Superior Plus dividend – Superior Plus Corp. Declares Quarterly Dividend of CA$0.06 Per Share

January 15, 2023

Trending News ☀️

Superior Plus ($TSX:SPB) Corp. is a leading North American distributor and marketer of energy products and services. With operations in the United States, Canada and the Caribbean, Superior Plus has a diverse portfolio of businesses focused on providing customers with reliable, cost-effective and value-added solutions. The company delivers energy products and services through its retail, distribution, specialty chemicals and wholesale businesses. The company recently declared a quarterly dividend of CA$0.06 per share. The dividend income from Superior Plus is an attractive option for income-seeking investors looking for reliable and growing income streams.

Additionally, the company’s strong financial performance and commitment to returning value to shareholders provides a compelling reason for investors to consider investing in the company. Superior Plus is also committed to delivering long-term value to shareholders through its growth strategy. The company has invested heavily in its operations, expanding its retail and distribution businesses while also introducing new products and services in order to drive growth. These investments have enabled the company to increase its market share and build a strong customer base. The company’s commitment to returning value to shareholders through dividends and increasing shareholder value through its growth strategy makes it an attractive option for investors looking for a reliable source of income as well as long-term capital appreciation.

Dividends – Superior Plus dividend

This is an increase from the dividends of CA$0.72 and CA$0.72 issued for the last two years respectively. The dividend yields of SUPERIOR PLUS have been 5.51%, 5.03%, and 5.83% from 2021 to 2022 respectively. This gives it a three-year average dividend yield of 5.46%. This is an attractive rate for investors looking to earn a steady income from dividends. It has grown to become one of the leading energy and home comfort product providers in North America.

The decision to issue a dividend of CA$0.06 per share is part of SUPERIOR PLUS’s commitment to providing value for its shareholders and rewarding them for their loyalty. The company also offers several other benefits such as share repurchasing and loyalty programs for its shareholders. If you are looking for dividend stocks to invest in, SUPERIOR PLUS might be worth considering. Their consistent dividend yields and commitment to their shareholders make them a great option for investors seeking long-term income and growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Superior Plus. More…

| Total Revenues | Net Income | Net Margin |

| 3.13k | -148.7 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Superior Plus. More…

| Operations | Investing | Financing |

| 219.2 | -623.5 | 411.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Superior Plus. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.29k | 2.8k | 5.59 |

Key Ratios Snapshot

Some of the financial key ratios for Superior Plus are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | -21.4% | -3.8% |

| FCF Margin | ROE | ROA |

| 3.2% | -6.3% | -1.8% |

Market Price

The news was well-received by investors, as the stock opened at CA$11.3 on Wednesday and closed at the same price. It is also the third consecutive quarter that Superior Plus has increased its dividend payments. This is likely to encourage further investor confidence in the company, as it demonstrates its commitment to rewarding shareholders with increasing returns.

This dividend news comes at a time when most news about Superior Plus is positive, as the company continues to expand its operations in Canada and the United States. This is likely to encourage further investor confidence in the company, as it demonstrates its commitment to rewarding shareholders with increasing returns. Live Quote…

