InvestorsObserver Gives High Rating to AstraZeneca PLC Stock

April 20, 2023

Trending News 🌥️

ASTRAZENECA ($LSE:AZN): InvestorsObserver has given AstraZeneca PLC a rating of 73, making it one of the best choices for drug manufacturers on Tuesday. The company’s portfolio includes various products across different therapeutic areas, including cardiovascular, oncology, respiratory, and gastroenterology, among others. In addition to its pharmaceuticals, it is also a leader in research and development for new healthcare technologies.

Its strong financial performance and dedication to innovation have helped make it one of the top drug manufacturers in the world. With InvestorsObserver giving it a rating of 73, investors can be assured that the company is a reliable option with potential for long-term returns.

Market Price

InvestorsObserver has given a high rating to AstraZeneca PLC stock. On Tuesday, the stock opened at £119.1 and closed at £120.4, a 1.8% increase from the previous closing price of 118.2. This positive rating reflects the strong performance of the company’s stocks in recent weeks.

With the upward trend continuing, investors are showing confidence in AstraZeneca PLC’s future prospects. The stock has been on an impressive run and is likely to continue to be a good investment opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Astrazeneca Plc. More…

| Total Revenues | Net Income | Net Margin |

| 44.35k | 3.29k | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Astrazeneca Plc. More…

| Operations | Investing | Financing |

| 9.81k | -2.96k | -6.82k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Astrazeneca Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 96.48k | 59.42k | 23.9 |

Key Ratios Snapshot

Some of the financial key ratios for Astrazeneca Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.1% | 15.0% | 8.6% |

