Yip’s Chemical dividend yield – Yip’s Chemical Holdings Ltd Declares 0.05 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 3, 2023, Yip’s Chemical ($SEHK:00408) Holdings Ltd declared a 0.05 cash dividend. This is great news for investors looking for a steady dividend income, as the company has issued annual dividends per share of 0.3, 0.28 and 0.19 HKD over the past three years, with yields of 6.23%, 6.34% and 9.17%, respectively. The average dividend yield amounts to 7.25%. It should be noted that the ex-dividend date for the current year is June 13, 2023. If you are investing in YIP’S CHEMICAL, it is essential to keep this in mind. YIP’S CHEMICAL has an impressive dividend history, and should be a strong consideration for investors who are looking for a reliable dividend stream. With their declared 0.05 cash dividend, investors can expect a yield of 7.25% on their investments.

However, as with any dividend income, it is essential to be aware of the ex-dividend date in order to receive the payout. YIP’S CHEMICAL is a great option for those who want to receive regular, reliable returns on their investments. With their declared 0.05 cash dividend, investors can expect a steady income stream with an impressive yield of 7.25%. With their impressive record of issuing dividends over the past three years, YIP’S CHEMICAL is an ideal pick for those who are looking for consistent returns on their investments.

Price History

On Monday, YIP’S CHEMICAL stock opened at HK$3.5 and closed at HK$3.4, representing a 0.3% increase from the prior closing price of 3.4. The dividend announcement has been met with positive sentiment amongst investors. The company is expected to announce its quarterly results in the near future, which could further influence the stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Yip’s Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 17.07k | 214.78 | 1.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Yip’s Chemical. More…

| Operations | Investing | Financing |

| 629.23 | -111.6 | -210.94 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Yip’s Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.51k | 5.07k | 6.28 |

Key Ratios Snapshot

Some of the financial key ratios for Yip’s Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.2% | 20.7% | 3.3% |

