Petron Malaysia Refining & Marketing stock dividend – Petron Malaysia Refining & Marketing Bhd Declares 0.25 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On June 1 2023, Petron Malaysia Refining & Marketing ($KLSE:3042) Bhd Declares 0.25 Cash Dividend. This marks the third consecutive year that the company has offered dividend per share for its shareholders. The first two years saw them offer 0.2 MYR and then 0.05 MYR with yields of 3.94% and 1.1% respectively, giving a cumulative average dividend yield of 2.99%. The ex-dividend date is June 16 2023 so investors have ample time to decide if they wish to take advantage of this dividend offering.

Market Price

This announcement saw PETRON MALAYSIA REFINING & MARKETING BHD’s stock open at RM4.6 and close at the same price, down by 0.2% from its closing price of 4.6 in the previous day. This comes as a reward to loyal shareholders of the company who have supported it over a period of time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Petron Malaysia Refining & Marketing. More…

| Total Revenues | Net Income | Net Margin |

| 18.37k | 302.94 | 1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Petron Malaysia Refining & Marketing. More…

| Operations | Investing | Financing |

| 249.7 | -75.53 | -183.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Petron Malaysia Refining & Marketing. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.63k | 2.3k | 7.29 |

Key Ratios Snapshot

Some of the financial key ratios for Petron Malaysia Refining & Marketing are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.8% | 53.7% | 1.9% |

