Merck Stock Fair Value – MERCK Study Finds mRNA Technology is a ‘Game Changer’ for Vaccine Manufacturers in Asia-Pacific Region

June 12, 2023

🌥️Trending News

The Merck ($NYSE:MRK) Study recently released suggests that mRNA Technology is a revolutionary development for Vaccine Manufacturers in the Asia-Pacific region. This study has been highly acclaimed as a “game changer” for the industry, as it provides a more efficient, cost-effective solution for vaccine production. It has a long history of innovation and research in the healthcare industry, and its recent study on mRNA technology is yet another testament to its commitment to progress. The Merck Study has spurred a renewed interest in mRNA technology, which has the potential to revolutionize vaccine production and accelerate the development of new vaccines.

This technology offers significant benefits to vaccine manufacturers in the Asia-Pacific region, such as faster production times, improved quality control, and reduced costs. It also provides a more efficient solution for production of existing vaccines, making them more accessible and affordable for patients. This technology provides significant advantages over traditional vaccine production methods, and its potential to reduce costs and improve quality control make it a game changer for the industry.

Market Price

On Wednesday, MERCK stock opened at $108.5 and closed at $110.4, up by 1.1% from prior closing price of 109.2. This technology allows for the rapid development of vaccines, and has been seen as a major breakthrough in the industry. With the help of this technology, vaccine manufacturers in the region can now produce vaccines more quickly and efficiently, making them more accessible to those who need them. This finding has been a catalyst for the increased stock price of MERCK. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Merck. More…

| Total Revenues | Net Income | Net Margin |

| 57.87k | 13.03k | 23.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Merck. More…

| Operations | Investing | Financing |

| 15.67k | -6.15k | -8.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Merck. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 107.8k | 60.89k | 18.46 |

Key Ratios Snapshot

Some of the financial key ratios for Merck are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.4% | 8.7% | 28.0% |

