Weltrend Semiconductor dividend yield – Weltrend Semiconductor Inc Announces 1.2 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Weltrend Semiconductor ($TWSE:2436) Inc announced on June 5 2023 that it will be issuing a cash dividend of 1.2 TWD per share. This is a great opportunity for investors looking to add dividend stocks to their portfolio; WELTREND SEMICONDUCTOR is a great option. Over the past three years, the company has issued an average annual dividend per share of 3.0 TWD, corresponding to a yield of 6.0%. This year, however, the dividend yield is slightly lower, coming in at 1.92%.

Nevertheless, the company’s average dividend yield over the past three years still stands at a strong 4.64%. The ex-dividend date for the current year is June 20 2023, so make sure to get your shares before this date if you would like to receive the dividend.

Market Price

This news sent the company’s stock soaring, opening at NT$54.2 and closing at NT$54.8, an increase of 3.0% from its previous closing price of 53.2. This marks the highest closing price for Weltrend Semiconductor in more than two years. These results demonstrate Weltrend’s ability to continue to generate strong profits and return value to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Weltrend Semiconductor. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | 53.58 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Weltrend Semiconductor. More…

| Operations | Investing | Financing |

| -18.3 | 36.42 | 267.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Weltrend Semiconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.77k | 1.91k | 17.85 |

Key Ratios Snapshot

Some of the financial key ratios for Weltrend Semiconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.9% | -25.1% | 0.8% |

