Texas Permanent School Fund Reduces Investment in Dynavax Technologies Co.

May 18, 2023

Trending News 🌥️

Dynavax Technologies ($NASDAQ:DVAX) Co. is a biopharmaceutical company headquartered in Berkeley, California. It specializes in the research, development and commercialization of products to prevent and treat infectious and inflammatory diseases. The Texas Permanent School Fund is a public fund that provides financial support for public schools in the state of Texas. Dynavax Technologies Co. has been facing challenges on various fronts, including regulatory delays and legal issues.

Despite these issues, the company has continued to focus on developing innovative vaccines and treatments for diseases such as hepatitis B and shingles. Investors should take note of this news and closely monitor the company’s progress in the coming months.

Share Price

On Wednesday, the Texas Permanent School Fund (TPSF) reduced its investment in Dynavax Technologies Co. The stock opened at $11.2 and closed at $11.1, a decrease of 0.4% from its prior closing price of $11.2. This decision to reduce the stake in Dynavax Technologies Co. comes as a result of investors becoming less enthused with the company’s potential returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dynavax Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 655.62 | 235.81 | 37.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dynavax Technologies. More…

| Operations | Investing | Financing |

| 140.78 | -151.85 | 6.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dynavax Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 969.92 | 406.19 | 4.39 |

Key Ratios Snapshot

Some of the financial key ratios for Dynavax Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 153.2% | – | 37.3% |

