TBLA dividend calculator – PT Tunas Baru Lampung Tbk Declares 20.0 Cash Dividend

June 11, 2023

🌥️Dividends Yield

On May 25, 2023, PT ($IDX:TBLA) Tunas Baru Lampung Tbk announced a 20.0 cash dividend for its shareholders. It has been paying out dividends consistently over the past three years, with 88.82, 88.82, and 24.67 IDR per share, respectively. This gives dividend yields of 11.92%, 11.92%, and 3.11%. The ex-dividend date is May 24, 2023, so investors need to purchase the stock on or before this day in order to qualify for the dividend payment.

Market Price

The stock opened at IDR0.0 and closed at IDR645.0, up by 0.8% from prior closing price of 640.0. This dividend payout is the highest in the company’s history and shows the commitment of TBLA in rewarding its shareholders with regular returns. This announcement is a testament to the strong fundamentals of TBLA and its long-term prospects for growth and returns. This move follows a series of other positive developments for TBLA in 2021, including a successful merger with another major player in the industry and the expansion into new markets.

With these initiatives, TBLA is well-positioned to be a leader in the Indonesian market and beyond. The declaration of the 20.0 cash dividend is expected to be well-received by investors and will likely increase investor confidence in the company. As a result, it is likely that the stock price will see an increase following the announcement. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TBLA. More…

| Total Revenues | Net Income | Net Margin |

| 17.09M | 816.76k | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TBLA. More…

| Operations | Investing | Financing |

| 1.17M | -1.26M | -317.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TBLA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.1M | 16.05M | 1.32k |

Key Ratios Snapshot

Some of the financial key ratios for TBLA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.3% | 9.3% | 12.1% |

