2023: China Approves CSPC Pharmaceutical’s First mRNA Vaccine.

March 26, 2023

Trending News ☀️

In an impressive development, the Chinese government has approved CSPC ($SEHK:01093) Pharmaceutical Group’s first ever mRNA vaccine for commercial use. This marks a major milestone in the company’s efforts to develop an efficient and safe vaccine against infectious diseases. This vaccine has been developed using mRNA technology, which is a relatively new approach to vaccine development. In contrast to traditional vaccine production techniques, mRNA technology does not require culturing of living cells and can instead be engineered more quickly and efficiently in the lab.

In addition, the use of mRNA technology eliminates the risk of contamination from potentially harmful viruses or bacteria. The approval of CSPC Pharmaceutical Group’s mRNA vaccine is expected to pave the way for the company to expand its vaccine portfolio and strengthen its presence in the global vaccine market. Furthermore, it will also bring China one step closer to achieving its goal of providing universal access to safe and effective vaccines by 2023. This is a major accomplishment for CSPC Pharmaceutical Group and it is sure to be a major breakthrough in the fight against infectious diseases. The company’s commitment to developing safe and effective vaccines is sure to help improve public health in China and around the world.

Share Price

On Thursday, CSPC PHARMACEUTICAL‘s stock opened at HK$8.3 and closed at HK$7.7, a decrease of 7.3% from the previous day’s closing price of HK$8.4. This is in response to the news that China has approved the company’s first mRNA vaccine for clinical trials in 2023. CSPC PHARMACEUTICAL is the first company in China to develop and register an mRNA vaccine, which is a novel technology that uses messenger RNA to produce an immune response and has the potential to provide more effective protection against infectious diseases. The approval of this vaccine marks an important milestone for CSPC PHARMACEUTICAL in its ongoing effort to develop new and innovative treatments to combat global infectious diseases and other illnesses.

The company is optimistic that this vaccine will eventually be approved for widespread use, and hopes that it will help China become a leader in the global vaccine development industry. With the approval of this mRNA vaccine, CSPC PHARMACEUTICAL is paving the way for a new generation of medical treatments that will ultimately benefit millions of people around the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cspc Pharmaceutical. More…

| Total Revenues | Net Income | Net Margin |

| 29.65k | 5.51k | 18.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cspc Pharmaceutical. More…

| Operations | Investing | Financing |

| 6.15k | -4.64k | -1.88k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cspc Pharmaceutical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.84k | 9.42k | 2.35 |

Key Ratios Snapshot

Some of the financial key ratios for Cspc Pharmaceutical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.4% | 15.7% | 23.3% |

