Tung Ho Textile stock dividend – Tung Ho Textile Co Ltd Announces 0.32 Cash Dividend

June 7, 2023

🌥️Dividends Yield

On June 2 2023, Tung Ho Textile ($TWSE:1414) Co Ltd announced a 0.32 cash dividend per share. This is in line with the company’s dividend track record in the last three years, which saw dividends of 0.54 TWD paid out in 2021 and 2022, and 0.25 TWD in 2023. This makes Tung Ho Textile a potentially attractive investment for investors looking for a reliable source of income, with an average dividend yield of 2.51%. The dividend yields for 2021, 2022, and 2023 are 3.07%, 3.07%, and 1.39%, respectively. This indicates that investors can expect a solid return on their investments with Tung Ho Textile, especially considering the ex-dividend date of June 14 2023.

The company’s track record of paying dividends over the past three years also proves that its commitment to rewarding shareholders is genuine and sustainable. For those searching for a dividend stock, Tung Ho Textile might be an excellent choice. The company’s commitment to paying regular dividends combined with its attractive yields make it a great investment option for investors looking to boost their returns. Furthermore, the ex-dividend date for its 0.32 cash dividend provides an ideal opportunity for investors to capitalize on the chance to earn a higher return.

Price History

The announcement pushed the company’s stock to open at NT$17.4 and close at NT$17.4, down by 0.3% from the last closing price. The dividend distribution is a sign of the company’s confidence in its future prospects and its ability to provide returns to its shareholders. With the announcement of the cash dividend, the company is demonstrating its commitment to providing value to stakeholders and creating long-term wealth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tung Ho Textile. More…

| Total Revenues | Net Income | Net Margin |

| 642.71 | 72.01 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tung Ho Textile. More…

| Operations | Investing | Financing |

| 39.83 | -108.05 | 42.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tung Ho Textile. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.58k | 1.51k | 14.11 |

Key Ratios Snapshot

Some of the financial key ratios for Tung Ho Textile are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.6% | 152.2% | 14.3% |