| FCF Margin | ROE | ROA |

| 1.1% | 9.4% | 4.6% |

Analysis

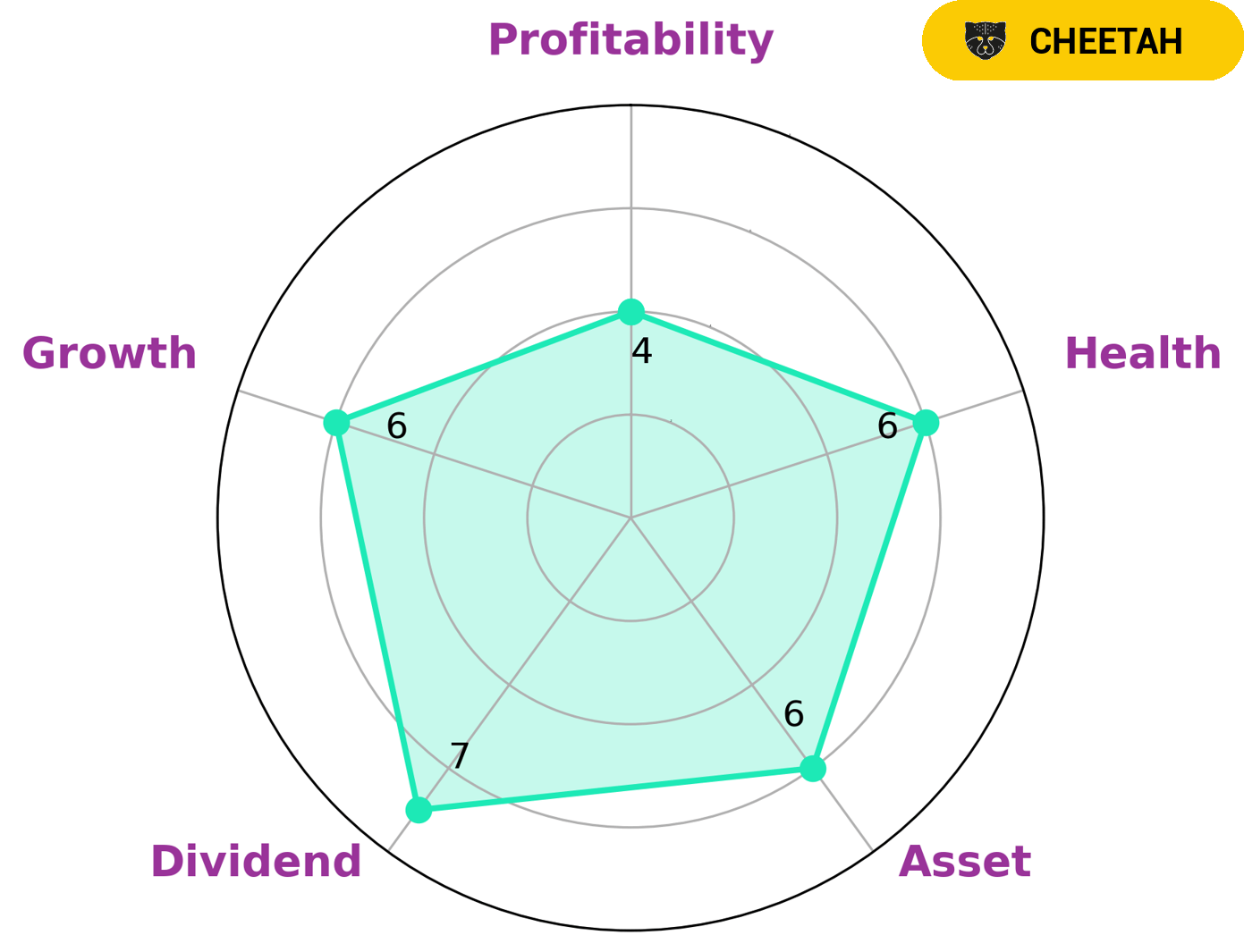

GoodWhale analyzed the financials of PETRON MALAYSIA REFINING & MARKETING BHD and found that they have an intermediate health score of 6/10, according to our Star Chart. This means they have enough cashflow and debt to both pay off debt and fund future operations. In terms of their other metrics, PETRON MALAYSIA REFINING & MARKETING BHD is strong in dividend, and medium in asset, growth, and profitability. Based on our analysis, PETRON MALAYSIA REFINING & MARKETING BHD is classified as a ‘cheetah’ company. This type of company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in this type of company might be those who are looking for high growth potential but who are also willing to accept higher risks. More…

Peers

The competition between Petron Malaysia Refining & Marketing Bhd and its competitors has become increasingly fierce in recent years. In this highly competitive market, Petron Corp, Hengyuan Refining Co Bhd, and Esso SAF are all vying for a larger share of the market. These companies are constantly working to improve their products and services in order to stay ahead of the competition. As such, the battle for the top spot in the industry is heating up.

– Petron Corp ($PSE:PCOR)

Petron Corporation is a leading oil and gas refining, marketing, and distribution company in the Philippines. It has been publicly listed since 1976 and is one of the largest companies in the country, currently having a market capitalization of 32.81 billion US dollars as of 2023. Its Return on Equity (ROE) rate of 12.22% reflects the company’s overall performance and financial health. Petron Corporation is the market leader in the retail segment, owning the largest network of service stations in the Philippines. It also produces and distributes lubricants, fuel oil, and asphalt, and operates international shipping and freight forwarding services.

– Hengyuan Refining Co Bhd ($KLSE:4324)

Hengyuan Refining Co Bhd is one of Malaysia’s leading integrated energy companies, providing a wide range of petroleum and petrochemical products. As of 2023, it has a market capitalization of 960 million, making it one of the largest companies in the country. The company’s Return on Equity (ROE) stands at -23.9%, which is relatively low compared to other companies in the same sector. This indicates that the company is not making good use of its shareholders’ invested funds, leading to a decline in returns. Nevertheless, the company continues to be one of the most profitable and profitable energy companies in Malaysia.

– Esso SAF ($BER:EH8)

Esso SAF is a major oil and gas refining and marketing company based in France. It has a market capitalization of 629.36 million Euros as of 2023, which is a significant market presence in the industry. The company also has a strong Return on Equity of 33.57%, indicating its ability to generate returns on its investments. This is higher than the average ROE for other companies in the same sector, which showcases its financial strength. Esso SAF primarily focuses on refining and marketing petroleum products to customers in France and abroad. It is also involved in related activities, such as exploration, production, and transportation of oil and gas.

Summary

Investing in PETRON MALAYSIA REFINING & MARKETING BHD may be an attractive option for those seeking dividend income. The company has offered a dividend per share of 0.2 MYR over the past three years, yielding an average of 2.99%. With careful analysis of the company’s financials and future prospects, investors may determine whether PETRON MALAYSIA REFINING & MARKETING BHD is a suitable choice for their portfolios.

Recent Posts