VI Analysis

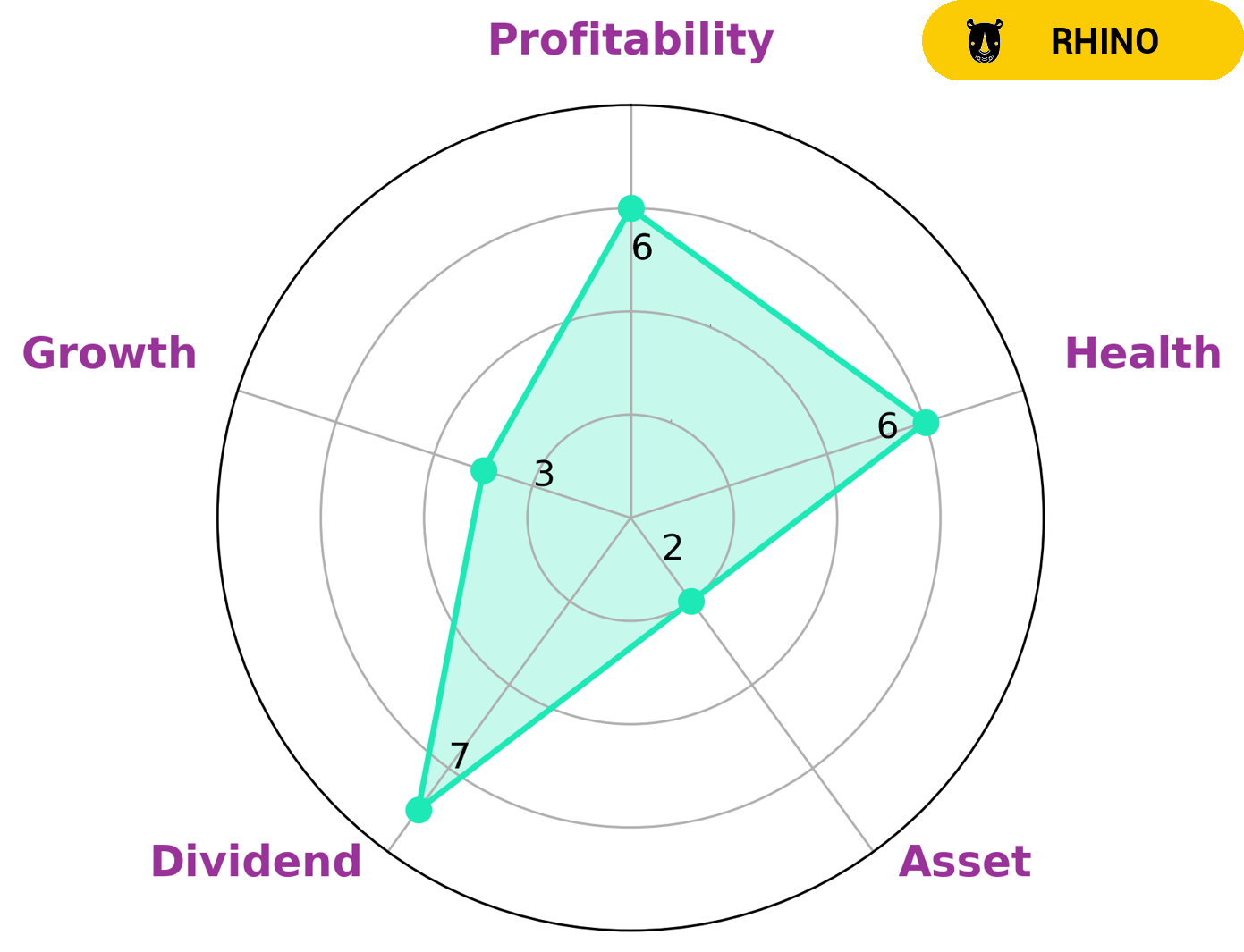

Investors looking for a long-term potential company should examine the fundamentals of Superior Plus. The VI Star Chart shows that Superior Plus is classified as a “rhino”, meaning it has achieved moderate revenue or earnings growth. Superior Plus is strong in dividend, medium in profitability and weak in asset and growth. Its overall health score is 6/10, considering its cashflows and debt. This means that the company is likely to be able to pay off debt and fund future operations. Investors should also consider the overall financial performance and position of the company. The balance sheet of Superior Plus reveals that it has adequate liquidity and a manageable level of debt. It also has a healthy cash flow and a reasonable return on equity, which indicates that the company could be well-positioned for growth in the future. Furthermore, Superior Plus has a reasonable share price, which indicates that it could have potential for appreciation over time. Overall, Superior Plus is a company with a good long-term potential for investors. Its balance sheet and financial ratios reflect its financial health, and its reasonable share price suggests that it could offer investors some appreciation potential over time. Additionally, its dividend and moderate growth prospects could make it an attractive option for investors looking for a company with long-term potential. More…

VI Peers

The company has a strong presence in the market, competing with other energy distributors such as UGI Corp, Naturgy Energy Group SA, and SPC Power Corp. Although each energy distributor has its own unique offerings, they all strive to provide reliable energy solutions to meet the needs of their customers.

– UGI Corp ($NYSE:UGI)

Ugi Corp is a global energy services company that provides energy solutions to customers in the Americas, Europe, and Asia. The company also offers a range of energy-related services, including energy efficiency, renewable energy, and other energy-related services. With a current market cap of 8.27B, Ugi Corp is one of the leading energy services companies in the world. The company’s strong Return on Equity (ROE) of 17.89% reflects the success of its operational strategies and ability to generate high returns for its shareholders.

– Naturgy Energy Group SA ($BER:GAN)

Naturgy Energy Group SA is an energy and services company with a presence in over 20 countries. It is one of the leading energy companies in the world, providing electricity and natural gas to more than 19 million customers. The company has a market capitalization of 23.85 billion as of 2023 and a very impressive Return on Equity of 26.36%. This signifies the company’s ability to generate a high return from its equity investments. The company’s impressive performance is due to its focus on sustainable growth, digital innovation, and customer centricity. Naturgy has also made a commitment to invest heavily in renewable energy projects, in order to reduce its carbon footprint.

– SPC Power Corp ($PSE:SPC)

SPC Power Corp is a leading provider of energy solutions, supplying electricity, natural gas, and other energy products to businesses, homes, and other customers. The company has a market capitalization of 13.9 billion dollars as of 2023, reflecting the confidence of investors in its ability to generate long-term value. SPC Power Corp also has a Return on Equity of 5.12%, which is higher than the average for the industry and indicates a strong focus on profitability. This strong performance is indicative of the company’s ability to create value for its shareholders through efficient management of its resources and capital.

Summary

Investors in Superior Plus Corp. are likely to be pleased with the recent news that the company has declared a quarterly dividend of CA$0.06 per share. This dividend is a sign of the company’s financial health and strength, and indicates that Superior Plus is confident in its ability to generate income for shareholders. Analysts have pointed out that the dividend is unlikely to be affected by any potential market downturns, and that it currently offers investors a steady and reliable return.

Furthermore, there have been no reports of any major changes to the company’s fundamentals. This news may attract new investors, who may find the stock attractive due to its strong dividend yield and stable fundamentals.

Recent Posts