Shinkong Insurance stock dividend – Shinkong Insurance Co Ltd Declares 2.54 Cash Dividend

June 9, 2023

🌥️Dividends Yield

Shinkong Insurance ($TWSE:2850) Co Ltd recently announced a 2.54 cash dividend which will be paid on June 1 2023. This is great news for investors looking for dividend stocks, as SHINKONG INSURANCE has consistently paid out dividends in the last three years. The average dividend per share paid out over that period has been 3.2, 3.2, and 1.95 TWD, resulting in dividend yields of 6.0%, 6.0%, and 4.64% respectively. This yields an average dividend yield of 5.55%.

The ex-dividend date will be on June 12 2023, so those wishing to partake in the dividend must have purchased the stocks before that date. Overall, SHINKONG INSURANCE is an attractive option for investors seeking a reliable dividend stock with a strong average yield of 5.55%.

Stock Price

In addition to the dividends announcement, SHINKONG INSURANCE stock opened at NT$52.5 and closed at NT$52.1, down by 0.8% from last closing price of 52.5. The decision to declare the dividends was made despite the dip in stock price and is the company’s way of rewarding shareholders for their support and loyalty. This is not the first time Shinkong Insurance Co Ltd has declared dividends. The board of directors of Shinkong Insurance Co Ltd are confident that the dividends will support the long-term growth of the company and create sustainable returns for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shinkong Insurance. More…

| Total Revenues | Net Income | Net Margin |

| 18.95k | 1.89k | 10.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shinkong Insurance. More…

| Operations | Investing | Financing |

| 730.22 | -76.52 | -1.03k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shinkong Insurance. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 45.06k | 29.2k | 47.57 |

Key Ratios Snapshot

Some of the financial key ratios for Shinkong Insurance are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.1% | – | – |

