Merck’s Phase 3 Prostate Cancer Trial of Keytruda Combination Fails to Meet Main Goals.

March 2, 2023

Trending News 🌧️

Merck ($NYSE:MRK)’s phase 3 trial of their blockbuster drug Keytruda in combination with enzalutamide and androgen deprivation therapy (Xtandi plus ADT) for metastatic castration-resistant prostate cancer (mCRPC) has unfortunately not been successful. This trial, named KEYNOTE-641, was meant to treat those who had not received chemotherapy, were abiraterone-naïve, or had progressed on abiraterone acetate, but it failed to meet its main objectives. This news follows another late stage trial of Keytruda for a type of lung cancer which also did not reach its main goals. In light of these results, Merck has decided to discontinue this phase 3 trial.

This is a setback for Merck and the larger medical community, as Keytruda has been a critical drug used in the treatment of various forms of cancer. The failure of KEYNOTE-641 is a reminder that developing treatments for cancer is often a long and difficult process, and success is never guaranteed. Merck will now look to explore other treatments in their ongoing quest to provide better treatments for those affected by cancer.

Market Price

N e w s c o v e r a g e o f M e r c k ‘ s P h a s e 3 P r o s t a t e C a n c e r T r i a l o f K e y t r u d a C o m b i n a t i o n h a s b e e n p r e d o m i n a n t l y n e g a t i v e , w i t h t h e n e w s o f i t s f a i l u r e t o m e e t t h e m a i n g o a l s . 2 , d o w n b y 2 . 4 . T h i s d e c l i n e w a s r e p o r t e d l y d u e t o t h e d i s a p p o i n t i n g r e s u l t s o f t h e i r p r o s t a t e c a n c e r d r u g t r i a l .

T h e t r i a l , w h i c h t e s t e d t h e c o m b i n a t i o n o f K e y t r u d a a n d h o r m o n e t h e r a p y v e r s u s h o r m o n e t h e r a p y a l o n e , f a i l e d t o m e e t t h e m a i n g o a l s o f p r o l o n g i n g p a t i e n t s ‘ p r o g r e s s i o n – f r e e s u r v i v a l . D e s p i t e t h i s s e t b a c k , M e r c k p l a n s t o c o n t i n u e c l i n i c a l t e s t i n g w i t h t h e h o p e s o f g a i n i n g a b e t t e r u n d e r s t a n d i n g o f h o w t o b e s t u t i l i z e t h e c o m b i n a t i o n w i t h h o r m o n e t h e r a p y. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Merck. More…

| Total Revenues | Net Income | Net Margin |

| 59.28k | 14.52k | 25.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Merck. More…

| Operations | Investing | Financing |

| 19.7k | -16.55k | 2.59k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Merck. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 107.08k | 62.56k | 17.55 |

Key Ratios Snapshot

Some of the financial key ratios for Merck are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.2% | 14.3% | 30.8% |

