Sichuan Expressway dividend calculator – Sichuan Expressway Co Ltd Announces 0.111195 Cash Dividend

June 12, 2023

🌥️Dividends Yield

Sichuan Expressway ($SEHK:00107) Co Ltd announced on June 1 2023 an upcoming 0.111195 cash dividend to be distributed to shareholders. This dividend announcement makes SICHUAN EXPRESSWAY an attractive option for dividend seekers. Over the past three years, the company declared dividends of 0.11, 0.11, and 0.08 CNY per share respectively for an average dividend yield of 6.11%. The ex-dividend date for the upcoming dividend is set for June 6 2023, so be sure to make any necessary adjustments to your portfolio in time for the payout.

This dividend yield is significantly higher than that of the Shanghai stock exchange, so it may be a wise option for those who are looking to increase their returns. For those considering investing in SICHUAN EXPRESSWAY, now is the time to act and reap the rewards of the upcoming dividend payout.

Price History

This comes after the company’s stock opened and closed at HK$2.2 on the same day. This dividend is an indication of the company’s financial health and stability, and investors may be considering buying into the stock. It is worth noting that Sichuan Expressway Co Ltd is one of the leading expressway construction and operation companies in China, and has a strong presence in the industry. As such, investors are likely to have confidence in the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sichuan Expressway. More…

| Total Revenues | Net Income | Net Margin |

| 9.88k | 947.18 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sichuan Expressway. More…

| Operations | Investing | Financing |

| 1.96k | -3.69k | 1.67k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sichuan Expressway. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 42.32k | 23.14k | 5.82 |

Key Ratios Snapshot

Some of the financial key ratios for Sichuan Expressway are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.3% | 6.4% | 17.3% |

| FCF Margin | ROE | ROA |

| -23.9% | 5.9% | 2.5% |

Analysis

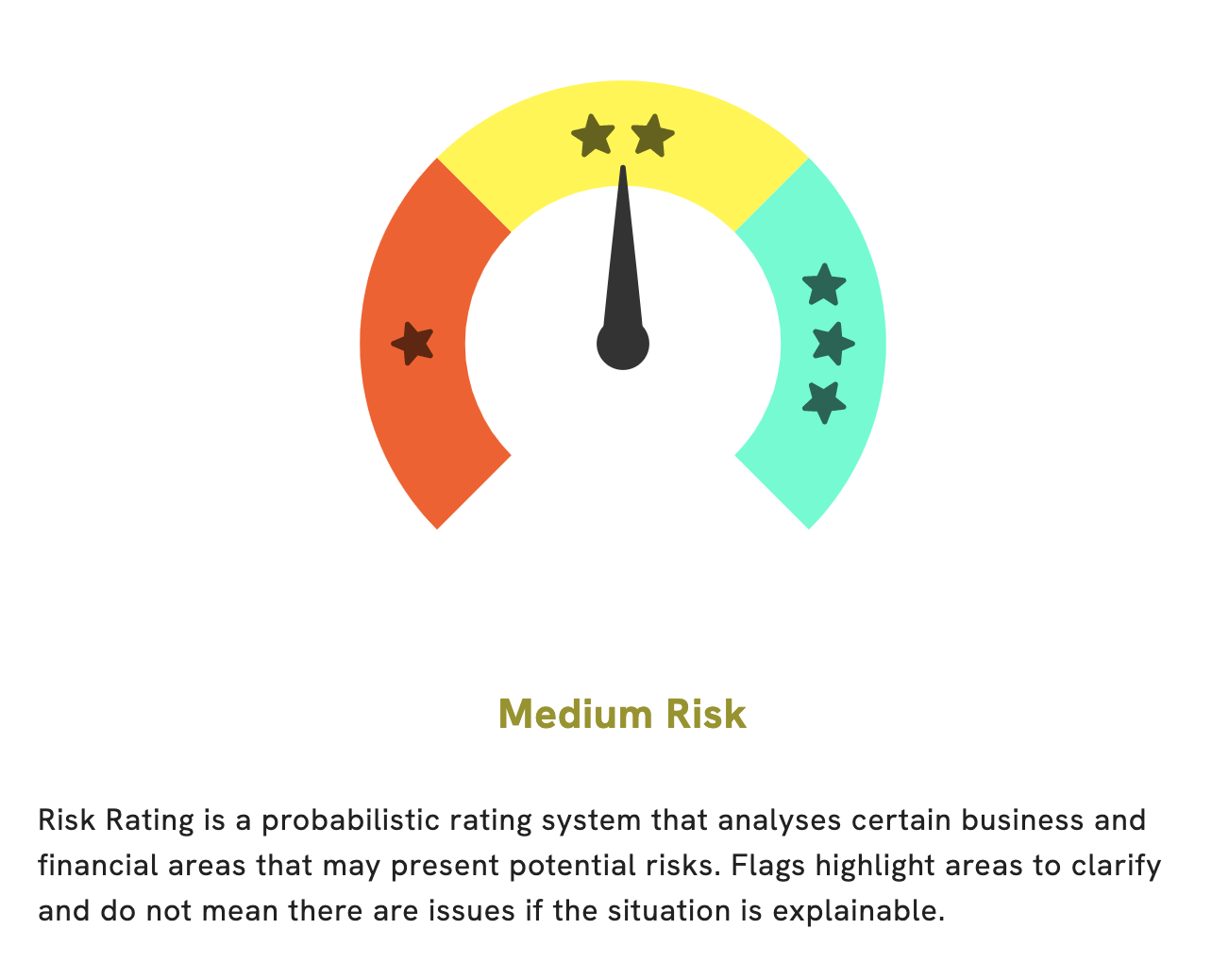

At GoodWhale, we have conducted an in-depth financial analysis of Sichuan Expressway, to assess the company’s performance and risk profile. We have concluded that Sichuan Expressway is a medium risk investment when considering both business and financial aspects. For interested investors, GoodWhale has detected two risk warnings in Sichuan Expressway’s income sheet and balance sheet. To access these findings, we encourage investors to register on goodwhale.com. We also provide tailored advice and further research for investors looking into Sichuan Expressway. More…

Summary

Sichuan Expressway is a good dividend-yielding stock option for investors. With an average dividend yield of 6.11% over the past three years, the company has consistently declared annual dividends per share of 0.11, 0.11, and 0.08 CNY. The stock’s high dividend yield makes it attractive to investors seeking income from their investments.

Additionally, its financial performance and sound fundamentals provide further reasons for considering this stock for portfolio diversification and long-term growth potential. It is important for investors to weigh the risks and rewards before investing in Sichuan Expressway or any other dividend stock.

Recent Posts