Clever Leaves Intrinsic Value – CLEVER LEAVES Shines with Strong Earnings and Revenue Outperformance

May 12, 2023

Trending News ☀️

CLEVER LEAVES ($NASDAQ:CLVR), a leading cannabis company, recently released its quarterly earnings report, showing strong outperformance of both earnings and revenue. According to the report, the company’s GAAP EPS of -$0.09 was exceeded by $0.06 and the revenue of $4M surpassed the expected amount by $0.4M. This marks the third consecutive quarter of year-over-year growth, signaling an optimistic outlook for the company. Its growing portfolio of products includes beloved brands such as Ziggy Marley and Mary Jane. The company is focused on international expansion and is already exporting to several countries, including the US and Canada.

With its strong financial performance and leadership in international cannabis markets, Clever Leaves is positioned to be a major player in the industry for years to come. Investors have responded positively to the news, with stock prices soaring as a result. It remains to be seen what opportunities lie ahead for the company, but what is certain is that Clever Leaves is off to a very promising start.

Price History

On Thursday, shares of CLEVER LEAVES made a strong showing in earnings and revenue outperformance. Despite the stock opening at $0.3 and closing at $0.3, it was still down by 1.1% from its prior closing price. Despite the slight dip, the company showed impressive results with their earnings and revenue outperformance. This was evident in their strong financial performance and positive outlook for the future.

Overall, investors were pleased with the results. The company’s outlook for the future was also positive and investors were encouraged by this progress. It was clear that CLEVER LEAVES was well positioned to continue to thrive in the coming months and years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Clever Leaves. More…

| Total Revenues | Net Income | Net Margin |

| 17.8 | -66.17 | -164.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Clever Leaves. More…

| Operations | Investing | Financing |

| -29.07 | 1.19 | 3.29 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Clever Leaves. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 52.1 | 11.69 | 1.58 |

Key Ratios Snapshot

Some of the financial key ratios for Clever Leaves are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.5% | – | -391.9% |

