SBRA dividend – Discover What’s Driving Sabra Healthcare REIT’s High Dividend Yield

December 27, 2022

Trending News 🌥️

Sabra ($NASDAQ:SBRA) Healthcare REIT is a real estate investment trust specializing in the acquisition, ownership, and management of healthcare-related real estate. It owns a portfolio of senior housing, skilled nursing and medical office properties located throughout the United States. Sabra Healthcare REIT has a long history of providing shareholders with attractive dividends, making it one of the most popular stocks among dividend-focused investors. What factors are contributing to Sabra Healthcare’s high dividend yield? The company has a stable portfolio of income-producing assets that generate consistent cash flow. Even during the pandemic, the company was able to continue to pay out dividends due to its strong financial position. Another factor that contributes to Sabra Healthcare’s high dividend yield is its conservative financial strategy. The company has a low leverage ratio, which allows it to maintain an attractive payout ratio and keep its dividend yield high. Sabra Healthcare also has a strong track record of growing its dividend payout over the years. This is important for dividend investors, as it indicates that the company is committed to increasing its dividends and is financially stable enough to do so.

Additionally, the company has a diversified portfolio of properties, which helps to reduce risk and provide steady income. Overall, Sabra Healthcare REIT has a long history of delivering attractive dividend yields for investors. Its conservative financial strategy, stable portfolio of income-producing assets, and commitment to growing dividends have all contributed to its high dividend yield.

Dividends – SBRA dividend

SABRA HEALTH CARE REIT is a real estate investment trust (REIT) that focuses on owning and investing in real estate properties for the healthcare industry. As of September 30, 2021, the company reported a dividend per share of 1.2 USD for FY2022 Q3, compared to dividends of 1.2 USD and 1.35 USD issued last two years. SABRA HEALTH CARE REIT’s dividend yields from 2020 to 2022 are 8.71%, 7.15%, and 8.41%, with a three-year average dividend yield of 8.09%. The high dividend yield of SABRA HEALTH CARE REIT could be explained by its large portfolio of healthcare-related real estate, which includes senior living facilities, medical office buildings, and skilled nursing facilities. The company has also been able to generate consistent revenue and profits through its ownership and management of these properties. The company’s strong balance sheet is another key factor that has contributed to its high dividend yield.

SABRA HEALTH CARE REIT has a strong credit rating, with an investment grade rating of BBB+. This indicates that the company is financially stable and has a good track record of paying dividends to shareholders. Overall, if you are looking for dividend stocks, SABRA HEALTH CARE REIT could be a good option. The company’s consistent dividend yields, strong balance sheet, and large portfolio of healthcare-related real estate make it an attractive investment for those seeking income and stability.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SBRA. More…

| Total Revenues | Net Income | Net Margin |

| 595.48 | -17.01 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SBRA. More…

| Operations | Investing | Financing |

| 346.08 | -443.92 | -422.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SBRA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.84k | 2.64k | 13.89 |

Key Ratios Snapshot

Some of the financial key ratios for SBRA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 36.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Price History

Sabra Healthcare REIT is an American real estate investment trust (REIT) with a focus on investing in skilled nursing and assisted living facilities, medical office buildings, long-term acute care hospitals, and other healthcare-related businesses. On Friday, Sabra Healthcare REIT stock opened at $12.4 and closed at $12.3, down by 2.8% from its previous closing price of 12.7. These properties generate a steady stream of income, which allows the company to pay out high dividends.

Additionally, Sabra Healthcare REIT is well-diversified across different types of healthcare facilities, which helps to reduce risk and increase returns. The company has a conservative approach to leveraging its portfolio and has maintained a relatively low debt-to-equity ratio over the past few years. This has allowed the company to generate a steady cash flow, which it then uses to fund its dividend payments. Finally, Sabra Healthcare REIT has been successful in repositioning its portfolio in order to maximize returns and protect against market volatility. The company has a track record of successful acquisitions and dispositions, which has enabled it to shift its focus to higher-yielding properties and increase its dividend payments. Overall, Sabra Healthcare REIT’s high dividend yield is a result of its strong portfolio of properties, prudent capital management, and successful repositioning of assets. Live Quote…