| FCF Margin | ROE | ROA |

| 16.3% | 6.6% | 2.5% |

Analysis

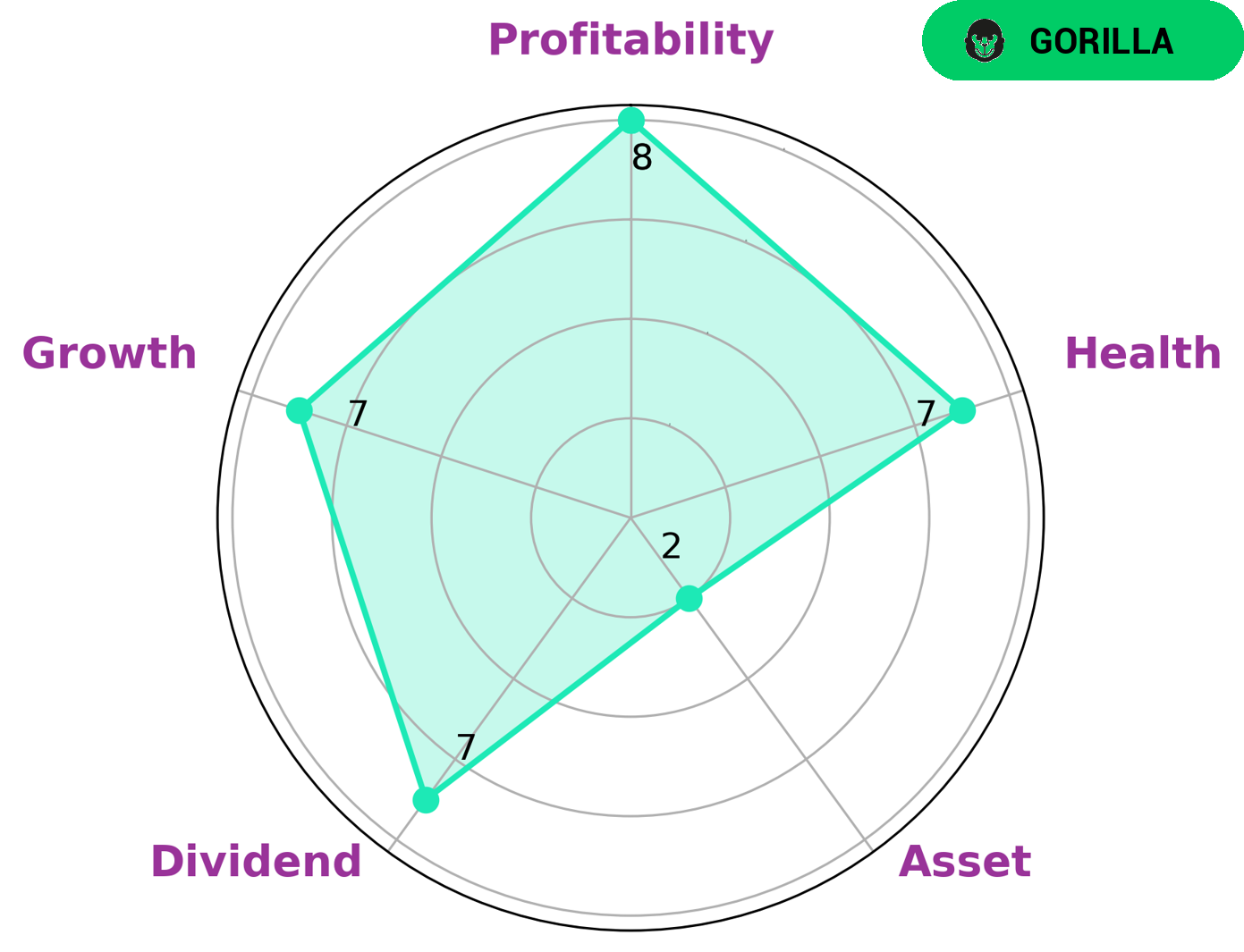

As a GoodWhale analyst, I took a look at ASTRAZENECA PLC‘s financials and the results are impressive. Through our star chart analysis, ASTRAZENECA PLC proved to be a strong company in terms of dividend, growth, and profitability, but slightly weak in asset. This combination of strengths earned ASTRAZENECA PLC the classification of ‘gorilla’, a type of company with strong competitive advantage that achieves stable and high revenue or earning growth. Investors who seek companies like ASTRAZENECA PLC with steady yields and long-term growth potential may be interested in investing in them. Furthermore, ASTRAZENECA PLC has a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable to sustain future operations in times of crisis. All in all, ASTRAZENECA PLC’s financials are very promising and could be a great potential opportunity for investors. More…

Peers

AstraZeneca PLC is a pharmaceutical company that specializes in the development, manufacture, and marketing of prescription drugs. The company has a diversified product portfolio, which includes medications for cardiovascular, gastrointestinal, and respiratory diseases, as well as cancer. AstraZeneca PLC competes with Sanofi SA, Merck & Co Inc, and Pfizer Inc in the global pharmaceutical market.

– Sanofi SA ($OTCPK:SNYNF)

As of 2022, Sanofi SA has a market cap of 100.1B and a Return on Equity of 7.56%. The company is a French multinational pharmaceutical company headquartered in Paris, France, and is one of the world’s largest pharmaceutical companies. Sanofi is a diversified company, focused on human health. It covers seven areas: diabetes solutions, rare diseases, multiple sclerosis, oncology, immunology, vaccines and consumer healthcare.

– Merck & Co Inc ($NYSE:MRK)

Merck & Co Inc is a pharmaceutical company with a market cap of 236.25B as of 2022. The company has a return on equity of 28.84%. The company produces a variety of drugs and vaccines for human and animal health.

– Pfizer Inc ($NYSE:PFE)

Pfizer Inc is a research-based pharmaceutical company with a market cap of 241.95B as of 2022. The company has a return on equity of 24.63%. Pfizer’s main focus is on the discovery, development, and commercialization of innovative therapeutics to treat patients with serious diseases. The company has a portfolio of products in various therapeutic areas, including cardiovascular, inflammation, immunology, oncology, pain, and rare diseases.

Summary

AstraZeneca PLC is a good choice for investors looking to invest in drug manufacturers. According to InvestorsObserver, it has earned a 73 rating, which puts it near the top of the list. Additionally, analysts’ consensus recommendation is a “strong buy”. As such, AstraZeneca PLC is an attractive option for investors looking for a drug manufacturer that is performing well and has a good dividend yield.

Recent Posts