| FCF Margin | ROE | ROA |

| 1.4% | 1.9% | 1.3% |

Analysis

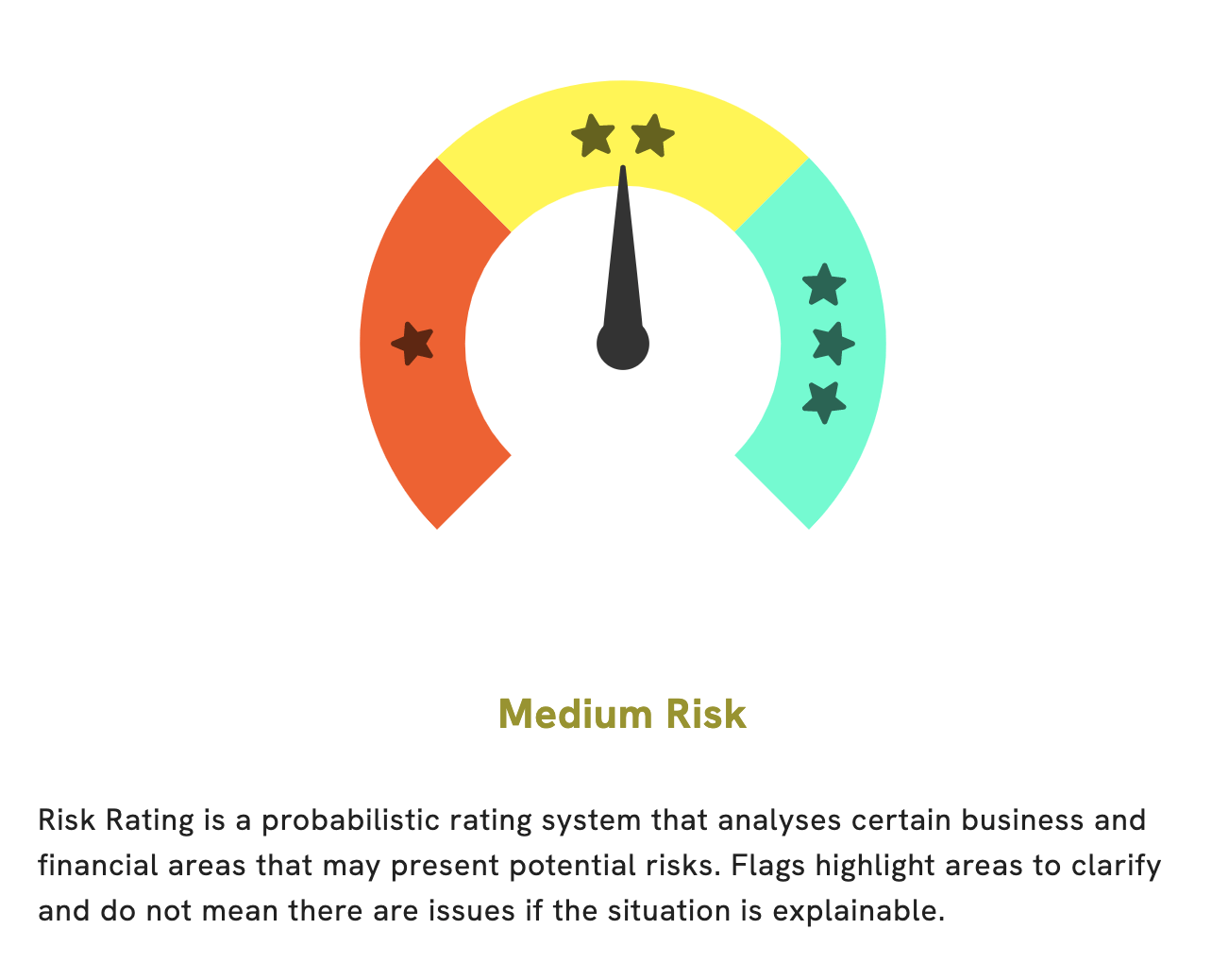

When it comes to evaluating the financials of TUNG HO TEXTILE, GoodWhale is the perfect tool. With our Risk Rating, we have determined that TUNG HO TEXTILE is a medium risk investment in terms of both financial and business aspects. We have also detected two risk warnings in the income sheet and balance sheet. If you want to get more information about these potential risks, you can register on our website, goodwhale.com. From there, you can access our comprehensive database of financial and business insights on TUNG HO TEXTILE. Our team of experienced analysts can help you make an informed decision about your investment. More…

Peers

Tung Ho Textile Co Ltd is one of the leading textile companies in the sector, operating alongside its competitors Suryaamba Spinning Mills Ltd, SVP Global Textiles Ltd, and Angel Fibers Ltd. Serving customers around the world with quality fabrics and garments, Tung Ho Textile Co Ltd has established a strong presence in the industry.

– Suryaamba Spinning Mills Ltd ($BSE:533101)

Suryaamba Spinning Mills Ltd is a leading textile manufacturer based in India. The company specializes in yarn spinning and other related activities including garment manufacturing, engineering, technical textiles, and more. As of 2023, the company has a market cap of 605.89M and a Return on Equity of 16.83%. The company’s market cap is indicative of its successful track record and stability, while its Return on Equity reflects the efficiency and profitability of the organization. Suryaamba Spinning Mills Ltd is well positioned to continue its leadership in the textile industry.

– SVP Global Textiles Ltd ($BSE:505590)

SVP Global Textiles Ltd is a leading international textile company that specializes in the production of fabrics, apparel, and textile-related products. With a current market capitalization of 1.43B, the company has established itself as a major player in the global textile market. The company’s return on equity of -8.7%, however, indicates that the company has had difficulty generating profits from its operations and investments. Nevertheless, SVP Global Textiles Ltd continues to be an innovative leader in the international textile industry, committed to providing quality materials and services to its customers.

– Angel Fibers Ltd ($BSE:541006)

Angel Fibers Ltd is a leading global manufacturer of synthetic fibers and fabrics used in apparel, home furnishings, and other consumer products. The company has a market cap of 722.5M as of 2023, reflecting its strong position in the industry. Angel Fibers Ltd’s return on equity of -3.54%, however, indicates that it is not performing as well as it could be. This suggests that the company may need to make changes to its operations in order to increase its profitability. The company could focus on cost cutting initiatives or improving operational efficiency in order to improve its profitability.

Summary

Investors looking at TUNG HO TEXTILE as a potential investment may be encouraged by the company’s recent dividend yields. Over the past three years, the company has issued dividends per share of 0.54 TWD, 0.54 TWD, and 0.25 TWD, giving investors an average dividend yield of 2.51%. Looking ahead, the company’s annual dividend yields are projected to stay consistent in 2021 and 2022 at 3.07%, before dropping to 1.39% in 2023. This suggests a solid long-term return on investment for those who choose to purchase TUNG HO TEXTILE stock in the near future.

Recent Posts