TAPG dividend – PT Triputra Agro Persada Tbk Announces 38.0 Cash Dividend

May 27, 2023

Dividends Yield

PT ($IDX:TAPG) Triputra Agro Persada Tbk has recently announced its 38.0 Cash Dividend on May 26 2023. This announcement follows its issuance of annual dividend per share of 25.0, 25.0, and 15.11 IDR respectively for the past 3 years. The dividend yields from 2021 to 2023 are 3.52%, 3.52%, and 2.14% respectively, averaging an impressive 3.06%. With its ex-dividend date set on May 26 2023, investors can benefit from the long-term gains offered by this company.

The cash dividend offers a great opportunity to increase your returns on your investments. This makes it a great option for those looking to benefit from a reliable and steady dividend yield. The 38.0 Cash Dividend offers a great opportunity to grow your portfolio and take advantage of the long-term gains that this company offers.

Market Price

On Friday, PT Triputra Agro Persada Tbk (TRIP) stock opened at IDR0.0 and closed at IDR555.0, representing a 5.9% drop from the prior closing price of IDR590.0. The company made an announcement that same day regarding a 38.0 cash dividend for shareholders. This dividend payout marks an increase from the prior year’s dividend of 25.0, highlighting the company’s commitment to providing returns to its shareholders. This announcement comes during an uncertain time for many companies, further highlighting TRIP’s commitment to returning value to its shareholders and providing stability in times of volatility. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TAPG. More…

| Total Revenues | Net Income | Net Margin |

| 9.08M | 2.4M | 27.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TAPG. More…

| Operations | Investing | Financing |

| 2.68M | -759.18k | -1.86M |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TAPG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.7M | 3.98M | 519.63 |

Key Ratios Snapshot

Some of the financial key ratios for TAPG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.2% | 110.2% | 34.0% |

