Sonoco Products dividend yield – Sonoco Products Co Announces 0.51 Cash Dividend

May 29, 2023

Dividends Yield

On May 26 2023, Sonoco Products ($NYSE:SON) Co announced a 0.51 cash dividend for the fiscal year. This is great news for investors who are looking for a dividend stock to add to their portfolio. Over the past three years, the company has been consistent in issuing annual dividends per share of 1.96 USD in 2021, 1.92 USD in 2022, and 1.8 USD in 2023. This equates to dividend yields of 3.17%, 3.14%, and 2.84% for the respective periods, with an average dividend yield of 3.05%.

The ex-dividend date for the year 2023 is set for May 9th. Investors looking to benefit from SONOCO PRODUCTS’ dividends need to have their investments in place before this date.

Stock Price

The announcement saw the company’s stock open at $60.1 and close at $60.7, representing a 1.2% increase from its closing price of $60.0 the previous day. The company has established itself as one of the leading manufacturers in the world with its focus on sustainability and innovation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sonoco Products. More…

| Total Revenues | Net Income | Net Margin |

| 7.21k | 499.42 | 6.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sonoco Products. More…

| Operations | Investing | Financing |

| 605.99 | -328.63 | -216.62 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sonoco Products. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.06k | 4.86k | 22.44 |

Key Ratios Snapshot

Some of the financial key ratios for Sonoco Products are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.6% | 10.8% | 10.1% |