| FCF Margin | ROE | ROA |

| 13.8% | 16.0% | 11.1% |

Analysis

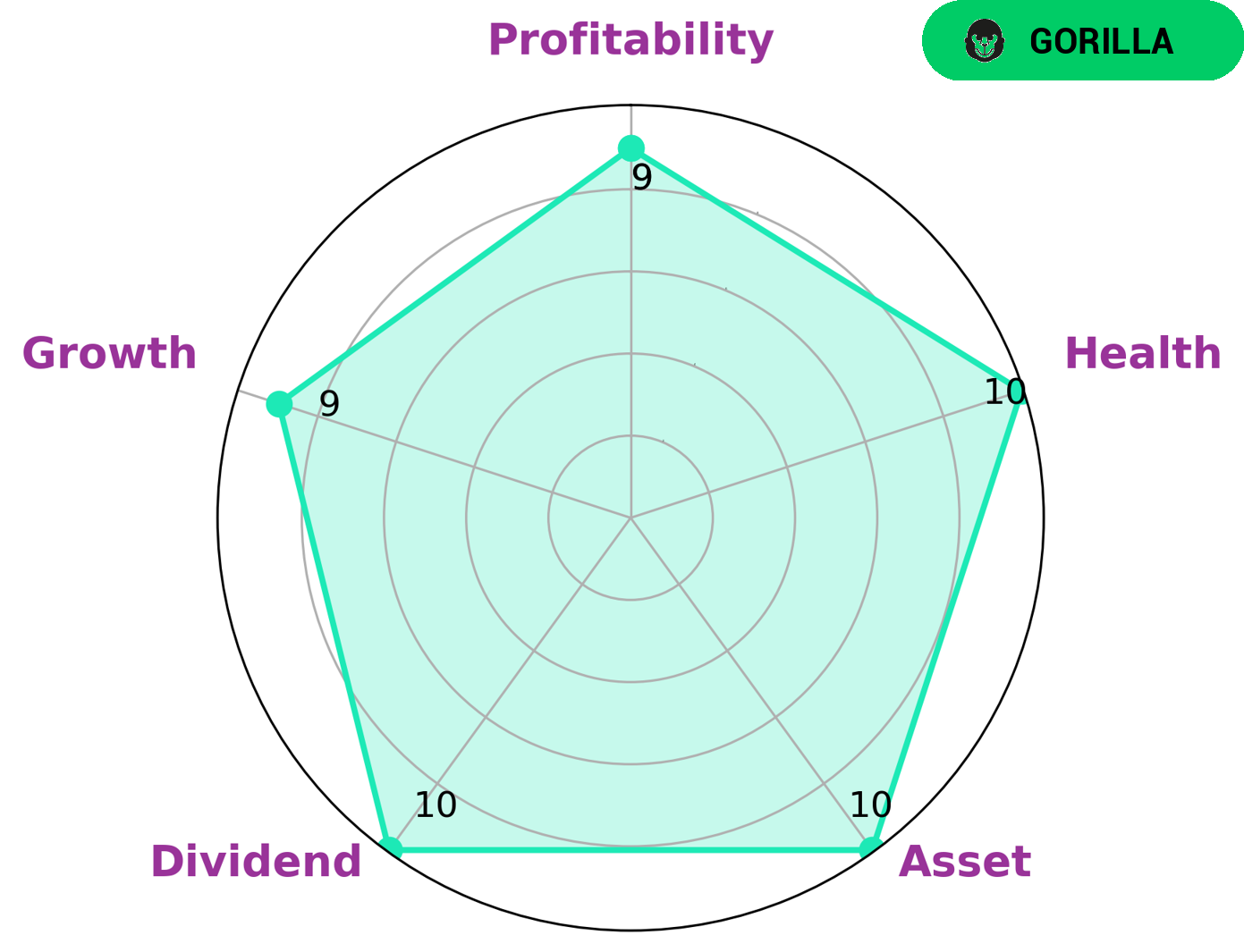

GoodWhale’s analysis of CSPC PHARMACEUTICAL‘s fundamentals indicates that the company is in a strong position. Our Star Chart gave it a high health score of 10/10, indicating that it has both the ability to pay off its debt and the funds needed to propel future operations. Furthermore, we classify CSPC PHARMACEUTICAL as a ‘gorilla’ type of company – one that shows stable, consistent growth thanks to a strong competitive advantage. Analyzing the fundamentals, we find that CSPC PHARMACEUTICAL is strong in terms of asset, dividend, growth, and profitability. These strong fundamental qualities make the company attractive to a variety of investors. Value investors may appreciate the company’s dividends and assets, while those looking for long-term growth may be drawn by the potential of its profitability and growth. More…

Peers

The pharmaceutical industry is an intensely competitive sector, with CSPC Pharmaceutical Group Ltd competing against a range of powerful rivals, such as Hansoh Pharmaceutical Group Co Ltd, Luye Pharma Group Ltd and Evoke Pharma Inc. All four companies have significant resources and are constantly striving to gain market share in an ever-changing environment.

– Hansoh Pharmaceutical Group Co Ltd ($SEHK:03692)

Hansoh Pharmaceutical Group Co Ltd is a leading Chinese pharmaceutical company which focuses on the research, development, manufacturing and marketing of innovative pharmaceuticals. In 2022, the company had a market capitalization of 90.73 Billion US Dollars and a Return on Equity of 10.07%, indicating a strong financial performance. The company has been able to successfully utilize its resources to generate a strong financial return, which indicates a healthy and profitable business. This has allowed the company to expand its operations and develop new products, furthering its position as one of the leading pharmaceutical companies in the world.

– Luye Pharma Group Ltd ($SEHK:02186)

Luye Pharma Group Ltd is a pharmaceutical company based in China. It develops and manufactures pharmaceuticals, active pharmaceutical ingredients, and medical devices. As of 2022, the company has a market cap of 12.14 billion and a Return on Equity of 1.66%. This market cap indicates the company’s potential and size in the industry, while the Return on Equity provides an indication of the company’s profitability. Luye Pharma Group Ltd continues to be a major player in the pharmaceutical industry, developing innovative products and services that meet the needs of its customers.

– Evoke Pharma Inc ($NASDAQ:EVOK)

Evoke Pharma Inc is a specialty pharmaceutical company focused on treatments for gastrointestinal diseases. With a market cap of 6.22M as of 2022, Evoke Pharma is a smaller company compared to its peers. Additionally, the company has a Return on Equity of -74.6%, indicating that it is not generating profits from its shareholders’ investments. This could be due to the company’s focus on research and development of products instead of generating profits. The company’s share price has been volatile in recent months, so investors should consider the risks before investing in Evoke Pharma.

Summary

CSPC Pharmaceutical has recently been approved to produce the first mRNA vaccine in China, but investors have been cautious surrounding the news. The company’s stock price dropped the same day that the vaccine was approved, likely due to investor uncertainty as to how much of a market demand there will be for the vaccine. For investors considering a position in CSPC Pharmaceutical, it is important to consider their profitability, the growth potential of their products, and the overall economic situation.

Additionally, they should carefully evaluate the potential risks associated with investing in such a new technology. Ultimately, investors need to weigh the potential risks and rewards before deciding to invest in CSPC Pharmaceutical.

Recent Posts