Zhejiang Changsheng Sliding dividend yield – Zhejiang Changsheng Sliding Bearings Co Ltd Announces 0.35 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1, 2023, Zhejiang Changsheng Sliding ($SZSE:300718) Bearings Co Ltd announced a cash dividend of 0.35 CNY per share. This dividend payout marks the third consecutive year of dividend payments for the company, with 0.35 CNY per share being issued in 2021 and 2022, and 0.33 CNY in 2023. The cumulative average yield of these three years comes to 2.6%.

The company has a track record of paying out dividends over the last three years, and the most recent dividend payment of 0.35 CNY per share promises a good return on investment. The ex-dividend date for this dividend payment is June 1st, 2023, for any investor who is interested in taking advantage of this opportunity.

Market Price

The news of the dividend announcement followed the company’s stock opening at CNY17.8 and closing at CNY17.5 on Thursday, down by 3.0% from its prior closing price of 18.0. The dividend is seen as a sign of the company’s commitment to rewarding its shareholders with a strong return on their investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Zhejiang Changsheng Sliding. More…

| Total Revenues | Net Income | Net Margin |

| 1.07k | 123.37 | 20.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Zhejiang Changsheng Sliding. More…

| Operations | Investing | Financing |

| 255.44 | -35.95 | -99.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Zhejiang Changsheng Sliding. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.75k | 236.4 | 4.58 |

Key Ratios Snapshot

Some of the financial key ratios for Zhejiang Changsheng Sliding are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.2% | 23.2% | 13.1% |

