Taiwan Pelican Express dividend – Taiwan Pelican Express Co Ltd Declares 1.5 Cash Dividend

June 11, 2023

🌥️Dividends Yield

Taiwan Pelican Express ($TWSE:2642) Co Ltd recently announced that it will be paying a cash dividend of 1.5 TWD per share on June 2, 2023. This news will be welcome to shareholders of the company, as TAIWAN PELICAN EXPRESS has paid an annual dividend of 2.1 TWD per share for the last 3 years and offers a dividend yield of 2.95%, 2.95% and 2.17% respectively for 2021, 2022 and 2023, with an average dividend yield of 2.69%. For those investors looking to increase their dividends portfolio, this will be an attractive option as it has a consistent dividend history.

The ex-dividend date is set for June 7, 2023, and shareholders who own shares by this date will be able to benefit from the dividend payment. With an attractive dividend yield and a consistent history of dividend payments, it is an attractive investment choice for those interested in dividend stocks.

Price History

TPE stock opened at NT$45.0 and closed at NT$45.2, a slight decrease from the previous closing price of NT$45.5. This announcement comes as a sign of confidence from the company to reward its shareholders. With this dividend announcement, TPE hopes to continue to reward its loyal customers and shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Taiwan Pelican Express. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 141.8 | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Taiwan Pelican Express. More…

| Operations | Investing | Financing |

| 460.33 | -154.65 | -414.06 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Taiwan Pelican Express. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.63k | 2.13k | 23.03 |

Key Ratios Snapshot

Some of the financial key ratios for Taiwan Pelican Express are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | -9.6% | 4.4% |

