Walsin Lihwa dividend calculator – Walsin Lihwa Corp Declares 1.8 Cash Dividend

June 11, 2023

🌥️Dividends Yield

Walsin Lihwa ($TWSE:1605) Corp announced on June 1, 2023 that it will declare a cash dividend of 1.8 TWD per share. If you are looking for dividend stocks, WALSIN LIHWA may be a great choice for your portfolio. The company has been paying an annual dividend of 1.6 TWD per share for the past three years, and is expected to offer dividend yields of 3.7%, 3.7%, and 2.96% in 2021, 2022, and 2023 respectively, with an average yield of 3.45%.

The ex-dividend date for this dividend is June 6, 2023, so holders of WALSIN LIHWA stock as of that date will be eligible to receive the dividend. Investors should take note that the dividend yields may vary depending on the market conditions and the company’s performance so it is important to do your research before investing.

Market Price

This news has been welcomed by investors, as the cash dividend and stock buyback program signal the company’s confidence in its future growth prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Walsin Lihwa. More…

| Total Revenues | Net Income | Net Margin |

| 188.56k | 17.61k | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Walsin Lihwa. More…

| Operations | Investing | Financing |

| 26.13k | -31.53k | -264.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Walsin Lihwa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 251.05k | 119.55k | 33.51 |

Key Ratios Snapshot

Some of the financial key ratios for Walsin Lihwa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.7% | 33.6% | 12.3% |

