animal Health Corporation is a diversified animal health and specialty ingredients company with products in over 100 countries. The company’s products are sold through veterinarians, distributors, and feed stores. Phibro Animal Health Corporation’s mission is to improve the health and productivity of animals. The company’s products are used in a variety of animals, including cattle, swine, poultry, and aquaculture. Phibro Animal Health Corporation’s products are designed to improve the health and productivity of animals while providing a safe and healthy environment for them to live in.

Summary

Investing in Zoetis Inc. has recently been met with positive sentiment, as the company recently forecasted revenue to exceed expectations and surpass $8 billion by 2023. This news caused the company’s stock price to surge 5.4% on the day of the announcement. Many investors are optimistic that the company will continue to experience growth and generate strong returns on their investments in the future. Therefore, Zoetis Inc. is a good choice for those looking for a well-performing stock with the potential for long-term success.

Recent Posts