Topco Scientific dividend yield – TOPCO SCIENTIFIC Declares 10.0 Cash Dividend

June 3, 2023

🌥️Dividends Yield

TOPCO SCIENTIFIC ($TWSE:5434) has just announced that they will be declaring a 10.0 TWD cash dividend on June 1, 2023. This is a notable increase from the past three years, when TOPCO SCIENTIFIC paid out an annual dividend per share of 8.8, 8.8, and 8.0 TWD, resulting in dividend yields of 5.4%, 5.4%, and 6.23% in 2021, 2022, and 2023 respectively, with an average dividend yield of 5.68%. For those investors looking to increase their portfolio’s dividend yield, TOPCO SCIENTIFIC is definitely worth considering.

The company has an ex-dividend date of June 8, 2023, so investors must purchase the stock before that date in order to be eligible for the dividend payout. With a 10.0 TWD dividend, investors can expect to see a higher return on their investment and potentially even greater yields in the future.

Stock Price

The stock opened at NT$199.0 and closed at NT$201.0, an increase of 0.5% from the previous closing price of NT$200.0. This dividend comes as a welcome announcement and is the company’s third dividend distributed this year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Topco Scientific. More…

| Total Revenues | Net Income | Net Margin |

| 52.89k | 3.1k | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Topco Scientific. More…

| Operations | Investing | Financing |

| 2.55k | -1.45k | -1.05k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Topco Scientific. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.37k | 17.23k | 65.11 |

Key Ratios Snapshot

Some of the financial key ratios for Topco Scientific are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.6% | 18.3% | 8.2% |