| FCF Margin | ROE | ROA |

| 3.4% | 11.6% | 5.8% |

Analysis

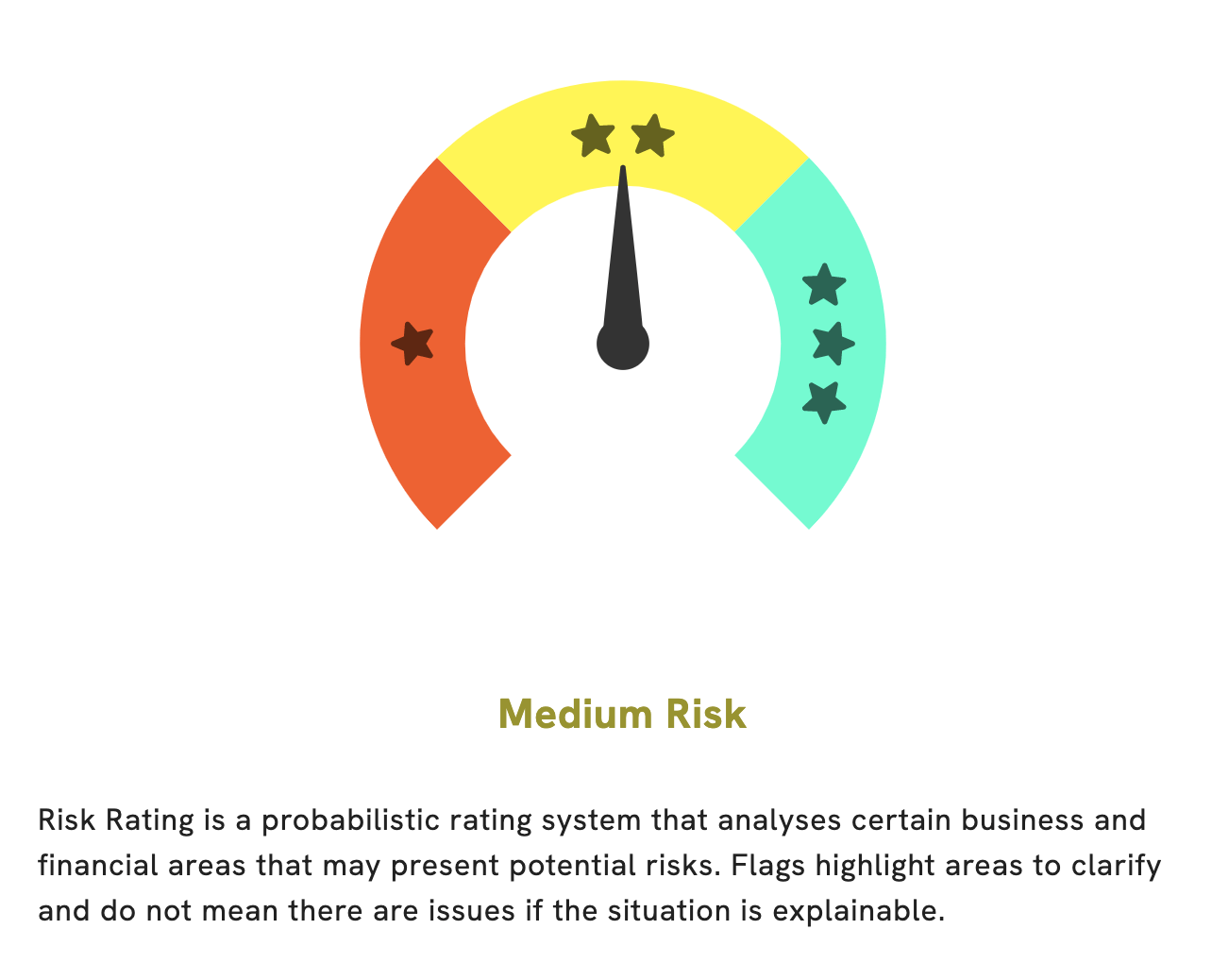

At GoodWhale, we have completed an analysis of WALSIN LIHWA‘s fundamentals. After thorough evaluation, we have determined that WALSIN LIHWA is a medium risk investment in terms of financial and business aspects. We have detected two risk warnings on the income sheet and balance sheet. To explore these in more detail, become a registered user on our platform. Our goal is to help investors make informed decisions by providing the latest information on investments. More…

Peers

The company operates in highly competitive markets, competing directly with fellow Asian companies such as KEI Industries Ltd, Polycab India Ltd, and Hua Eng Wire & Cable Co Ltd. Despite fierce competition in the industry, Walsin Lihwa Corp has remained highly successful due to its commitment to innovation and quality.

– KEI Industries Ltd ($BSE:517569)

TAKEDA KEI Industries Ltd is a global conglomerate based in Japan. The company has a diverse portfolio of businesses which includes automotive, electronics, chemicals, energy, and medical technology, among others. TAKEDA KEI Industries Ltd has an impressive market cap of 189.81 billion as of 2023, which reflects its sustained strong performance over the years. The company also has a high Return on Equity of 17.15%, which further speaks to its sound financial performance and ability to generate returns for its shareholders.

– Polycab India Ltd ($BSE:542652)

Polycab India Ltd is one of the largest wires and cables manufacturers in India. The company is also among the leading players in the electrical equipment and appliances industry in India. As of 2023, it has a market cap of 531.54 billion, making it one of the most valuable companies in India. Additionally, Polycab India Ltd has a Return on Equity (ROE) of 17.2%, which is significantly higher than the industry average, indicating that the company has a strong financial position and is likely to deliver superior returns to its investors.

– Hua Eng Wire & Cable Co Ltd ($TWSE:1608)

Hua Eng Wire & Cable Co Ltd is a leading wire and cable manufacturer based in Hong Kong that specializes in the design, manufacture, and sale of high-quality cables for a variety of industries, including automotive, communications, telecommunication, and power. The company has a market capitalization of 9.86 billion US dollars as of 2023, making it one of the largest publicly traded companies in the region. The company’s Return on Equity (ROE) is 5.89%, which is indicative of its ability to generate profits from its investments. This demonstrates that the company is well-established and financially healthy.

Summary

WALSIN LIHWA is an attractive investment candidate for those looking to receive dividends from their shares. The company has an impressive average dividend yield of 3.45%, with an annual dividend of 1.6 TWD per share in the past 3 years. The expected dividend yields for 2021, 2022, and 2023 are 3.7%, 3.7%, and 2.96%, respectively. Investors should consider not only the dividend yields when evaluating WALSIN LIHWA as an investment, but also their own individual financial goals and the company’s financial position.

Recent Posts