| FCF Margin | ROE | ROA |

| 3.6% | 21.4% | 6.5% |

Analysis – Sonoco Products Intrinsic Value

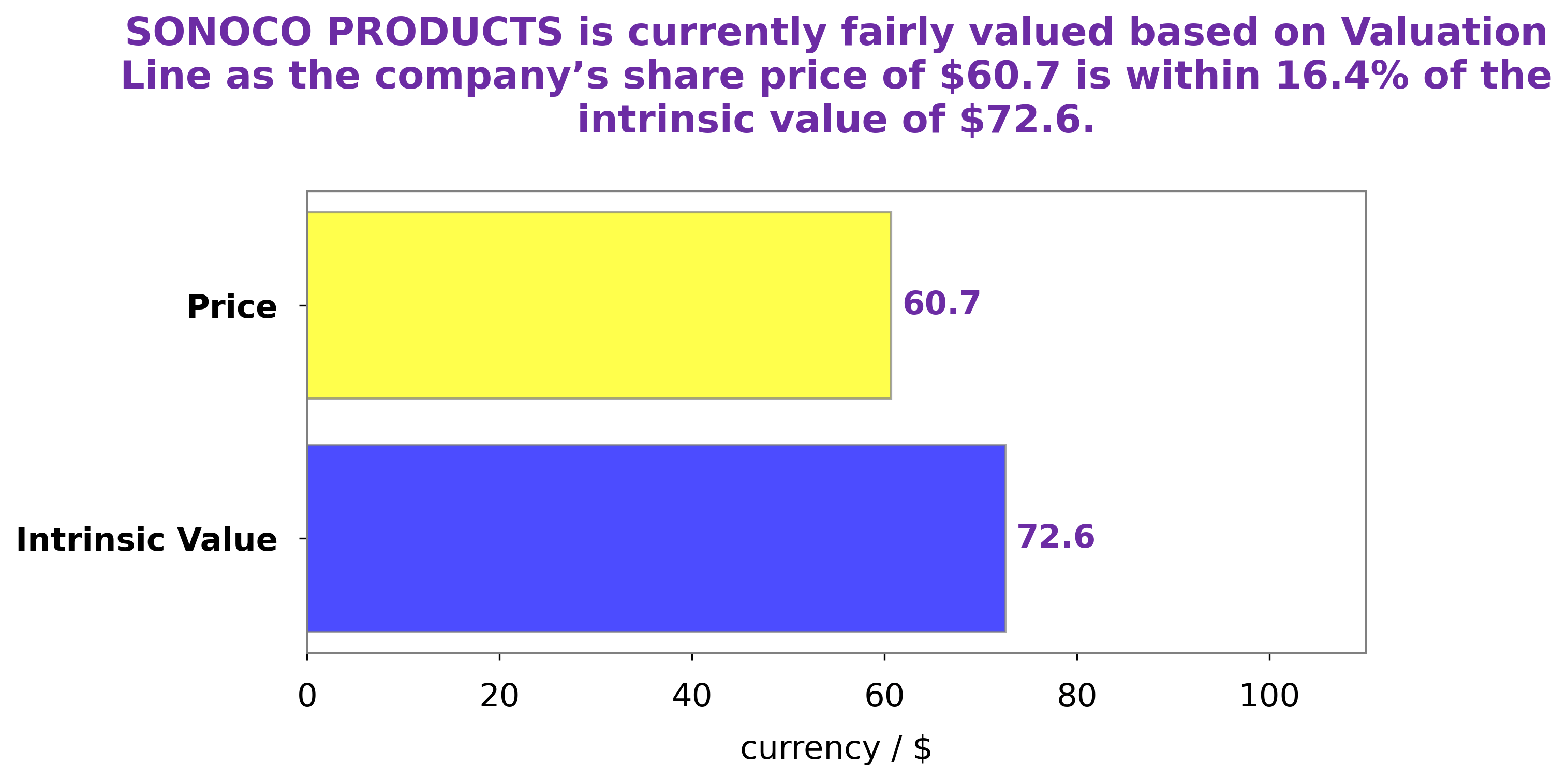

At GoodWhale, we have extensively analyzed the fundamentals of SONOCO PRODUCTS and created a comprehensive assessment of the company. Our proprietary Valuation Line shows that the intrinsic value of SONOCO PRODUCTS share is around $72.6. However, the stock is currently traded at $60.7, meaning it is slightly undervalued by 16.4%. This presents a good buying opportunity for investors who are looking to increase their financial portfolio in the company. Furthermore, the company has a strong financial performance with positive cash flows which is a reassuring sign of long-term stability. As such, our recommendation is to invest in the company at the current market price. More…

Peers

The company has operations in 34 countries and serves customers in over 85 countries. Sonoco has been in business for over 100 years and is a publicly traded company on the New York Stock Exchange. The company’s competitors include Huhtamaki India Ltd, Huhtamäki Oyj, and Shanghai Xintonglian Packing Co Ltd.

– Huhtamaki India Ltd ($BSE:509820)

Huthamaki India Ltd is a food packaging company with a market cap of 16.63B as of 2022. The company has a return on equity of 2.38%. Huthamaki India Ltd is a leading manufacturer of food packaging products and solutions. The company provides innovative and sustainable packaging solutions for food and beverage products. Huthamaki India Ltd has a strong presence in the Indian market with a wide range of products. The company has a strong commitment to quality and customer satisfaction.

– Huhtamäki Oyj ($LTS:0K9W)

Huhtamäki Oyj is a Finnish packaging company. It is headquartered in Espoo, Finland and has operations in over 40 countries. The company is listed on the Nasdaq Helsinki stock exchange.

Huhtamäki Oyj has a market cap of 3.7B as of 2022. The company has a Return on Equity of 14.22%. Huhtamäki Oyj is a Finnish packaging company. It is headquartered in Espoo, Finland and has operations in over 40 countries. The company is listed on the Nasdaq Helsinki stock exchange.

– Shanghai Xintonglian Packing Co Ltd ($SHSE:603022)

Shanghai Xintonglian Packing Co Ltd is a company that produces and sells packaging products. It has a market cap of 2.02B as of 2022 and a Return on Equity of 3.94%. The company has a wide range of products that include paper bags, plastic bags, and other packaging materials.

Summary

SONOCO PRODUCTS is a company that investors may be interested in for its potential dividend payments. As of 2021, the dividend yield is 3.17%, with subsequent years offering yields of 3.14% and 2.84%. On average, investors can expect a dividend yield of 3.05% from SONOCO PRODUCTS. This makes it an attractive option for those looking for reliable and consistent dividend payments.

Recent Posts