| FCF Margin | ROE | ROA |

| 6.9% | 5.1% | 2.6% |

Analysis

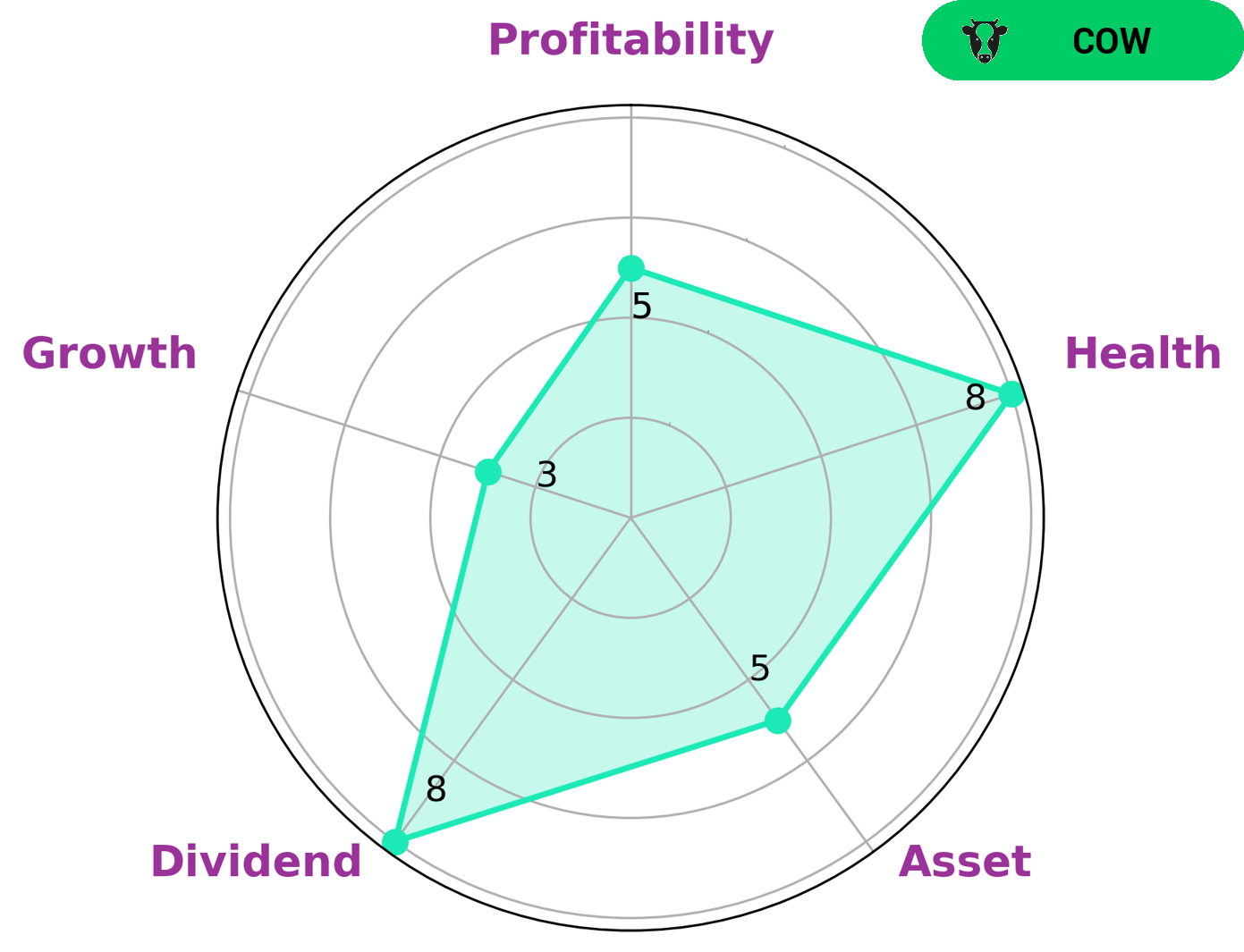

As GoodWhale, we conducted an analysis of the fundamentals of TAIWAN PELICAN EXPRESS. Our results show that the company has a high health score of 8/10, considering its cashflows and debt. This indicates that the company is capable of safely riding out any crisis without the risk of bankruptcy. Additionally, classifying the company as a ‘cow’, it was established that TAIWAN PELICAN EXPRESS has the track record of paying out consistent and sustainable dividends. Thus, investors looking to profit from long-term dividend income would be interested in such a company. Overall, our analysis revealed that TAIWAN PELICAN EXPRESS is strong in dividend, medium in asset, profitability and weak in growth. This makes it suitable for investors who are looking for steady, long-term income rather than short-term capital gains. More…

Peers

The logistics industry in Taiwan is highly competitive, and Taiwan Pelican Express Co Ltd faces competition from several prominent companies, including Flomic Global Logistics Ltd, Sinotrans Ltd, and Antong Holdings Co Ltd. All of these companies provide international and domestic logistics services, making it a challenge for Taiwan Pelican Express Co Ltd to stay ahead in the market.

– Flomic Global Logistics Ltd ($BSE:504380)

Flomic Global Logistics Ltd is a leading global provider of logistics services and solutions. It is one of the largest companies in its sector, with a market cap of 1.81B as of 2023. Its Return on Equity (ROE) stands at 32.53%, which is significantly higher than the industry average. The company provides integrated logistics solutions, including international freight forwarding, customs brokerage, warehousing, and transportation services. It has developed an extensive network of offices in Europe, North America, and Asia Pacific, enabling it to offer clients comprehensive solutions for their transportation needs. With its innovative solutions and cutting-edge technology, Flomic Global Logistics Ltd is well-positioned to maintain its leadership position in the industry.

– Sinotrans Ltd ($SEHK:00598)

Sinotrans Ltd is a Chinese logistics services provider offering services ranging from international freight forwarding to domestic transportation. As of 2023, the company has a market capitalization of 19.27 billion, indicating that the company is highly regarded in the current market. Its return on equity of 10.32%, provides further evidence of its strong financial position. Sinotrans has a well-established reputation and is committed to providing high quality services to its customers. The company continues to invest in new technologies and efficient processes to ensure it remains competitive in the market.

– Antong Holdings Co Ltd ($SHSE:600179)

Antong Holdings Co Ltd is a China-based company that specializes in the development, manufacture, and distribution of electronic products and services. The company’s market cap of 12.31B as of 2023 demonstrates its strong financial position. This is further highlighted by the company’s Return on Equity of 16.28%, which is an indication of its profitable operations. This indicates that the company is successfully generating returns on the shareholder’s capital invested in the business.

Summary

Taiwan Pelican Express is a stock offering a consistent and reliable dividend yield for investors. Over the last three years, it has paid an average dividend of 2.1 TWD per share and a dividend yield of 2.69%. This provides a steady source of income for investors, especially those looking for fixed and low-risk returns.

Additionally, the company has strong fundamentals, making it an attractive long-term investment option. Its share price is relatively stable, which helps to reduce risk. With these factors taken into consideration, investors looking for a safe, steady source of income should give Taiwan Pelican Express serious consideration.

Recent Posts