Merck Stock Fair Value Calculation – FDA Grants Priority Review to Merck’s Keytruda Combination Therapy for Gastric and Esophagus Cancer

April 14, 2023

Trending News 🌧️

Recently, the US Food and Drug Administration (FDA) granted a priority review to Merck ($NYSE:MRK)’s Keytruda (pembrolizumab) combination therapy for use as an initial therapy for people with advanced unresectable gastric or gastroesophageal junction adenocarcinoma. Merck is a global healthcare leader developing innovative medicines and vaccines to help people around the world do more, feel better, and live longer. They have been at the forefront of scientific research and development in the fields of immunology, hematology, infectious diseases, and oncology. The combination therapy is intended to be used in combination with two chemotherapy drugs, fluorouracil and platinum. If approved, Keytruda’s combination therapy would become the first immunotherapy-based combination treatment for advanced unresectable gastric or gastroesophageal junction adenocarcinoma.

This would address an unmet need and potentially provide patients with increased survival rates. Merck will continue to provide additional data to support their application for approval of the Keytruda combination therapy. With the FDA’s priority review granted, a decision is expected soon, which could offer new hope and better outcomes for those affected by this disease.

Price History

This was a significant milestone for Merck, as the therapy is expected to be available to patients who could benefit from it far sooner than previously anticipated. In response to this news, MERCK stock opened at $115.0 and closed at $115.6, up by 1.6% from its previous closing price of 113.8. This increase in stock price reflects optimism among investors that the therapy will be approved, given its priority review status.

If approved, the therapy could prove to be a game changer for Merck and the cancer patient population, as it would be the first therapy of its kind to receive FDA approval. Merck is hopeful that the FDA will approve the therapy and is working hard to ensure that it meets all requirements for safety and efficacy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Merck. More…

| Total Revenues | Net Income | Net Margin |

| 59.28k | 14.52k | 27.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Merck. More…

| Operations | Investing | Financing |

| 19.09k | -4.96k | -9.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Merck. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 109.16k | 63.1k | 17.55 |

Key Ratios Snapshot

Some of the financial key ratios for Merck are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.2% | 14.3% | 29.4% |