| FCF Margin | ROE | ROA |

| 3.4% | – | – |

Analysis

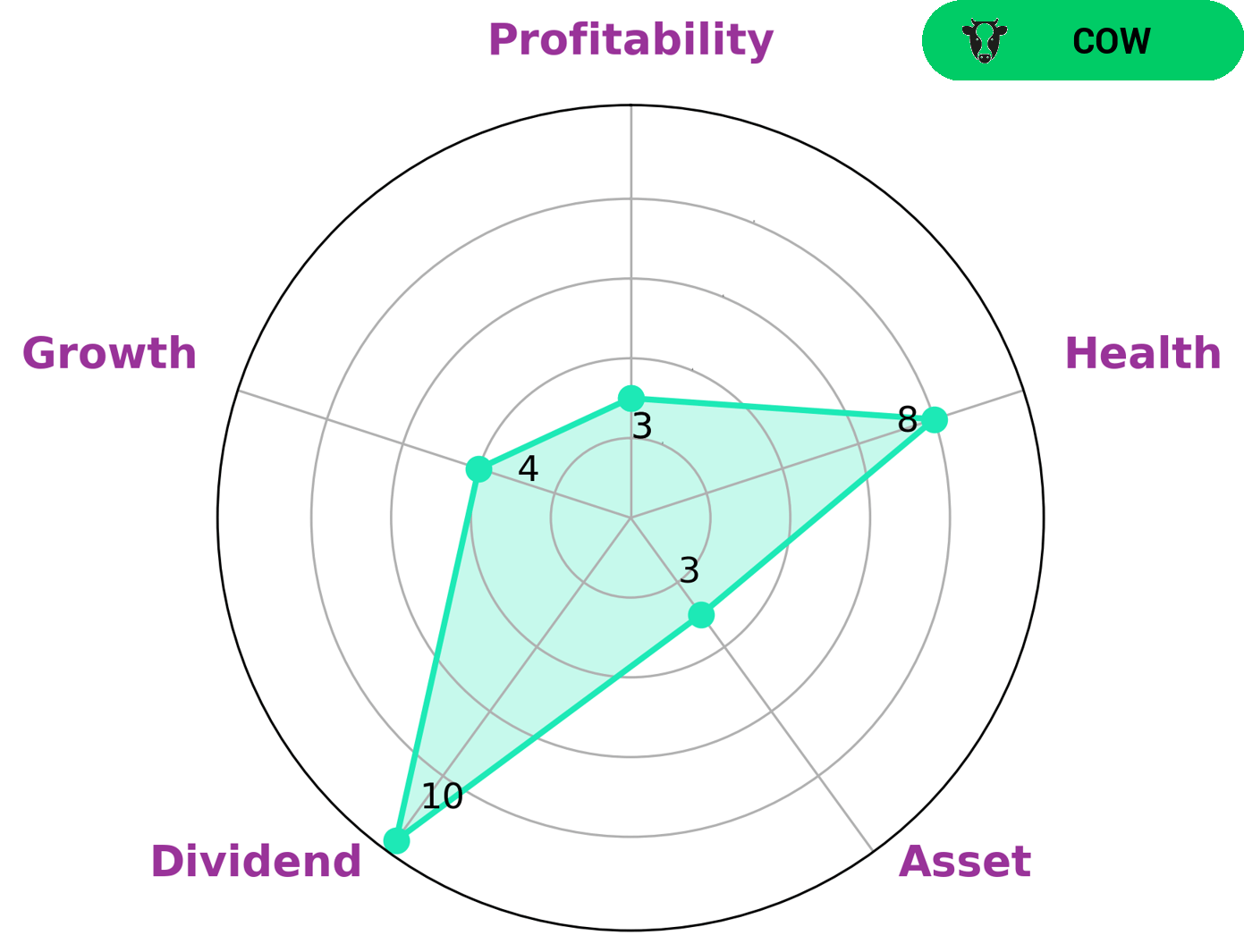

GoodWhale has performed an analysis of SHINKONG INSURANCE‘s financials, and based on the Star Chart, we conclude that SHINKONG INSURANCE is strong in dividend, medium in growth, and weak in asset and profitability. This makes SHINKONG INSURANCE what we call a ‘cow’, a type of company which has the track record of paying out consistent and sustainable dividends. We believe that this type of company would be attractive to investors who are looking for a steady income stream and are less interested in growth. Furthermore, with a high health score of 8/10 considering its cashflows and debt, SHINKONG INSURANCE is capable to sustain future operations in times of crisis. More…

Peers

The competition between Shinkong Insurance Co Ltd and its competitors, Viet Nam National Aviation Insurance Corp, Bao minh Insurance Corp, and Heungkuk Fire & Marine Insurance Co Ltd, is fierce. All four companies are vying for customers by offering the best rates and coverage for their products and services. As the competition intensifies, each company is looking to innovate and find new ways to attract customers and stand out from the competition.

– Viet Nam National Aviation Insurance Corp ($HNX:AIC)

Bao Minh Insurance Corp is one of the largest insurers in Vietnam with a market capitalisation of 2.65 trillion as of 2023. The company serves a wide range of customers, from individuals to corporate entities, offering a range of insurance products and services. The company has achieved notable success with a Return on Equity of 7.91%, signifying a strong ability for the company to convert its investments into profits. This has been achieved through a combination of careful management and utilising the latest technology to ensure efficient customer service and risk management.

– Bao minh Insurance Corp ($HOSE:BMI)

Heungkuk Fire & Marine Insurance Co Ltd is an insurance company headquartered in South Korea, providing a range of insurance services to businesses and individuals. With a market capitalization of 209.43 billion as of 2023, Heungkuk Fire & Marine Insurance Co Ltd is one of the largest insurers in the country. The company’s return on equity stands at 18.44%, a strong performance that speaks to the company’s financial strength and stability. Heungkuk Fire & Marine Insurance Co Ltd has a wide-ranging portfolio of products including property, motor, health, life, and other specialized policies. The company continues to expand its offerings with innovative and competitive insurance solutions for its customers.

Summary

Investing in SHINKONG INSURANCE can be a great choice for those looking for a consistent dividend yield. It has had an average dividend yield of 5.55% over the last three years, with annual dividends per share of 3.2, 3.2 and 1.95 TWD in 2021, 2022 and 2023 respectively. Its robust dividend policy makes it a reliable option for investors seeking consistent returns. Additionally, its strong financial performance in recent years and good outlook for the future make it an attractive choice for investors.

Recent Posts