| FCF Margin | ROE | ROA |

| -0.6% | 18.6% | 5.6% |

Analysis

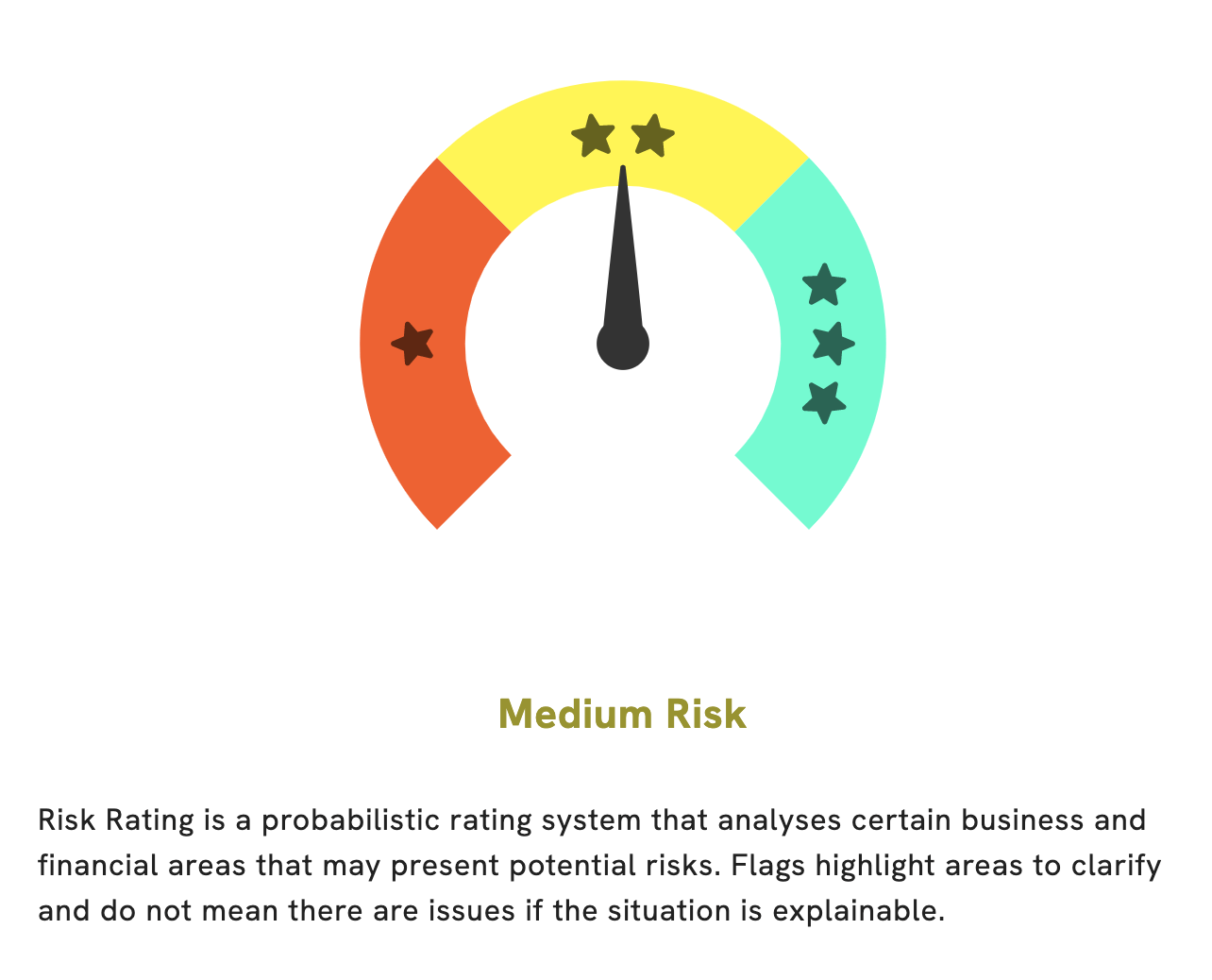

At GoodWhale, we recently conducted an analysis of PT TUNAS BARU LAMPUNG TBK’s wellbeing. Our Risk Rating report shows that the company is a medium risk investment in terms of both its financial and business aspects. Our analysis also detected two risk warnings in the company’s income sheet and balance sheet, so we strongly recommend that potential investors register with us to get a closer look at the data. We are committed to helping investors make informed decisions when it comes to their investments, and we believe our detailed analysis of PT TUNAS BARU LAMPUNG TBK can be a valuable asset in that regard. More…

Peers

It is a publicly traded company listed on the Indonesia Stock Exchange, and competes with the likes of PT Salim Ivomas Pratama Tbk, Indofood Agri Resources Ltd and PT Mahkota Group Tbk. With a strong focus on sustainable development, PT Tunas Baru Lampung Tbk has committed to producing quality goods and services in order to enhance the lives of its shareholders, customers, and employees.

– PT Salim Ivomas Pratama Tbk ($IDX:SIMP)

PT Salim Ivomas Pratama Tbk is a leading Indonesian food and beverage company that focuses on producing ingredients and items for the retail and foodservice industries. The company’s market capitalization as of 2023 is 6.14 trillion, which reflects the company’s strong financial performance and growth potential. Furthermore, its Return on Equity of 9.38% shows that the company is managing its assets effectively and efficiently to generate a higher return on equity to increase shareholder wealth. This demonstrates the company’s ability to generate sustainable profit from its operations in the long run.

– Indofood Agri Resources Ltd ($SGX:5JS)

Indofood Agri Resources Ltd is a major player in the food, agribusiness, and consumer goods sector in Southeast Asia. The company produces a range of products including rice, flour, spices, noodles, and other food items, as well as providing packaging solutions for food products. As of 2023, the company’s market cap stands at 418.77 million and the return on equity (ROE) is 14.01%. This shows that the company is doing well through its operations and has been able to generate healthy returns for its shareholders. Additionally, this indicates that investors have confidence in the management and their ability to generate returns from their business operations.

– PT Mahkota Group Tbk ($IDX:MGRO)

PT Mahkota Group Tbk is an Indonesian-based holding company that engages in the acquisition and management of companies operating in the food processing, property development, and mining industries. With a market capitalization of 2.52T as of 2023, the company has been able to generate significant returns on equity. Currently, it boasts a Return on Equity of 1.48%, which is well above the industry average. This demonstrates the company’s efficient use of its capital and strong financial performance over the past year.

Summary

PT TUNAS BARU LAMPUNG TBK is an attractive option for investors seeking dividend income. Over the past three years, the company has paid out annual dividends per share of 88.82, 88.82, and 24.67 IDR, resulting in dividend yields of 11.92%, 11.92%, and 3.11%, with an average yield of 8.98%. Financial analysis of the company reveals a stable and growing business model with potential upside in the long-term and a relatively low risk of capital loss. Furthermore, its return on equity and debt levels are acceptable, signifying that the company has been able to manage its debt and maintained a good balance sheet, making it a relatively safe investment option.

Recent Posts