Tsh Resources Bhd dividend – TSH Resources Bhd Announces 0.025 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1, 2023, TSH Resources Bhd announced a 0.025 MYR cash dividend for the year 2023. This is a decrease from the dividend it provided in the previous two years of 0.08 MYR and 0.11 MYR, respectively. The average dividend yield from 2021 to 2023 is 5.91%, with dividend yields of 7.48%, 8.87%, and 1.39%, respectively. As a result of the announcement, prospective investors looking for stocks with a steady stream of income should consider TSH RESOURCES BHD ($KLSE:9059).

The ex-dividend date for this dividend is June 16, 2023, giving investors enough time to conduct due diligence on the company before making a decision to invest. TSH RESOURCES BHD is a viable option for investors looking for dividend stocks as it has consistently paid a dividend for the past three years despite the volatile market conditions.

Share Price

The announcement was made shortly after the stock opened at RM0.9 and closed at the same price on the day of announcement. This dividend distribution marks the first time that TSH Resources Bhd is paying out dividends to its shareholders. The announcement was made with the intention of rewarding shareholders and providing them with returns on their investments.

The company believes that this will strengthen investor confidence and serve as a sign of their commitment to long-term growth. This dividend is a reflection of the company’s positive financial performance and is expected to positively impact its stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tsh Resources Bhd. More…

| Total Revenues | Net Income | Net Margin |

| 1.22k | 389.36 | 3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tsh Resources Bhd. More…

| Operations | Investing | Financing |

| 215.53 | 467.87 | -727.97 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tsh Resources Bhd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.97k | 727.11 | 1.44 |

Key Ratios Snapshot

Some of the financial key ratios for Tsh Resources Bhd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.1% | 25.8% | 42.1% |