VI Analysis

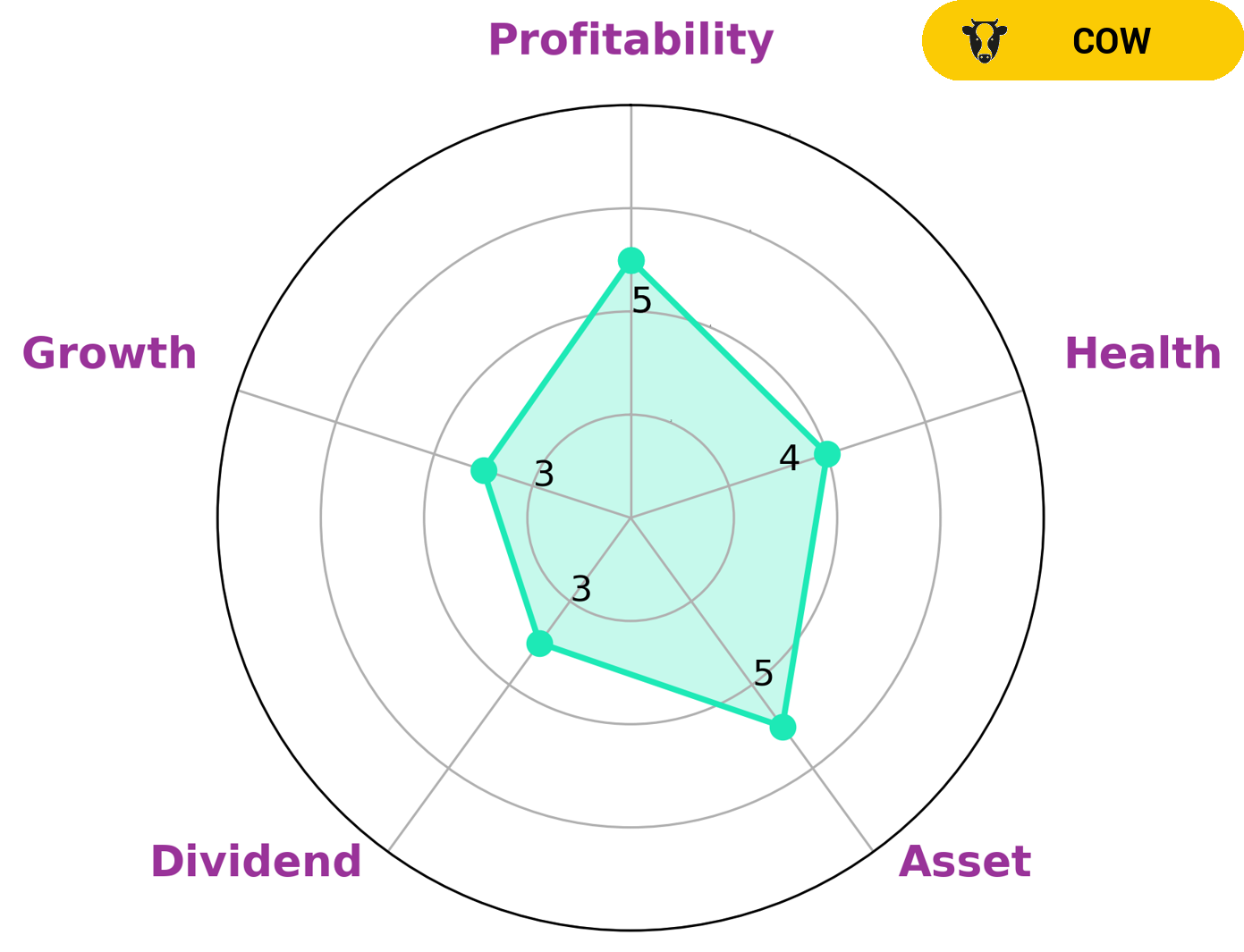

SABRA HEALTH CARE REIT is an attractive investment for those seeking a reliable income stream. The company’s fundamentals, as seen through the VI Star Chart, reflect its strong asset base, good profitability, and moderate dividend. Its classification as a ‘cow’ denotes a track record of consistent and sustainable dividends. As such, investors with a lower risk tolerance, such as retirees and conservative investors, may be particularly interested in SABRA HEALTH CARE REIT. The company’s intermediate health score of 4/10 in relation to cashflows and debt indicates that it is likely to be able to pay off debt and finance future operations. This is an important factor for long-term investors, as it suggests that the company is well-positioned to maintain its dividend payouts in the long-term. In summary, SABRA HEALTH CARE REIT is an attractive investment opportunity for those who are looking for consistent dividend payments and long-term stability. Its fundamentals suggest that it is well-positioned to maintain its dividends and pay off debt in the future. Investors with a lower risk tolerance may find this company particularly appealing. More…

VI Peers

There are several large, publicly traded healthcare real estate investment trusts (REITs) that own and operate properties leased to skilled nursing and other healthcare operators. The largest and most prominent of these firms are Sabra Health Care REIT Inc, Healthcare Realty Trust Inc, LTC Properties Inc, and Omega Healthcare Investors Inc. These firms are all engaged in a fierce competition to acquire the best performing nursing home and assisted living properties.

– Healthcare Realty Trust Inc ($NYSE:HR)

Healthcare Realty Trust Inc is a real estate investment trust that specializes in healthcare-related properties. As of 2022, the company had a market cap of 7.2 billion dollars. The company owns and operates hospitals, medical office buildings, and other healthcare-related facilities across the United States. Healthcare Realty Trust is headquartered in Nashville, Tennessee.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a publicly traded real estate investment trust (REIT) that invests in senior housing and long-term care properties. As of December 31, 2020, LTC owned a portfolio of 260 skilled nursing, assisted living, and other long-term care properties located in 29 states.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in leasing long-term care facilities. As of March 31, 2021, the company owned 1,543 properties in 44 states and the United Kingdom. The company was founded in 1992 and is headquartered in Hunt Valley, Maryland.

Summary

Investing in Sabra Health Care REIT can be a great option for those looking for a high dividend yield. In addition to the high dividend yield, Sabra Health Care REIT also offers investors the potential for capital appreciation. In addition to the high dividend yield and potential for capital appreciation, Sabra Health Care REIT also offers a diversified portfolio of health care-related real estate assets. The company owns and operates a portfolio of skilled nursing, assisted living, memory care, and independent living properties throughout the United States. The company has been able to successfully manage its portfolio of assets, providing stable cash flows and consistent returns. Sabra Health Care REIT also offers investors the potential for long-term growth.

The company has been actively investing in new properties and expanding its portfolio of health care-related real estate assets. This expansion has allowed Sabra Health Care REIT to increase its revenue and cash flows, which should provide investors with long-term returns. Overall, Sabra Health Care REIT is an attractive option for those looking for a high dividend yield and potential for capital appreciation and long-term growth. With its diversified portfolio of health care-related real estate assets and its ability to successfully manage these assets, Sabra Health Care REIT is well-positioned for long-term success.

Recent Posts