| FCF Margin | ROE | ROA |

| 4.0% | 21.9% | 9.2% |

Analysis – Topco Scientific Stock Intrinsic Value

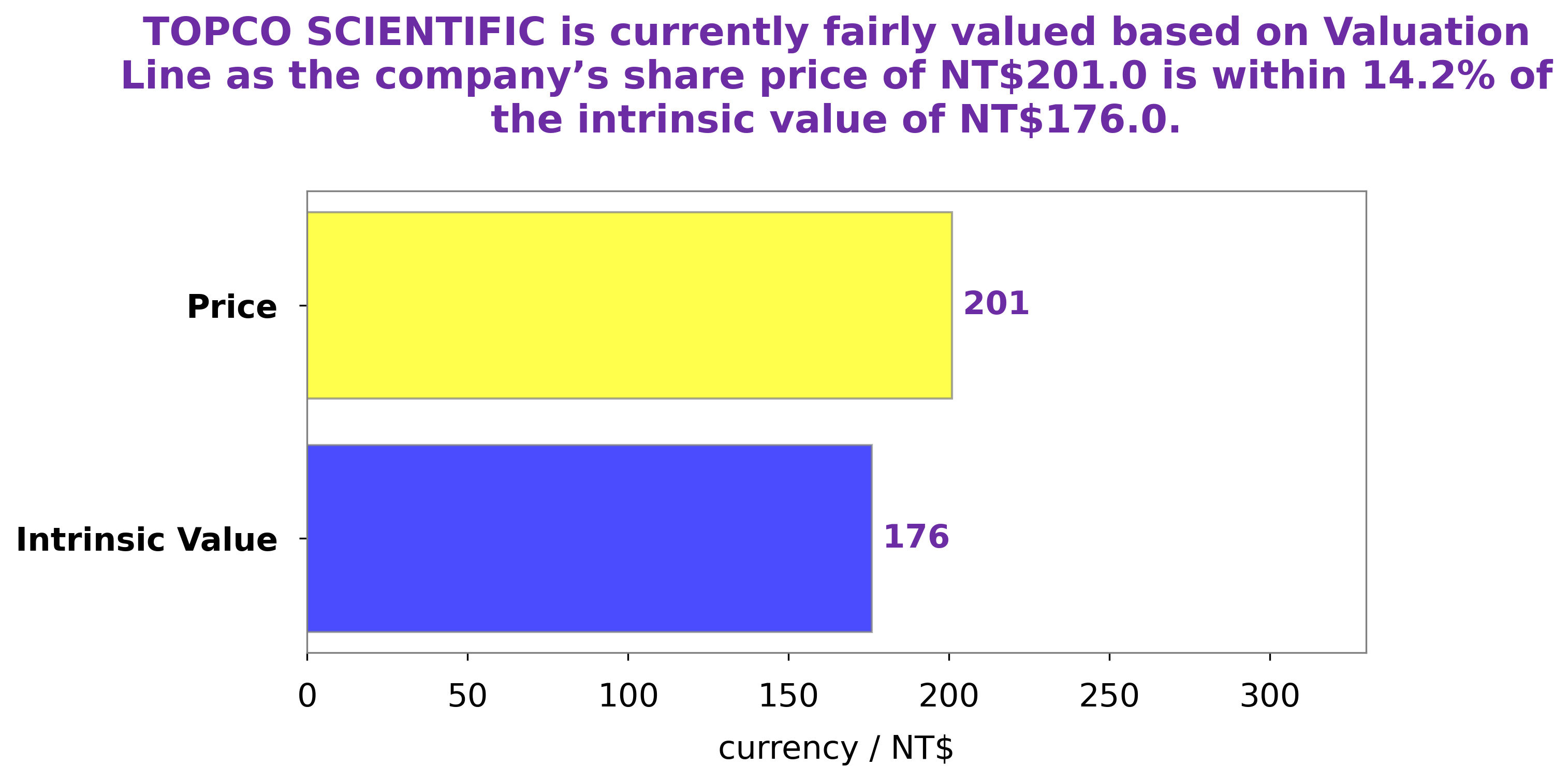

At GoodWhale, we have conducted an analysis of TOPCO SCIENTIFIC‘s fundamentals and have calculated that its fair value is around NT$176.0, using our proprietary Valuation Line. Currently, the stock is being traded at NT$201.0, which is 14.2% higher than its fair value, making it an overvalued fair price. Therefore, investors should consider the current overvaluation before investing in TOPCO SCIENTIFIC. More…

Peers

It is one of the leading companies in the industry, competing with Lasertec Corp, Ferrotec Holdings Corp, and ShunSin Technology Holdings Ltd. All four companies strive to offer high quality products and services that meet the needs of their customers.

– Lasertec Corp ($TSE:6920)

Lasertec Corp is a leading manufacturer of laser-based technology solutions. The company has a market capitalization of 1.94T as of 2023, which makes it one of the largest companies in the industry. Additionally, the company has an impressive Return on Equity (ROE) of 33.08%. This high ROE figure reflects the successful execution of its business strategy and its ability to generate strong returns for its shareholders. Lasertec Corp offers a wide range of products and services, such as laser cutting and welding equipment, CNC machines, precision measurement systems, and 3D printing solutions. The company’s innovative products and services make it a leader in the laser technology industry.

– Ferrotec Holdings Corp ($TSE:6890)

Ferrotec Holdings Corp is a leading global manufacturer of precision engineered components and advanced materials for both industrial and consumer applications. The company has a market cap of 144.72B as of 2023 and a Return on Equity of 14.79%. This is generally considered to be a strong ROE, indicative of the company’s success in creating value for shareholders. The high market cap reflects investor confidence in the company and its products, as well as its ability to generate significant financial returns.

– ShunSin Technology Holdings Ltd ($TWSE:6451)

ShunSin Technology Holdings Ltd is a Chinese technology company that specializes in providing services such as software, consulting, and system integration. The company has a market cap of 9.31B as of 2023, indicating that the company is a large and well-established business in the industry. Furthermore, the company demonstrates a strong performance with a Return on Equity of 3.44%, showing that it is efficient and profitable.

Summary

TOPCO SCIENTIFIC is a good stock for dividend investors. Its consistent dividend payouts over the past three years have resulted in an average dividend yield of 5.68%, with the highest yield of 6.23% in 2023. This indicates that shareholders can expect reliable returns from the company, making it an attractive option for those looking for steady income.

Furthermore, its share price has grown steadily despite the recent market volatility, demonstrating its resilience and stability even in uncertain times. Investors should therefore consider adding TOPCO SCIENTIFIC to their portfolio as a safe and reliable source of income.

Recent Posts