| FCF Margin | ROE | ROA |

| 19.8% | 19.0% | 13.1% |

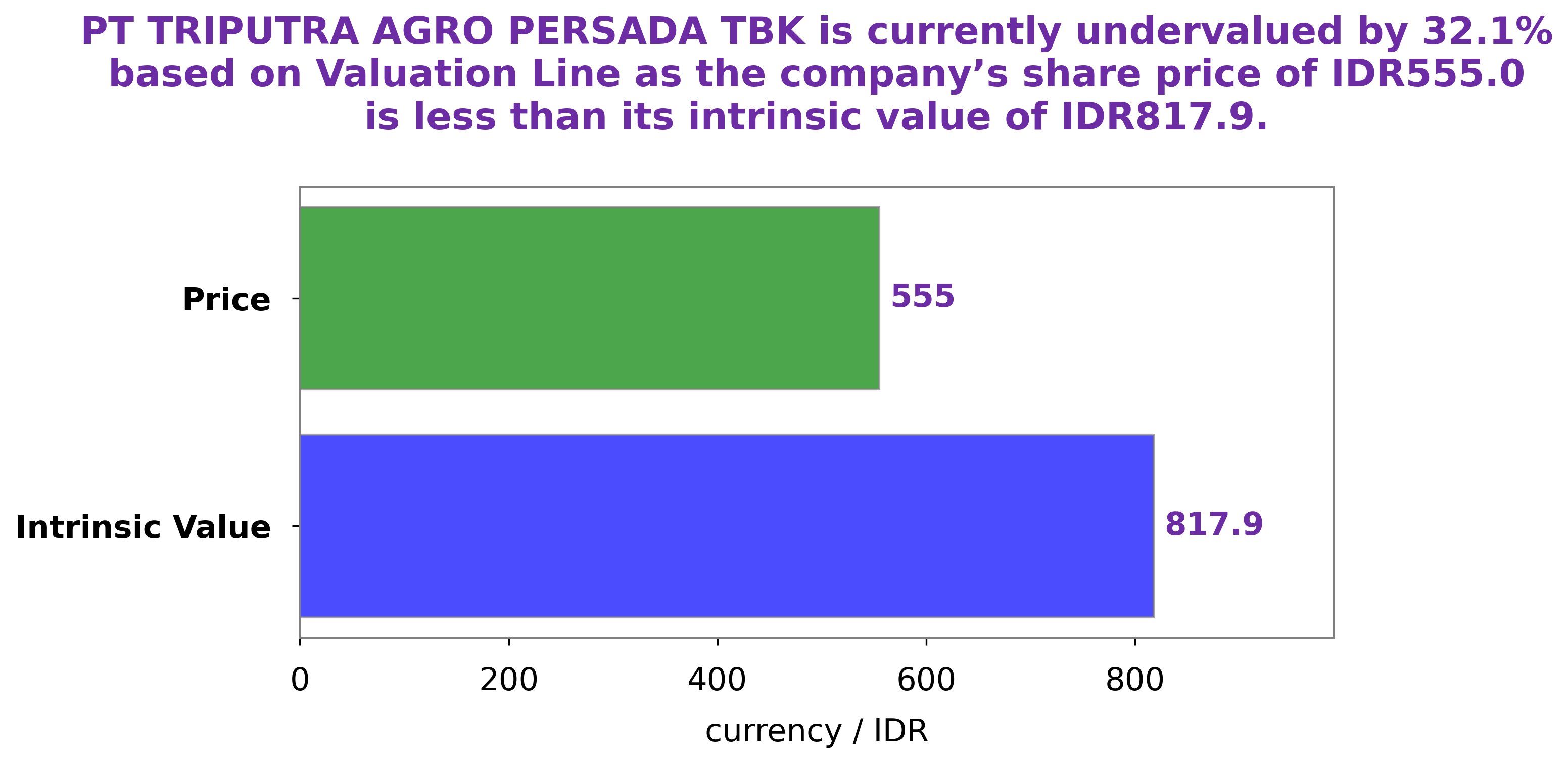

Analysis – TAPG Intrinsic Value Calculation

At GoodWhale, we conducted an analysis of the financials of PT TRIPUTRA AGRO PERSADA TBK and found that the intrinsic value of its share is around IDR817.9, which was determined using our proprietary Valuation Line. At the moment, PT TRIPUTRA AGRO PERSADA TBK stock is traded at IDR555.0, which means it is undervalued by 32.1%. Our analysis indicates that investors could gain a potential return of 32.1% if the stock price reaches the intrinsic value. More…

Peers

The company operates in the industry alongside other major players such as PT Andira Agro Tbk, PT Sampoerna Agro Tbk, and PT Golden Plantation Tbk. All of these companies are well-known for their commitment to providing quality agricultural products to the market.

– PT Andira Agro Tbk ($IDX:ANDI)

Andira Agro Tbk is an Indonesian agribusiness company which specializes in the production of oil palm and rubber. As of 2023, the company has a market capitalization of 467.5 billion, making it one of the largest companies in the region. Its Return on Equity (ROE) is -5.2%, indicating that it has not yet been able to generate sufficient profits from its investments. This could be due to a combination of factors such as the rising cost of raw materials, a lack of efficient management, and unfavorable market conditions. Andira Agro Tbk continues to strive for increased profitability and better shareholder returns.

– PT Sampoerna Agro Tbk ($IDX:SGRO)

Sampoerna Agro Tbk is an Indonesian-based company that specializes in the development and management of integrated agribusinesses. With a large market capitalization of 3.71T, Sampoerna Agro Tbk is a major player in the Indonesian agribusiness sector. Furthermore, their Return on Equity (ROE) of 22.46% demonstrates that the company generates a relatively high return on invested capital, further indicating their success in their industry.

– PT Golden Plantation Tbk ($IDX:GOLL)

PT Golden Plantation Tbk is an Indonesian-based company that engages in the trade and cultivation of palm oil, rubber, and cocoa. The company has a market cap of 183.25 billion as of 2023, making it one of the largest and most successful companies in the industry. In terms of performance metrics, the company has a Return on Equity (ROE) of -2.61%, indicating that the company’s investments are not generating a return and may be underperforming relative to its peers.

Summary

Investing in PT TRIPUTRA AGRO PERSADA TBK has proven to be a rewarding experience in the past few years, with the company issuing annual dividend per share of 25.0, 25.0, and 15.11 IDR respectively for the past 3 years. This has resulted in an average dividend yield of 3.06% from 2021 to 2023, with yields of 3.52%, 3.52%, and 2.14% respectively. With this track record, investors can look forward to continued returns from this company. However, given the volatile nature of the markets, investors should take into consideration other factors before making any decisions regarding investing in PT TRIPUTRA AGRO PERSADA TBK.

Recent Posts