| FCF Margin | ROE | ROA |

| 19.5% | 21.8% | 9.4% |

Analysis – Merck Stock Fair Value

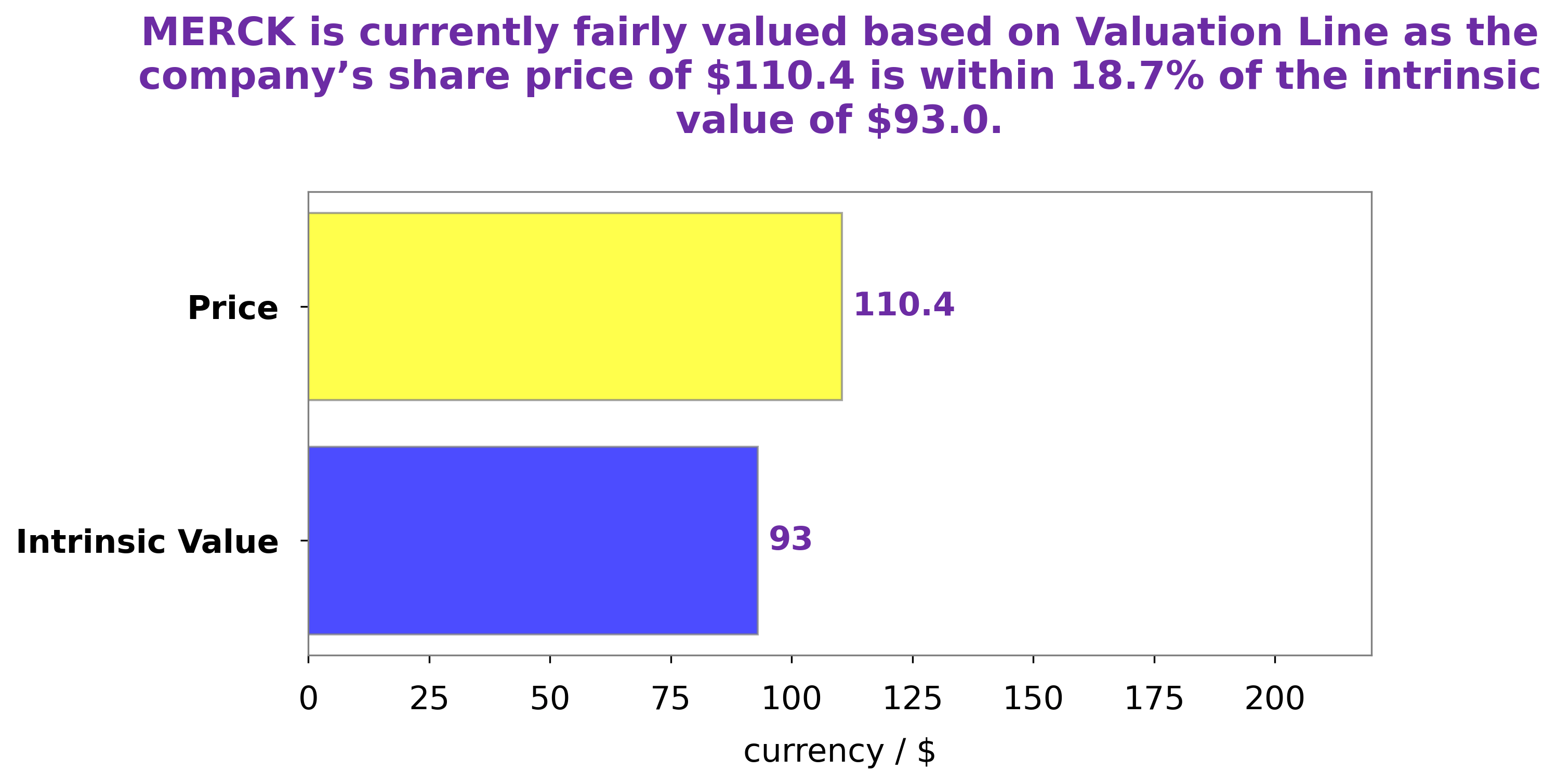

At GoodWhale, we recently conducted an analysis of Merck‘s wellbeing. After meticulous examination of the company’s financial standing and market performance, our proprietary Valuation Line has estimated the fair value of a Merck’s share to be around $93.0. Currently, Merck stock is trading at $110.4, signifying an 18.8% overvaluation of its fair price. Our analysis indicates that there could be an opportunity for investors to take advantage of this discrepancy in the short term. More…

Peers

In the pharmaceutical industry, Merck & Co Inc is up against some stiff competition. Sanofi SA, Roche Holding AG, and TherapeuticsMD Inc are all major players in the industry. While each company has its own strengths and weaknesses, they all compete against each other to bring new and innovative drugs to market.

– Sanofi SA ($LTS:0O59)

As of 2022, Sanofi SA has a market capitalization of 102.29 billion euros and a return on equity of 7.56%. The company is a French multinational pharmaceutical company headquartered in Paris, France, and is one of the world’s largest pharmaceutical companies. Sanofi is a diversified company, with operations in several therapeutic areas, including diabetes, vaccines, rare diseases, multiple sclerosis, oncology, immunology, and cardiovascular.

– Roche Holding AG ($LTS:0TDF)

Roche Holding AG, a Swiss multinational healthcare company, has a market cap of 270.34B as of 2022. The company’s Return on Equity is 47.83%. Roche is a leader in research-focused healthcare with combined strengths in pharmaceuticals and diagnostics. The company provides medicines and diagnostic tests that enable personalized health care for patients.

– TherapeuticsMD Inc ($NASDAQ:TXMD)

TherapeuticsMD Inc. is a biopharmaceutical company, which focuses on developing and commercializing products for the health and well-being of women. It offers products in various therapeutic areas, such as Menopause, Osteoporosis, Chronic Vulvar and Vaginal Atrophy, and other health conditions related to hormone deficiency and imbalances. The company was founded by Robert G. Finizio, George S. Paletta, and Douglas S. Leighton in 2010 and is headquartered in Boca Raton, FL.

Summary

MERCK is a vaccine manufacturer in the Asia-Pacific region that is using mRNA technology to revolutionize the industry. This technology has the potential to increase production efficiency and reduce costs for vaccine manufacturers. The company is well-positioned to capitalize on increasing demand for vaccines in the region. Furthermore, its mRNA technology could provide a competitive advantage in terms of pricing and production efficiency, making it an attractive option for investors.

Recent Posts