| FCF Margin | ROE | ROA |

| 1.4% | 9.5% | 3.7% |

Analysis

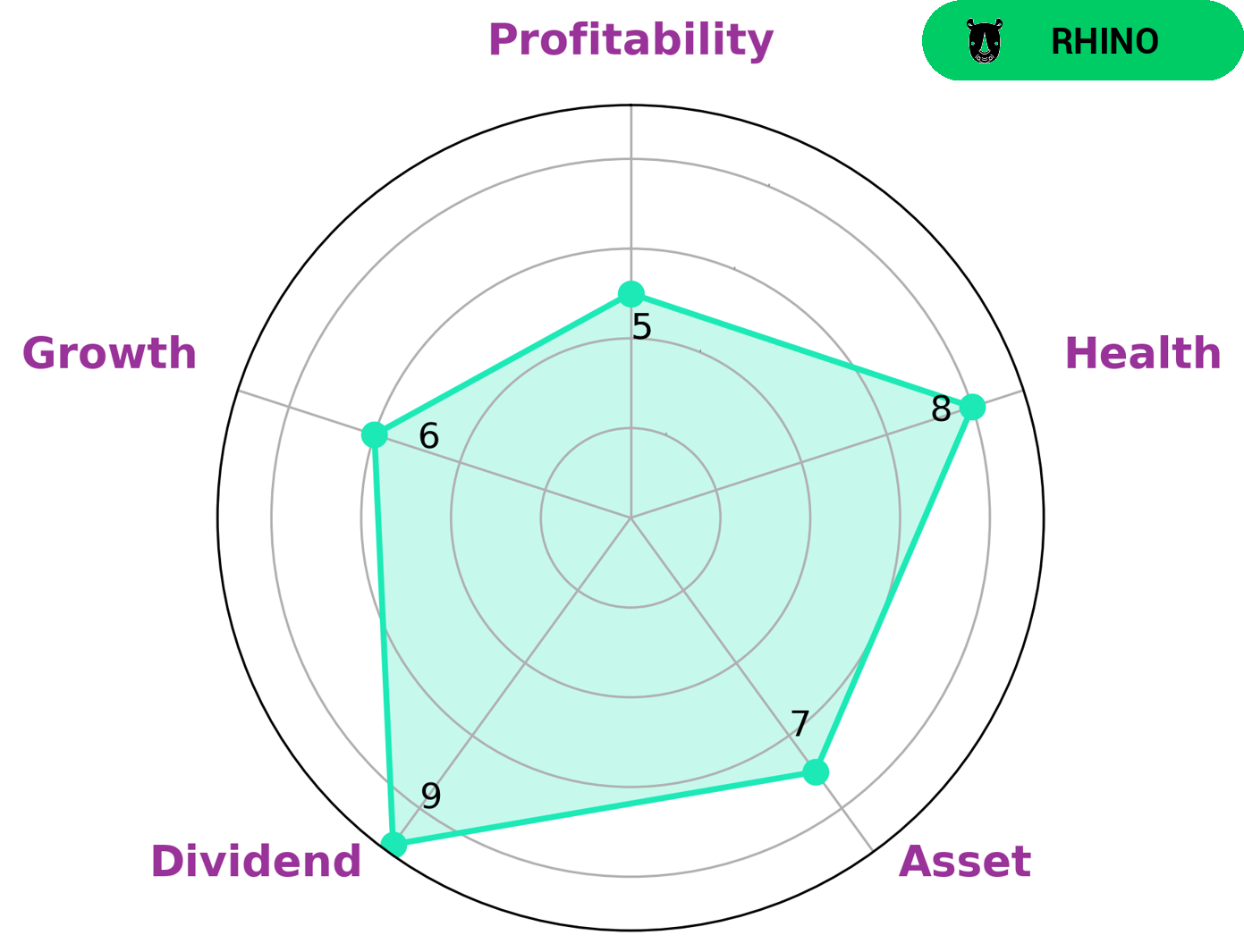

GoodWhale has the pleasure of analyzing YIP’S CHEMICAL‘s wellbeing. Our Star Chart system has labeled YIP’S CHEMICAL as strong in asset, dividend, and medium in growth and profitability. In terms of health score, YIP’S CHEMICAL receives an 8/10, meaning that the company is capable of sustaining future operations even in times of crisis. We classify YIP’S CHEMICAL as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. These results present a great opportunity for investors, especially those who are looking for long-term, steady investments. YIP’S CHEMICAL is a great choice for those who are looking for an asset-backed business with moderate growth potential. Additionally, the high health score indicates that YIP’S CHEMICAL is well placed to handle any potential obstacles that may be faced. More…

Peers

It has numerous competitors, including Jayant Agro-Organics Ltd, Luxchem Corp Bhd, and Abundance International Ltd. All of these companies have their own unique product offerings and a competitive edge in the market.

– Jayant Agro-Organics Ltd ($BSE:524330)

Jayant Agro-Organics Ltd is an agro-processing company that produces and markets castor-derivative products. The company has a market cap of 4.77 Billion as of 2023 and a Return on Equity of 12.48%, indicating the company is generating strong returns for its shareholders. By utilizing a variety of technologies, Jayant Agro-Organics Ltd is able to produce and process castor oil derivatives for a range of applications, such as food, cosmetics, pharmaceuticals, and more. The company consistently generates strong returns for its investors and has a robust market cap.

– Luxchem Corp Bhd ($KLSE:5143)

Luxchem Corp Bhd is a leading specialty chemical distributor in Malaysia, with a market cap of 513.49M as of 2023. It specializes in the sale and distribution of industrial and specialty chemicals, including for the oil & gas and water treatment industries. The company has a Return on Equity (ROE) of 11.55%, an indication of its solid financial performance. The high ROE reflects Luxchem’s strong profitability and efficient management of capital. The company is well-positioned to capitalize on growth opportunities in the specialty chemicals industry, which is expected to continue to expand in the coming years.

– Abundance International Ltd ($SGX:541)

Abundance International Ltd is a technology and business consulting firm providing innovative solutions to clients worldwide. With a market cap of 32.04M and Return on Equity of 2.72%, the company has had some success in the industry in terms of market growth and profitability. The company specializes in strategic initiatives, operational improvement, and organizational change initiatives. Their focus is on helping businesses create a competitive edge through leveraging their knowledge in technology and business operations. Abundance International Ltd is committed to providing tailored solutions that meet the needs of their customers, while delivering maximum value and results.

Summary

YIP’S CHEMICAL is an attractive choice for investors seeking a steady dividend income. Over the past three years, the company has provided dividends per share of 0.3, 0.28, and 0.19 HKD, respectively, giving yields of 6.23%, 6.34%, and 9.17%. The average dividend yield amounts to 7.25%, making it an attractive option for investors. YIP’S CHEMICAL is a reliable choice for dividend investors looking to get a steady return on their investment.

Recent Posts