| FCF Margin | ROE | ROA |

| 25.7% | 25.7% | 10.7% |

Analysis

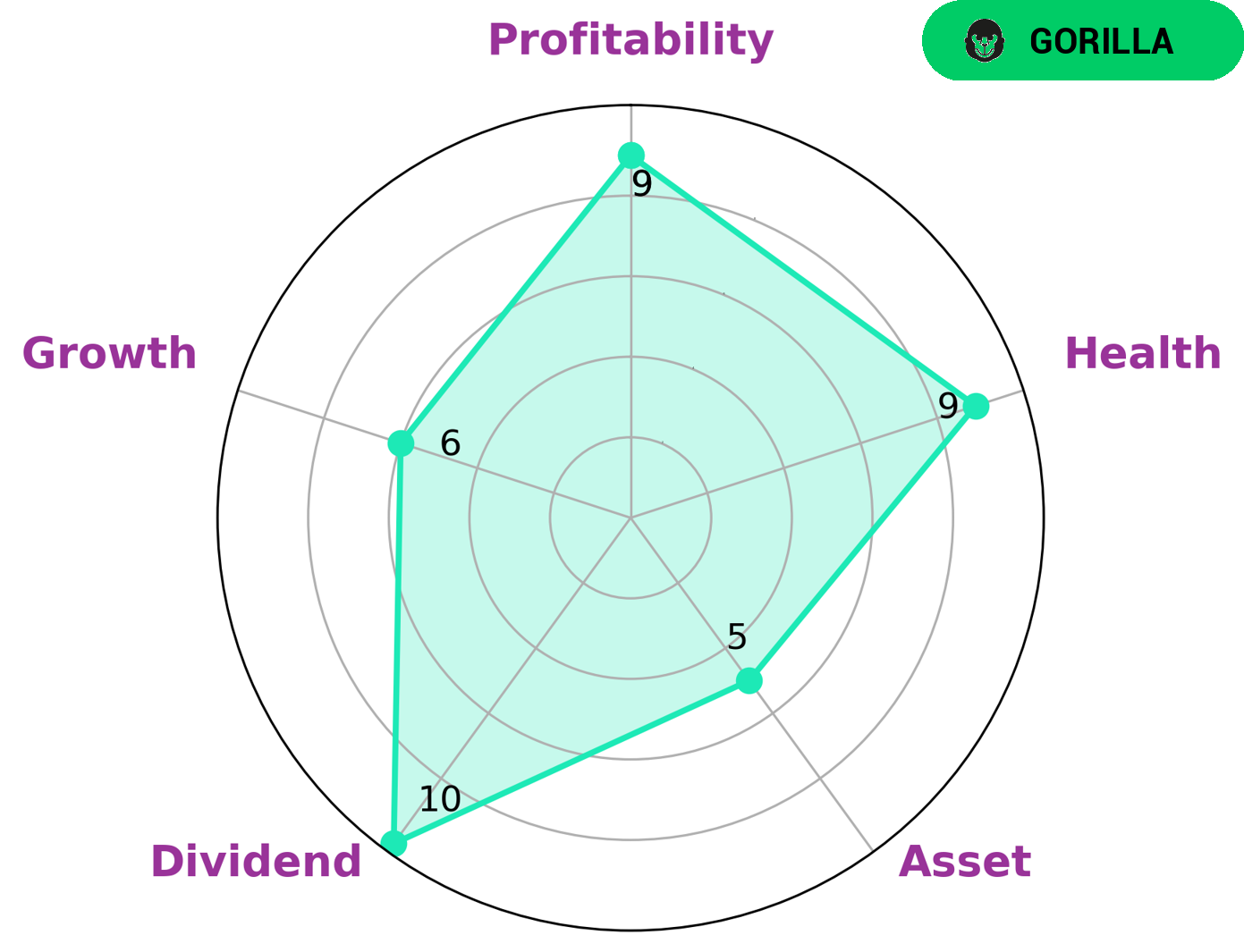

GoodWhale has completed an analysis of MERCK‘s financial records and based on the Star Chart, we can conclude that MERCK is a very healthy company with a rating of 9/10. Not only is it able to safely ride out any crisis without the risk of bankruptcy, but its strong cashflows and low debt also mean that they should have no problem continuing to pay out their dividends. MERCK’s profitability and asset standings rank medium among its peers, while its growth score is comparatively high. This type of company is likely to be attractive to investors who value sustainability, reliability and consistent growth. More…

Peers

In the pharmaceutical industry, Merck & Co Inc is up against some stiff competition. Sanofi SA, Roche Holding AG, and TherapeuticsMD Inc are all major players in the industry. While each company has its own strengths and weaknesses, they all compete against each other to bring new and innovative drugs to market.

– Sanofi SA ($LTS:0O59)

As of 2022, Sanofi SA has a market capitalization of 102.29 billion euros and a return on equity of 7.56%. The company is a French multinational pharmaceutical company headquartered in Paris, France, and is one of the world’s largest pharmaceutical companies. Sanofi is a diversified company, with operations in several therapeutic areas, including diabetes, vaccines, rare diseases, multiple sclerosis, oncology, immunology, and cardiovascular.

– Roche Holding AG ($LTS:0TDF)

Roche Holding AG, a Swiss multinational healthcare company, has a market cap of 270.34B as of 2022. The company’s Return on Equity is 47.83%. Roche is a leader in research-focused healthcare with combined strengths in pharmaceuticals and diagnostics. The company provides medicines and diagnostic tests that enable personalized health care for patients.

– TherapeuticsMD Inc ($NASDAQ:TXMD)

TherapeuticsMD Inc. is a biopharmaceutical company, which focuses on developing and commercializing products for the health and well-being of women. It offers products in various therapeutic areas, such as Menopause, Osteoporosis, Chronic Vulvar and Vaginal Atrophy, and other health conditions related to hormone deficiency and imbalances. The company was founded by Robert G. Finizio, George S. Paletta, and Douglas S. Leighton in 2010 and is headquartered in Boca Raton, FL.

Summary

Merck‘s stock price has seen a negative impact upon the release of their Phase 3 Prostate Cancer Trial of Keytruda Combination results, which have failed to meet their primary goals. The news coverage has been largely negative, with analysts suggesting that there is little hope for the product to reach the market in its current form. Investors are advised to remain cautious when considering Merck as the company faces uncertainty in the future.

Although Merck has a history of success in developing and marketing pharmaceuticals, this recent setback could lead to a long-term decline in their stock price. Investors should consider any potential risks and weigh them against the potential rewards before investing in Merck.

Recent Posts