| FCF Margin | ROE | ROA |

| 11.0% | 16.5% | 10.8% |

Analysis

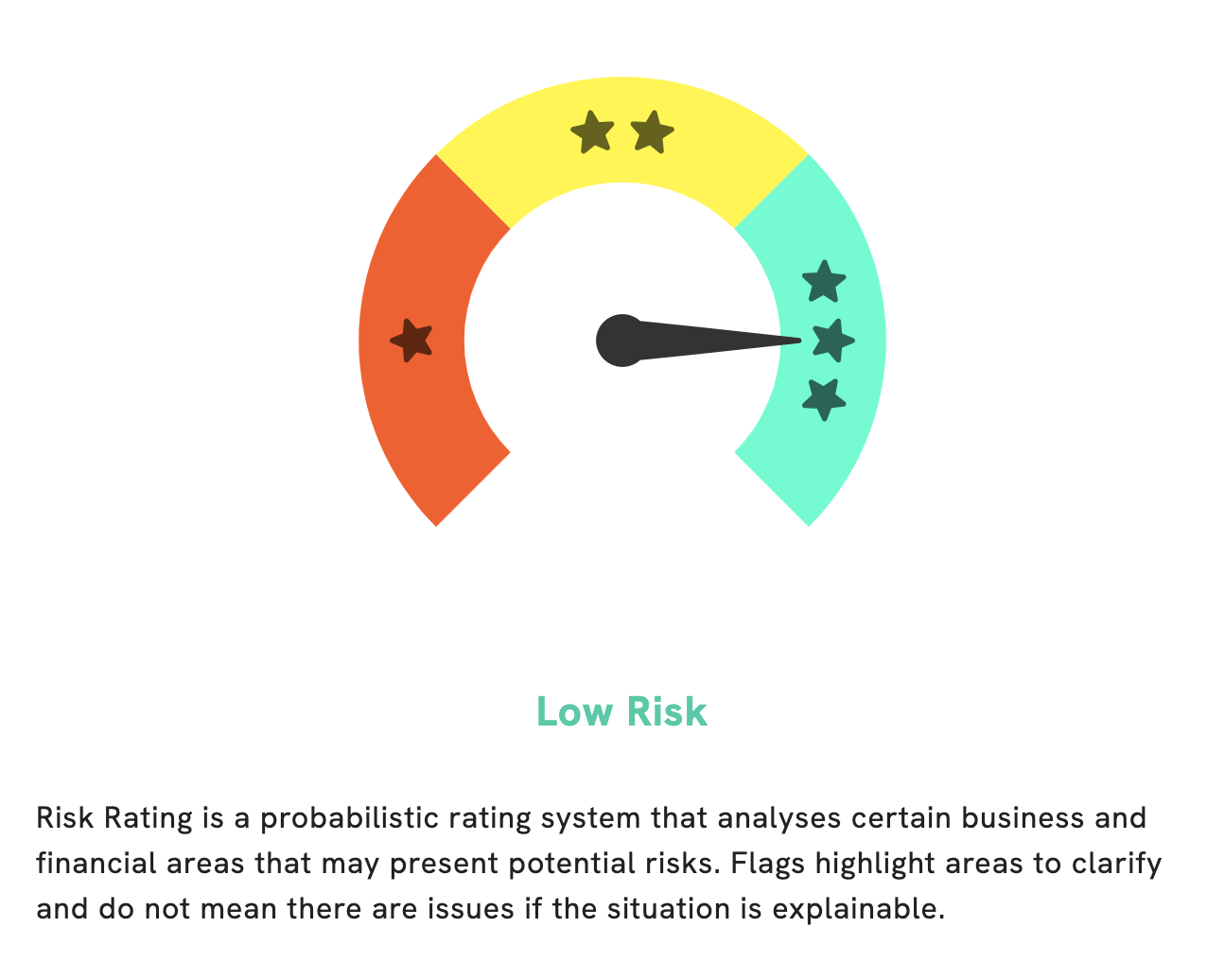

GoodWhale recently conducted an analysis of TSH RESOURCES BHD’s fundamentals and, based on our Risk Rating, found the company to be a low risk investment both from a financial and business perspective. There were, however, two risk warnings detected in the income statement and balance sheet, which is visible to registered users. To access this valuable information and to understand and protect yourself from any risks associated with investing in the company, we highly suggest that you become a registered user on GoodWhale. More…

Peers

TSH Resources Bhd is engaged in a fierce competition with some of the leading players in the industry such as Boustead Plantations Bhd, PT Andira Agro Tbk, and Global Palm Resources Holdings Ltd. These companies are all vying for a greater share of the market and have been offering innovative products and services to gain competitive advantage. While the competition is fierce, TSH Resources Bhd is making every effort to stay ahead of the competition and continue to provide quality products and services to their customers.

– Boustead Plantations Bhd ($KLSE:5254)

Boustead Plantations Bhd is a Malaysian-based agro-industrial and biotechnology group. The company focuses on oil palm plantation and related downstream activities. As of 2023, the company has a market cap of 1.78 billion Malaysian Ringgit and has a Return on Equity (ROE) of 5.69%. The market cap of Boustead Plantations Bhd is higher than its peers in the industry. The ROE of 5.69% puts it at a moderate level compared to the industry average of 7.62%. The company is well positioned to take advantage of future opportunities in the industry.

– PT Andira Agro Tbk ($IDX:ANDI)

Andira Agro Tbk is a publicly traded company in Indonesia that specializes in the agricultural sector. It has a market capitalization of 467.5 billion as of 2023, making it one of the largest companies in the Indonesian stock exchange. The company’s return on equity (ROE) stands at -5.2%, which is below the industry average of 8%. This indicates that the company is not generating sufficient returns on its equity investments. However, Andira Agro is a well-established and reliable business, and its size and market presence make it an attractive investment opportunity for many investors.

– Global Palm Resources Holdings Ltd ($SGX:BLW)

Palm Resources Holdings Ltd is a leading manufacturer and distributor of agricultural products across Asia and beyond. The company specializes in the production of palm oil products, including edible oil, oleochemicals, and specialty fats. Palm Resources Holdings Ltd has a market capitalization of 62.33M as of 2023. This market cap indicates the value of the company, and its potential for future growth. Additionally, the company’s Return on Equity (ROE) of 8.71% shows that the company is successfully utilizing its assets to generate income and returns for its shareholders.

Summary

Investing in TSH RESOURCES BHD can be a lucrative opportunity as the company has provided a steady dividend over the past three years. The average dividend yield between 2021 and 2023 was 5.91%. For 2021, the yield was 7.48%, for 2022 it was 8.87%, and for 2023 it was 1.39%.

This suggests that investors can expect reliable returns from the company and the dividends may continue to increase in the future. Investing in TSH RESOURCES BHD can be a great way to diversify and potentially grow a portfolio, while also gaining steady returns.

Recent Posts