Transalta Renewables dividend – TransAlta Renewables Declares Cash Dividend of 0.07833

April 4, 2023

Dividends Yield

TransAlta Renewables Inc. recently declared a cash dividend of 0.07833 on April 1st, 2023. This is the fourth consecutive year that TRANSALTA RENEWABLES ($BER:0TA) has issued an annual dividend per share of 0.94 CAD, making the total dividend yield for the past three years 5.28%. Investors who are looking for dividend stocks may want to consider adding TRANSALTA RENEWABLES to their list of considerations.

The ex-dividend date for this dividend is April 13, 2023. This could be a great opportunity to invest in dividend stocks with a long-term horizon.

Market Price

The stock opened the day at €8.5 and closed at €8.4, down by 0.5% from the previous closing price of €8.5. This was an unexpected minor change in the stock price, and indicated a decrease in investor confidence in the company’s ability to maintain its current dividend rate in the near future. However, with its strong portfolio of renewable energy assets and its commitment to supporting sustainable energy, TRANSALTA RENEWABLES remains an attractive long-term investment for many investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transalta Renewables. More…

| Total Revenues | Net Income | Net Margin |

| 560 | 74 | 12.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transalta Renewables. More…

| Operations | Investing | Financing |

| 257 | 34 | -446 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transalta Renewables. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.23k | 1.42k | 6.58 |

Key Ratios Snapshot

Some of the financial key ratios for Transalta Renewables are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.9% | -1.6% | 25.2% |

| FCF Margin | ROE | ROA |

| 24.8% | 5.0% | 2.7% |

Analysis

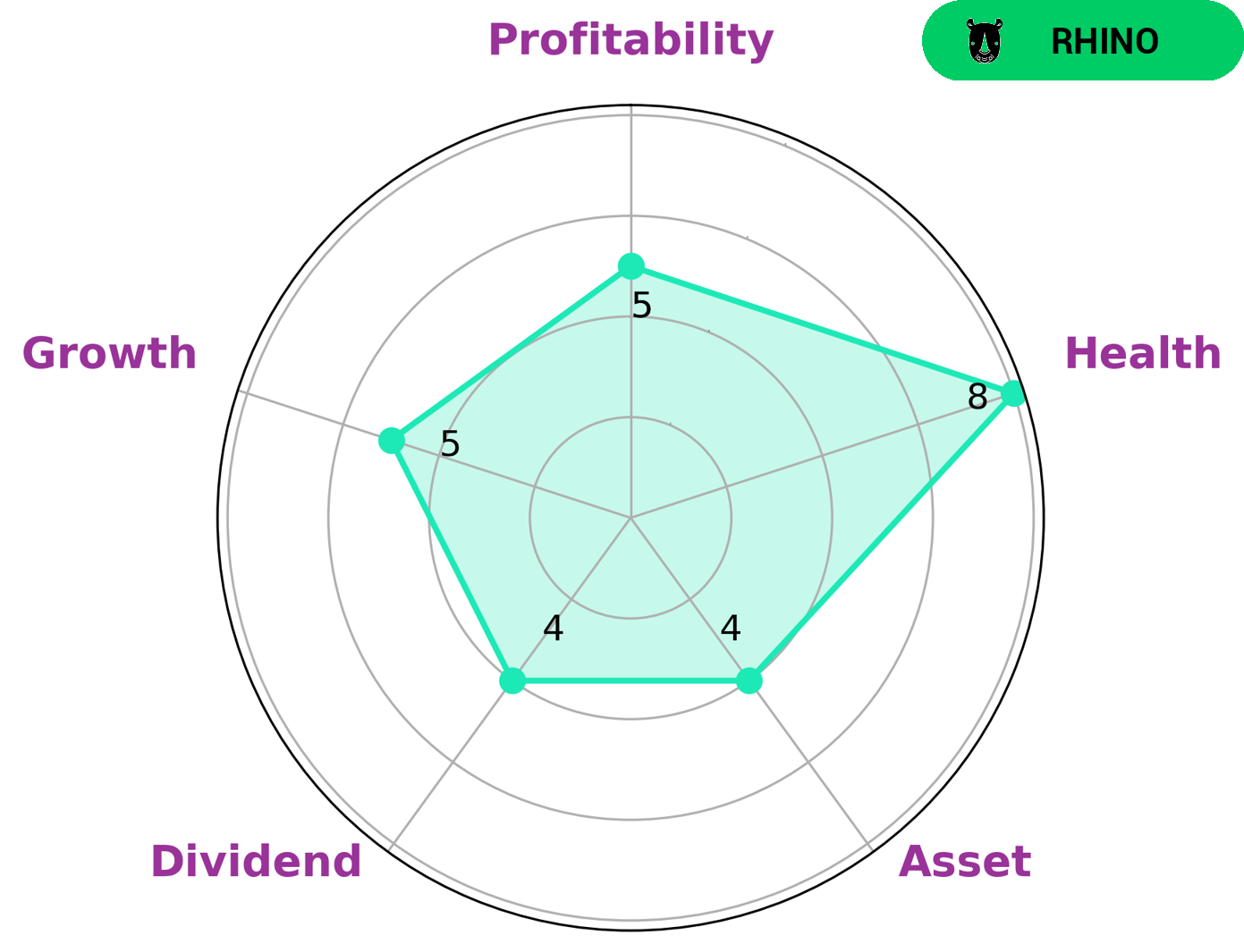

Our analysis of TRANSALTA RENEWABLES‘s financials has been completed, and the results are encouraging. According to our Star Chart, TRANSALTA RENEWABLES has achieved an impressive score of 8/10 when it comes to financial health, which is based on its ability to pay off debt and fund future operations. Based on this score, we classify TRANSALTA RENEWABLES as a ‘rhino’ type company – one that has achieved moderate revenue or earnings growth. Investors looking for a solid and reliable stock may be interested in TRANSALTA RENEWABLES, as it is strong in asset, dividend, growth, and profitability. With its strong financial health status, it is a secure investment choice for those looking to diversify their portfolio. More…

Summary

Investing in TRANSALTA RENEWABLES could be a viable option for dividend investors. It has issued an annual dividend of 0.94 CAD per share for the past three years, giving a yield of 5.28% from 2022 to 2023. This makes TRANSALTA RENEWABLES a reliable source of income.

Moreover, the company has a long history of consistent dividend payments, making it an attractive investment opportunity. It can also be a part of a diversified portfolio to provide a steady stream of income over the long-term.

Recent Posts