| FCF Margin | ROE | ROA |

| 16.5% | 6.3% | 5.0% |

Analysis – Zhejiang Changsheng Sliding Intrinsic Value Calculator

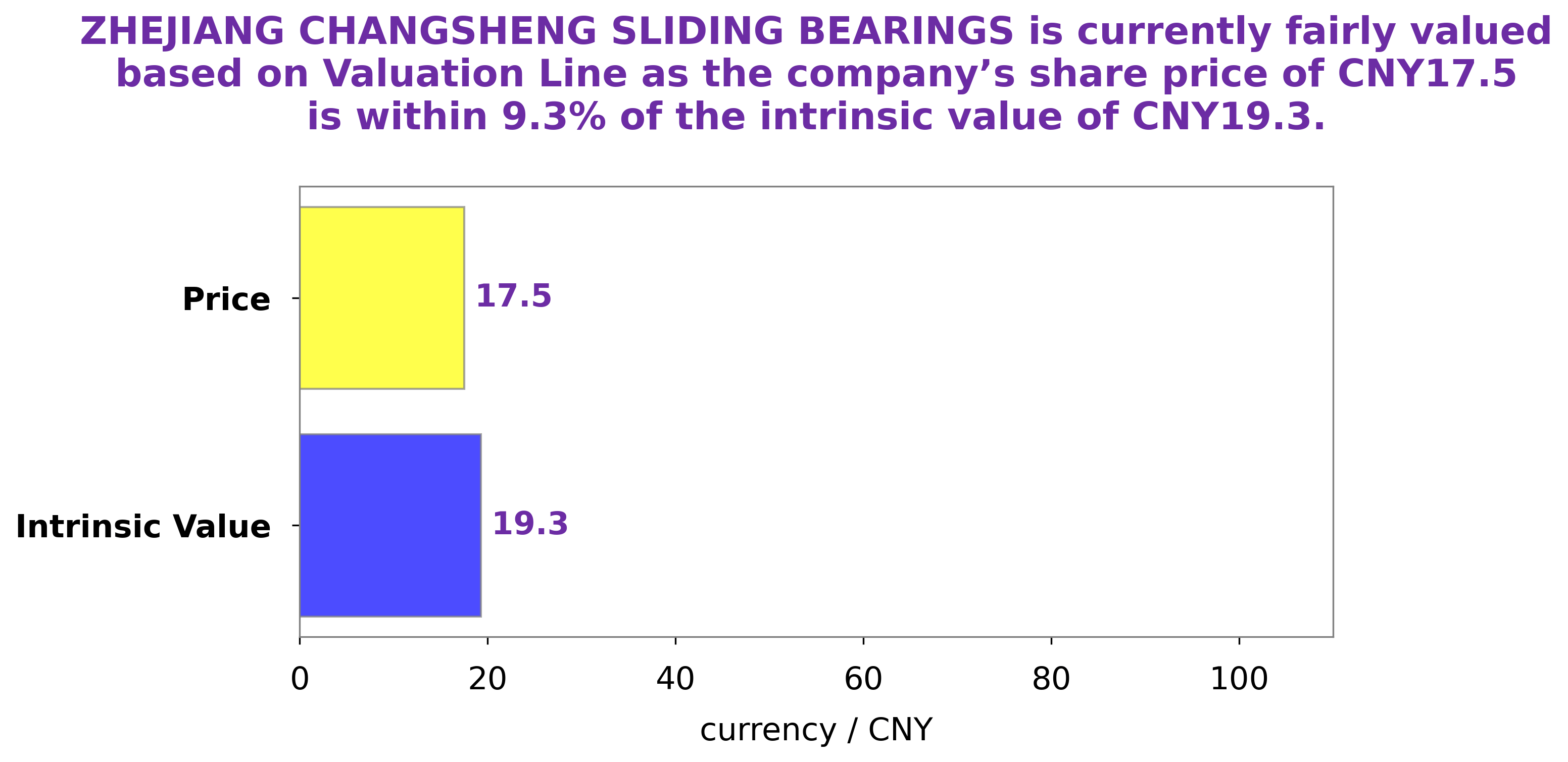

As GoodWhale, we have conducted an analysis of the fundamentals of ZHEJIANG CHANGSHENG SLIDING BEARINGS. Our proprietary Valuation Line has given the fair value of their share as CNY19.3. Currently, the stock is trading at CNY17.5, which is a 9.1% undervaluation compared to its fair price. We believe this is an attractive opportunity for investors and recommend considering it. More…

Peers

The competition between Zhejiang Changsheng Sliding Bearings Co Ltd and its competitors – Super Dragon Engineering Plastic Co Ltd, Kikuchi Seisakusho Co Ltd, and Sichuan Crun Co Ltd – has been fierce in recent years. All four companies have been striving to become the top provider in the industry, by offering the best quality products and services at competitive prices. As such, their rivalry has become increasingly intense as each company attempts to gain an edge over the other.

– Super Dragon Engineering Plastic Co Ltd ($SZSE:301131)

Super Dragon Engineering Plastic Co Ltd is a leading manufacturer of engineering plastic products, with an emphasis on innovation, quality and service. The company’s current market cap stands at 1.78 billion as of 2023. Furthermore, their Return on Equity (ROE) is 3.38%, indicating that the company is making a profit and creating value for its shareholders. Super Dragon Engineering Plastic Co Ltd has been one of the leading players in the engineering plastic industry for many years, and its market cap and ROE show that the company is in a strong financial position.

– Kikuchi Seisakusho Co Ltd ($TSE:3444)

Kikuchi Seisakusho Co Ltd is a Japanese-based manufacturer of industrial machinery, metal products, and automotive components. As of 2023, the company had an estimated market cap of 4.42 billion and a return on equity of -9.92%. Despite the negative return on equity, the company has continued to expand and develop new products that have driven their market cap to its current size. The company is well-known for its quality products and attention to detail when it comes to manufacturing.

– Sichuan Crun Co Ltd ($SZSE:002272)

Sichuan Crun Co Ltd is a consumer goods company based in China. It produces and distributes a variety of food, beverage, and personal care items. As of 2023, the company had a market capitalization of 3.01 billion USD, making it one of the top players in the Chinese consumer goods industry. Additionally, its Return on Equity (ROE) of 1.11% indicates that the company has been successful in generating profitability from shareholders’ investments.

Summary

Investing in ZHEJIANG CHANGSHENG SLIDING BEARINGS is a relatively safe bet with its consistent dividend yield of 2.6% over the last three years. The company has maintained its dividend payout per share of 0.35 CNY and 0.33 CNY in 2021 and 2023 respectively, indicating a stable financial and operational foundation. Furthermore, ZHEJIANG CHANGSHENG SLIDING BEARINGS has a low debt-to-equity ratio, which means that the company is not relying heavily on outside financing to operate and could be a good long-term investment. Investors should, however, conduct further research to ensure that the company’s fundamentals and prospects remain strong.

Recent Posts