Stag Industrial dividend yield – STAG INDUSTRIAL Announces 0.1225 Cash Dividend.

March 22, 2023

Dividends Yield

STAG INDUSTRIAL ($NYSE:STAG) recently announced that it will be issuing a cash dividend of 0.1225 USD per share on March 1 2023. For the past three years, the company has been issuing a dividend of 1.46 USD per share, yielding an average dividend yield of 4.12%. This indicates that investors can expect a stable and reliable income from the company’s dividend. If you’re interested in dividend stocks, you may want to consider STAG INDUSTRIAL, as the company has maintained its dividend for the past three years and has announced a new cash dividend of 0.1225 USD per share.

The ex-dividend date is set on March 30 2023, which means that investors must purchase the stock before this date in order to receive the dividend payments. With a high dividend yield and a reliable history of dividend payments, STAG INDUSTRIAL is an attractive choice for dividend-seeking investors.

Price History

Following the announcement, their stock opened at $33.5 but closed at $33.0, a decrease of 1.9% from the prior closing price of $33.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Stag Industrial. More…

| Total Revenues | Net Income | Net Margin |

| 657.35 | 178.09 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Stag Industrial. More…

| Operations | Investing | Financing |

| 387.93 | -447.52 | 63.19 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Stag Industrial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.18k | 2.73k | 18.88 |

Key Ratios Snapshot

Some of the financial key ratios for Stag Industrial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 31.9% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

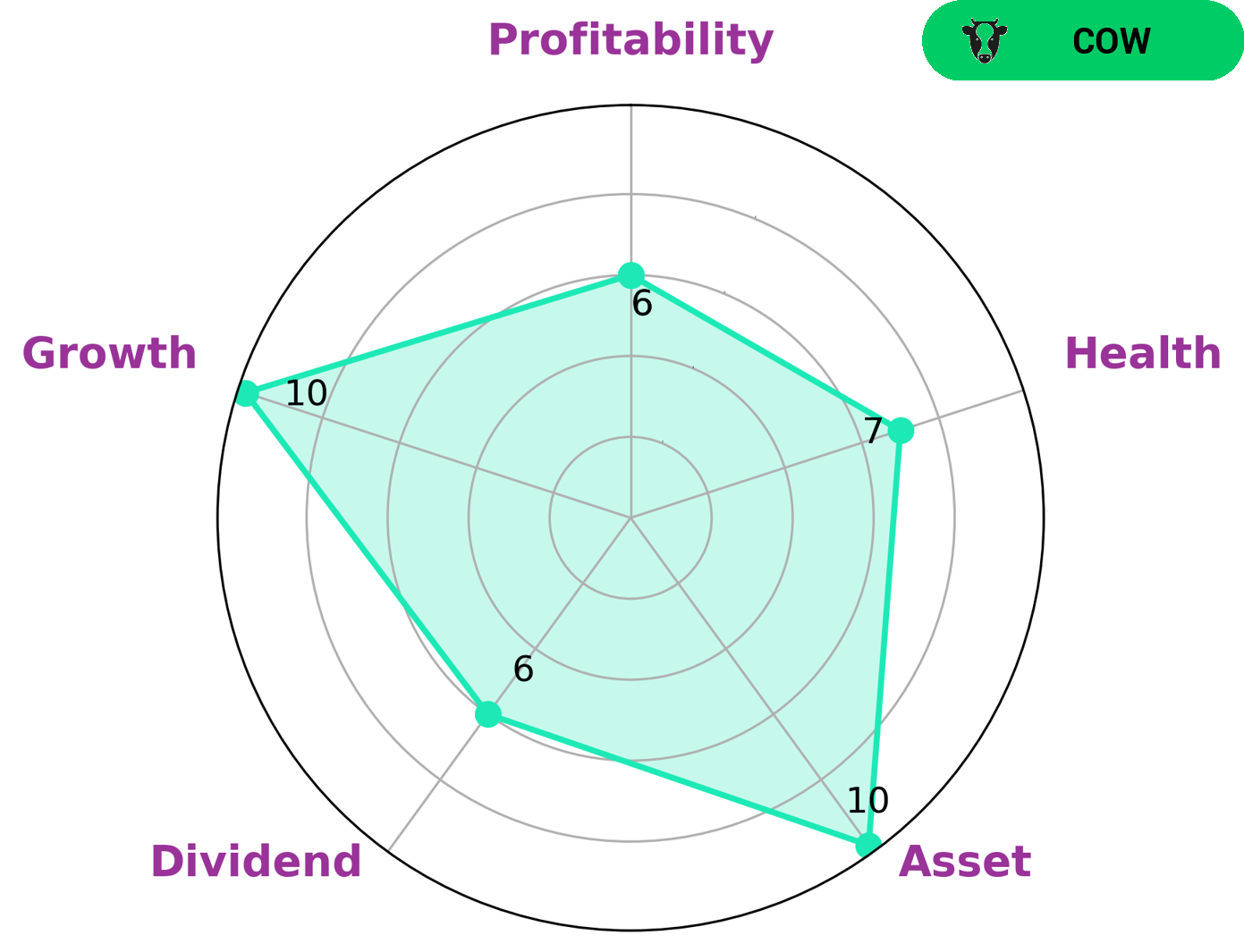

GoodWhale’s analysis of STAG INDUSTRIAL‘s financials has revealed that it is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. STAG INDUSTRIAL is strong in terms of its assets and growth, and medium in terms of its dividend and profitability. In terms of its health score, STAG INDUSTRIAL has a 7/10, indicating that it is very capable of paying off debt, as well as funding future operations. Given the consistent, strong dividends and high health score of STAG INDUSTRIAL, it is likely to be an attractive option for dividend investors and those who are looking for a safe, stable long-term investment. Its high health score implies that the company is well-managed and able to withstand the pressures of the market and financial crises. With its strong asset and growth potential, STAG INDUSTRIAL could be a rewarding option for those interested in capital gains as well. More…

Peers

The competition among Stag Industrial Inc, Prologis Inc, Terreno Realty Corp, and Duke Realty Corp is fierce. All four companies are in the business of providing industrial space for businesses. They all have their own strengths and weaknesses, and each is trying to outdo the others in terms of price, quality, and service.

– Prologis Inc ($NYSE:PLD)

Prologis Inc is a real estate investment trust that owns, operates, and develops warehouses and distribution facilities. As of December 31, 2020, the company owned or had investments in 3,109 properties in 19 countries. Prologis Inc is headquartered in San Francisco, California.

– Terreno Realty Corp ($NYSE:TRNO)

Terreno Realty Corp is a real estate investment trust that focuses on the acquisition, development, and operation of industrial properties in the United States. The company has a market cap of 4.32B as of 2022. Terreno Realty Corp’s properties are located in major metropolitan markets in the United States. The company was founded in 2006 and is headquartered in San Francisco, California.

Summary

STAG Industrial is a real estate investment trust that focuses on the acquisition, ownership, and operation of single-tenant industrial properties throughout the United States. Over the past three years, the company has consistently paid an annual dividend of 1.46 USD per share, resulting in a competitive dividend yield of 4.12%. As an investment, STAG Industrial offers investors a solid option for capital appreciation and income generation.

The company has a strong track record of growing its dividend, and its portfolio of industrial properties provides steady and reliable cash flow. With its deep knowledge of the industrial market and its commitment to disciplined capital allocation, STAG Industrial is well-positioned to continue providing attractive returns to its shareholders.

Recent Posts