| FCF Margin | ROE | ROA |

| 20.4% | 26.7% | 15.8% |

Analysis

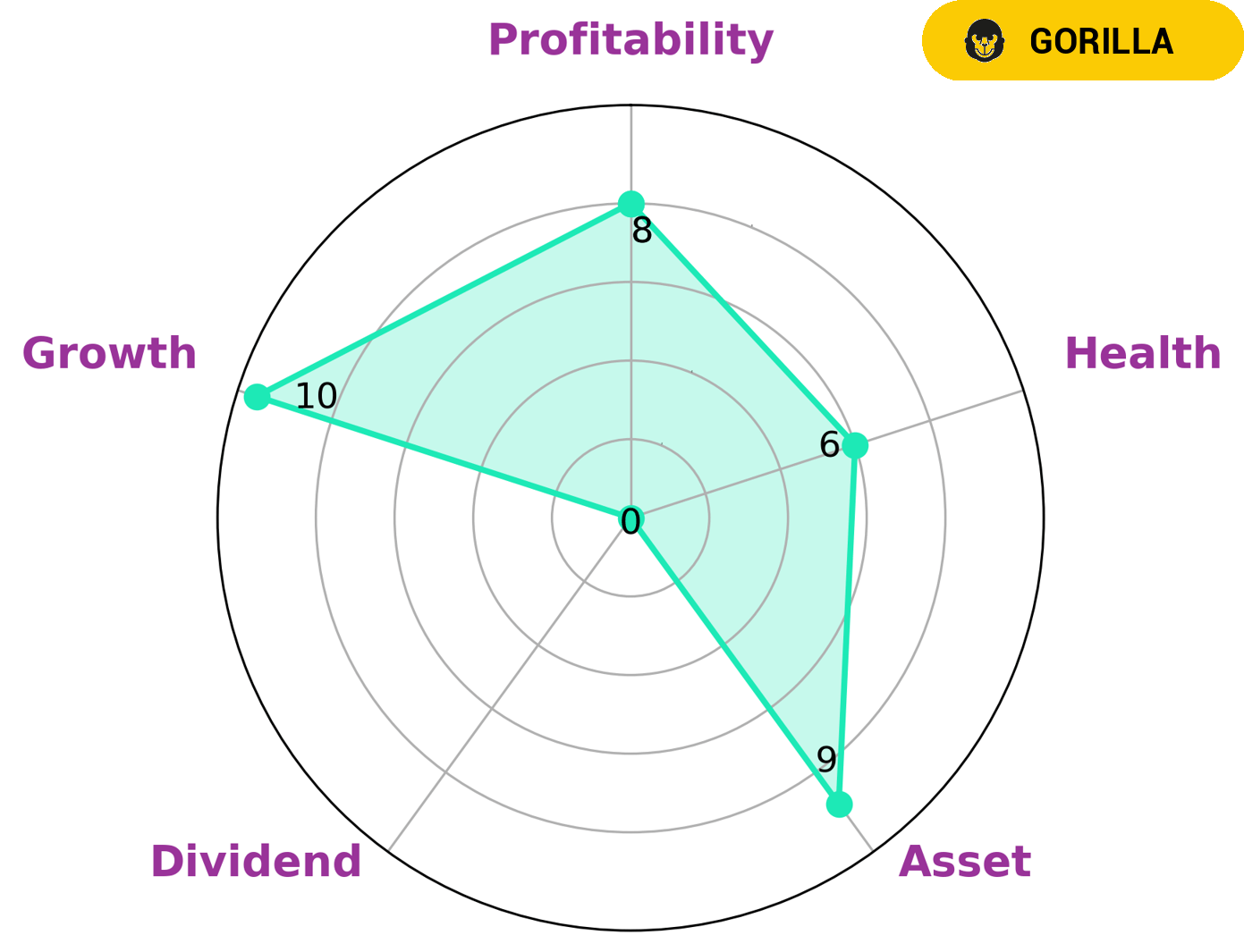

At GoodWhale, we take a deep dive into the fundamentals of DYNAVAX TECHNOLOGIES to give investors a comprehensive view of the company. According to our Star Chart analysis, DYNAVAX TECHNOLOGIES has an intermediate health score of 6/10 with regard to its cashflows and debt, indicating that the company might be able to safely ride out any crisis without the risk of bankruptcy. We find that DYNAVAX TECHNOLOGIES is strong in asset, growth, and profitability, with some weaknesses in dividend. As such, we classify DYNAVAX TECHNOLOGIES as a ‘gorilla’ type company – one that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors looking for growth with potential should find DYNAVAX TECHNOLOGIES an attractive investment opportunity. More…

Peers

The market for Dynavax Technologies Corp is quite competitive. The company’s main competitors are Foresee Pharmaceuticals Co Ltd, Aeolus Pharmaceuticals Inc, and Kala Pharmaceuticals Inc. All of these companies are vying for a share of the market, and each has its own strengths and weaknesses. Dynavax Technologies Corp must keep an eye on all of its competitors in order to stay ahead in the market.

– Foresee Pharmaceuticals Co Ltd ($TPEX:6576)

Foresee Pharmaceuticals Co Ltd is a pharmaceutical company with a market cap of 8.77B as of 2022. The company has a Return on Equity of -22.28%. The company focuses on the development and commercialization of innovative drugs for the treatment of cancer and other diseases. The company’s products include F-76, a phase III clinical candidate for the treatment of ovarian cancer; and F-288, a phase II clinical candidate for the treatment of solid tumors. Foresee Pharmaceuticals Co Ltd was founded in 2007 and is headquartered in Taipei, Taiwan.

– Aeolus Pharmaceuticals Inc ($OTCPK:AOLS)

Aeolus Pharmaceuticals Inc is a pharmaceutical company that focuses on the development of treatments for a variety of conditions. The company’s market cap is $167.29k and its ROE is -383.62%. Aeolus Pharmaceuticals Inc’s main product is a treatment for a condition called idiopathic pulmonary fibrosis. The company is also developing treatments for other conditions, including cancer and Alzheimer’s disease.

– Kala Pharmaceuticals Inc ($NASDAQ:KALA)

Kala Pharmaceuticals Inc is a biopharmaceutical company focused on the development and commercialization of therapies for the treatment of eye diseases. The company’s lead product candidate, KPI-121, is a topical ocular formulation of loteprednol etabonate in development for the treatment of pain and inflammation associated with ocular surgery. Kala Pharmaceuticals Inc has a market cap of 7.69M as of 2022, a Return on Equity of 435.55%. The company’s focus on the development and commercialization of therapies for the treatment of eye diseases makes it a promising investment for those interested in the healthcare sector.

Summary

Dynavax Technologies Co. has seen a decrease in its stock position from the Texas Permanent School Fund. The company also has a strong pipeline of biopharmaceutical products. This could indicate a need to better manage costs and consider strategic partnerships. With a healthy balance sheet and promising product pipeline, Dynavax Technologies Co. may be a stock worth considering for investors looking for value plays.

Recent Posts