| FCF Margin | ROE | ROA |

| 24.8% | 24.1% | 10.0% |

Analysis – Merck Stock Fair Value Calculation

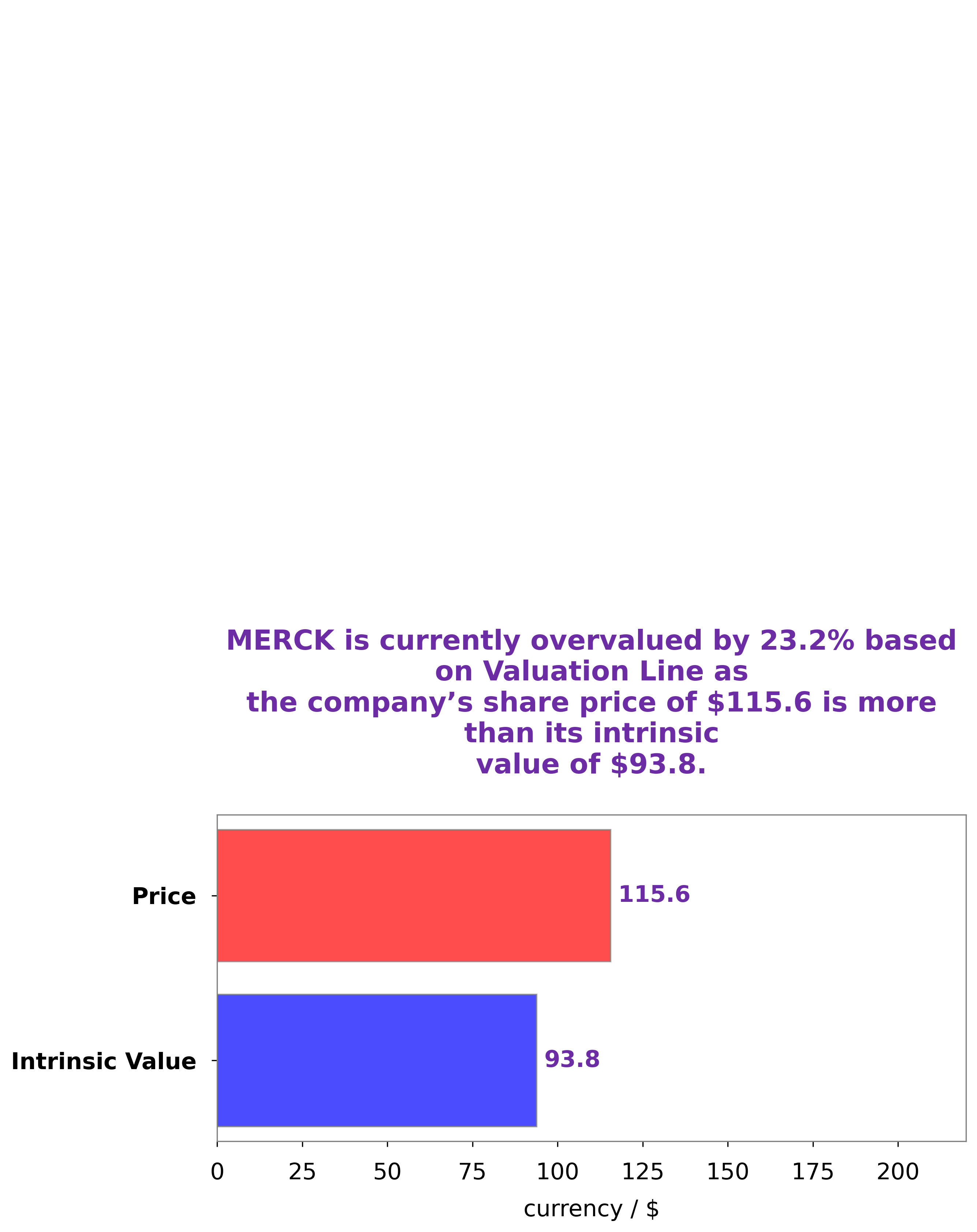

At GoodWhale, we recently conducted an in-depth analysis of MERCK’s fundamentals. After crunching the numbers, we have determined that the intrinsic value of MERCK’s share is approximately $93.8, which we calculated using our proprietary Valuation Line. As of today, MERCK’s shares are trading at $115.6, which represents an overvaluation of 23.3%. Mercks_Keytruda_Combination_Therapy_for_Gastric_and_Esophagus_Cancer”>More…

Peers

In the pharmaceutical industry, Merck & Co Inc is up against some stiff competition. Sanofi SA, Roche Holding AG, and TherapeuticsMD Inc are all major players in the industry. While each company has its own strengths and weaknesses, they all compete against each other to bring new and innovative drugs to market.

– Sanofi SA ($LTS:0O59)

As of 2022, Sanofi SA has a market capitalization of 102.29 billion euros and a return on equity of 7.56%. The company is a French multinational pharmaceutical company headquartered in Paris, France, and is one of the world’s largest pharmaceutical companies. Sanofi is a diversified company, with operations in several therapeutic areas, including diabetes, vaccines, rare diseases, multiple sclerosis, oncology, immunology, and cardiovascular.

– Roche Holding AG ($LTS:0TDF)

Roche Holding AG, a Swiss multinational healthcare company, has a market cap of 270.34B as of 2022. The company’s Return on Equity is 47.83%. Roche is a leader in research-focused healthcare with combined strengths in pharmaceuticals and diagnostics. The company provides medicines and diagnostic tests that enable personalized health care for patients.

– TherapeuticsMD Inc ($NASDAQ:TXMD)

TherapeuticsMD Inc. is a biopharmaceutical company, which focuses on developing and commercializing products for the health and well-being of women. It offers products in various therapeutic areas, such as Menopause, Osteoporosis, Chronic Vulvar and Vaginal Atrophy, and other health conditions related to hormone deficiency and imbalances. The company was founded by Robert G. Finizio, George S. Paletta, and Douglas S. Leighton in 2010 and is headquartered in Boca Raton, FL.

Summary

MERCK is a global leader in healthcare with a focus on innovative medicines and technologies. The company recently announced the FDA review of its Keytruda combination therapy for initial treatment of gastric and esophagus cancers. The approval of this therapy will give MERCK a competitive edge in the rapidly growing treatment market. Investors are encouraged to consider the potential for increased revenue, profits, and share price appreciation that may result from the approval of this therapy.

MERCK also offers a range of other treatments and technologies, including vaccines, biopharmaceuticals, and consumer healthcare products, that can be leveraged to further promote growth. Long-term investors should consider the potential for increased returns in the future as the company continues to explore new markets and develop innovative treatments.

Recent Posts