| FCF Margin | ROE | ROA |

| -2.5% | 0.4% | 0.2% |

Analysis

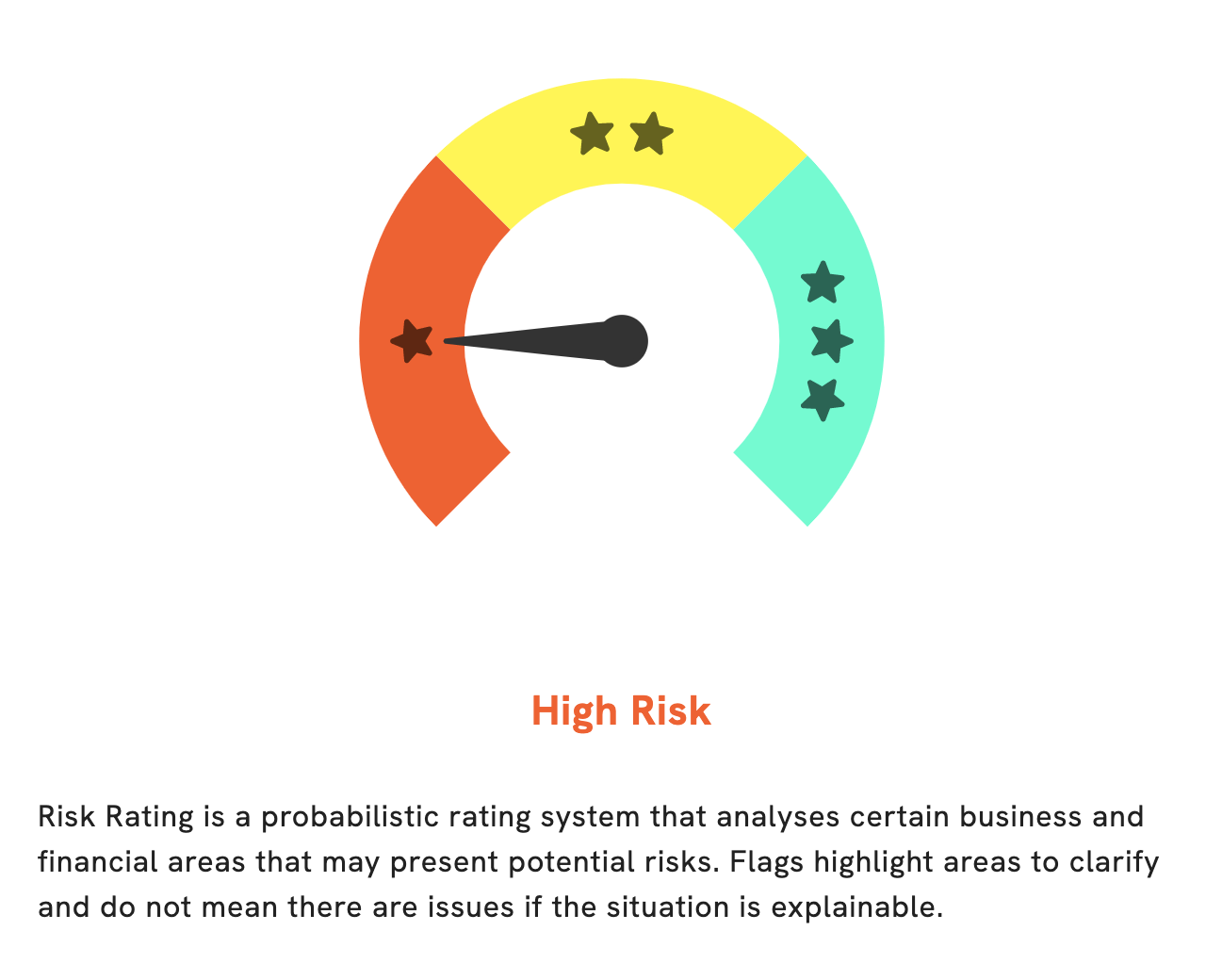

At GoodWhale, we conducted a thorough analysis of WELTREND SEMICONDUCTOR‘s fundamentals and generated a Risk Rating to provide you with a comprehensive understanding of the company. We determined that it is a high risk investment when considering both financial and business factors. Additionally, we identified two risk warnings in their income sheet and cashflow statement. To find out more about these warnings, become a registered user to access our comprehensive analysis. More…

Peers

Along with its direct competitors, TongFu Microelectronics Co Ltd, Powertech Technology Inc, and Ardentec Corp, Weltrend offers a wide range of products and services to meet the needs of today’s demanding marketplace. With its comprehensive range of technology solutions, Weltrend is one of the leading suppliers of semiconductor products in the world.

– TongFu Microelectronics Co Ltd ($SZSE:002156)

TongFu Microelectronics Co Ltd is a Chinese integrated circuit (IC) design company that focuses on wireless communication, digital multimedia, and power management solutions. As of 2023, the company has a market capitalization of 38.74 billion, making it one of the leading chipmakers in the world. Additionally, TongFu Microelectronics Co Ltd has an impressive Return on Equity (ROE) of 3.28%, indicating that the company efficiently utilizes its assets to generate profit and value for its shareholders.

– Powertech Technology Inc ($TWSE:6239)

Powertech Technology Inc is a leading provider of semiconductor manufacturing services, including wafer fabrication, assembly and testing, bumping, wafer probing, and package design. The company serves customers in the computer, consumer electronics, communications, automotive, and industrial markets. Powertech has a market capitalization of 74.73 billion USD as of 2023, which is indicative of the strong investor confidence in the company’s future prospects. Furthermore, Powertech has achieved a Return on Equity of 14.2%, indicating its ability to generate profit from its invested capital. This is a testament to the company’s focus on efficiency and sound financial management.

– Ardentec Corp ($TPEX:3264)

Ardentec Corp is a Taiwan-based electronics manufacturing company specializing in the design, manufacture, and sales of chips and semiconductor components. It is the world’s leading chip packaging company with a market cap of 28.53B as of 2023. Ardentec has achieved a high Return on Equity (ROE) of 16.65%, indicating that the company is efficient at using the invested capital to generate profits. The company’s success is attributed to its cutting-edge technology, product innovation, and customer satisfaction. Ardentec has established itself as a market leader in the semiconductor industry and continues to expand its presence in multiple markets.

Summary

WELTREND SEMICONDUCTOR is an attractive option for investors looking for a dividend stock. Over the past three years, the company has offered an increasingly attractive dividend yield of 6.0%, 6.0%, and 1.92%, averaging out to 4.64%. WELTREND SEMICONDUCTOR is an ideal investment opportunity for those seeking both short-term and long-term dividends. The company offers strong potential for growth and stability, making it an attractive option for investors.

Recent Posts