| FCF Margin | ROE | ROA |

| -170.6% | -79.3% | -83.7% |

Analysis – Clever Leaves Intrinsic Value

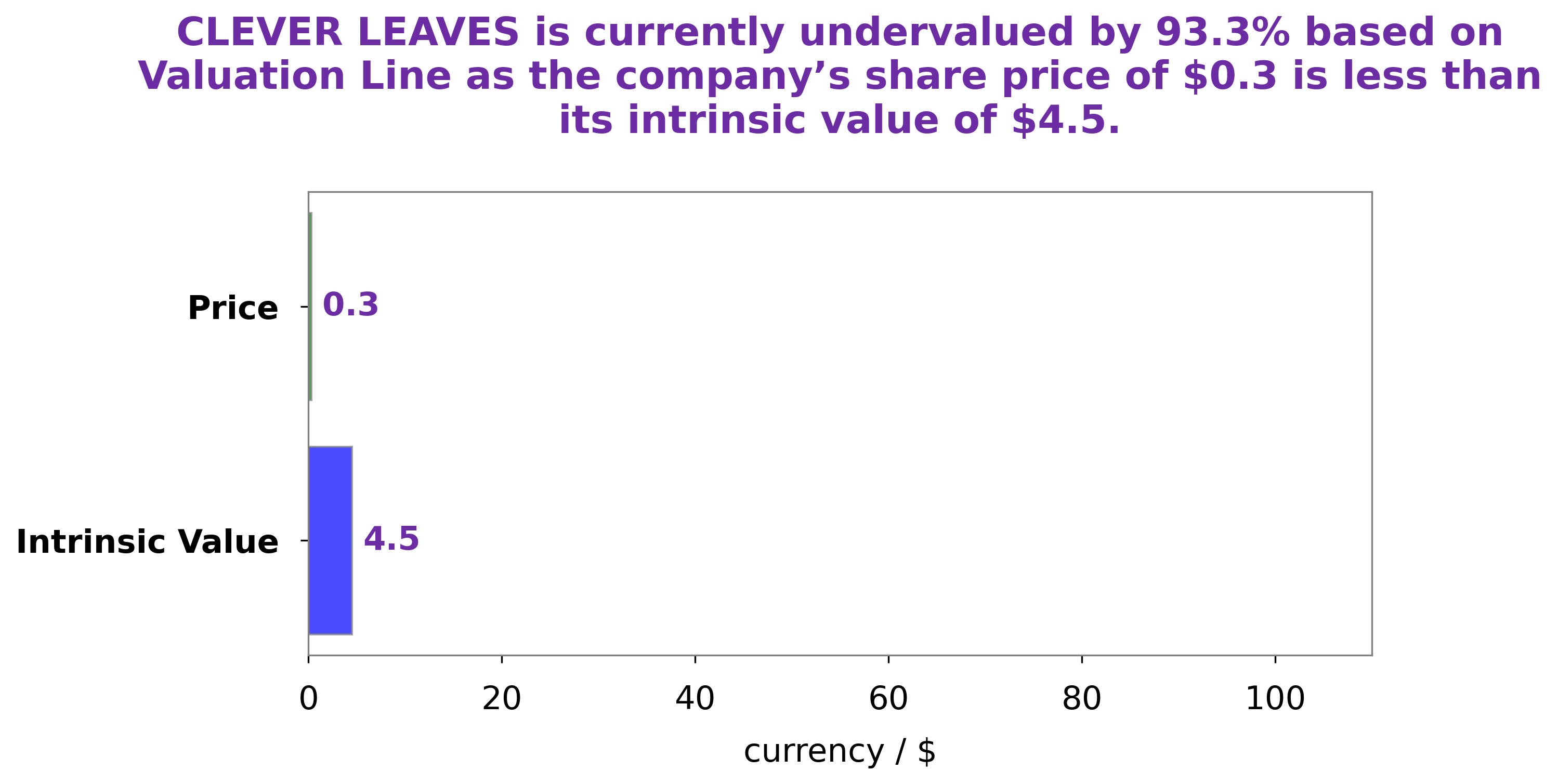

At GoodWhale, we take a closer look at the fundamentals of CLEVER LEAVES. We believe that the fair value of CLEVER LEAVES shares is around $4.5, as calculated by our proprietary Valuation Line. Yet, the current market price of CLEVER LEAVES shares is only around $0.3, which is undervalued by 93.3%. This presents a tremendous opportunity for investors seeking to benefit from the difference between the current market price and our fair value estimate. More…

Peers

Clever Leaves Holdings Inc is an emerging player in the cannabis industry. It is the first major international player to enter the scene and compete with established companies such as Bhang Inc, Fiore Cannabis Ltd and Green Thumb Industries Inc. Its focus is on cultivating premium grade cannabis products, providing them to consumers at a competitive price.

– Bhang Inc ($OTCPK:BHNGF)

Bhang Inc is a US-based cannabis company that produces high-quality cannabis products such as edibles, flower, concentrates, and topicals. The company has achieved impressive financial results, which has led to an impressive market cap of 4.68M as of 2023. Moreover, its Return on Equity (ROE) of 212.6% is indicative of the company’s success in leveraging its assets and generating profits for its shareholders. This impressive ROE is well above the industry average, and has helped Bhang Inc’s stock to become one of the most sought-after investments in the cannabis sector.

– Fiore Cannabis Ltd ($OTCPK:FIORF)

Fiore Cannabis Ltd is a Canadian-based cannabis company that focuses on the production, distribution, and sale of medicinal cannabis products. The company’s market cap as of 2023 is 315.28k, which is indicative of the company’s growth and success over the years. Furthermore, the company has achieved a Return on Equity of 423.76%, which demonstrates the level of profitability achieved by the company. The company strives to provide premium quality products while adhering to the regulatory standards of their respective markets.

– Green Thumb Industries Inc ($OTCPK:GTBIF)

Green Thumb Industries Inc is a leading cannabis company that operates in 12 states across the US. It has a market cap of 1.88B as of 2023, which is a reflection of its strong position in the industry and its potential for future growth. The company’s Return on Equity (ROE) ratio is 4.81%, which is an indication of its ability to generate profits from its equity capital. Green Thumb Industries Inc’s operations are focused on manufacturing, distributing, and retailing cannabis products to customers across the United States. This diversified approach is helping the company to capture new markets and drive increased revenues.

Summary

Clever Leaves is a publicly traded company that reported its quarterly earnings for the most recent period. The company reported a GAAP EPS of -$0.09, which beat the estimated figure by $0.06. Revenue for the quarter totaled $4M and exceeded analyst estimates by $0.4M.

The news of the company’s earnings beat is likely to be welcomed by investors and could result in an increase in the stock price. Although the quarterly numbers are positive, investors should take a closer look at the company’s performance over time before making a decision to invest.

Recent Posts