NXRT stock dividend – NEXPOINT RESIDENTIAL TRUST Announces 0.42 Cash Dividend

March 19, 2023

Dividends Yield

NEXPOINT RESIDENTIAL TRUST ($NYSE:NXRT) has declared a dividend of 0.42 USD per share for the period from 2020 to 2022. This translates to an average yield of 2.2%, which is considered to be a healthy and steady dividend return by investors. On March 1 2023, the company announced this cash dividend. The ex-dividend date for this dividend was declared to be March 14, 2023. As such, any investor looking to benefit from this dividend should purchase the stock before March 14 in order to receive the dividend.

NEXPOINT RESIDENTIAL TRUST is an attractive option for investors looking for stable dividend returns. The company’s steady annual dividend per share of 1.56 USD makes it a viable option for those looking to invest in dividend stocks. Those who are interested should consider adding NEXPOINT RESIDENTIAL TRUST to their list of considerations.

Stock Price

The stock opened at $48.2, but closed at $46.8, down 3.4% from the prior closing price of 48.4. This news has been received well by the investors, as the dividend is expected to further raise the value of their investments. The announcement has created optimism in the market and investors are expecting more good news from NEXPOINT RESIDENTIAL TRUST in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NXRT. More…

| Total Revenues | Net Income | Net Margin |

| 263.95 | -9.26 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NXRT. More…

| Operations | Investing | Financing |

| 79.1 | -162.3 | 46.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NXRT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.23k | 1.7k | 20.34 |

Key Ratios Snapshot

Some of the financial key ratios for NXRT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 12.0% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

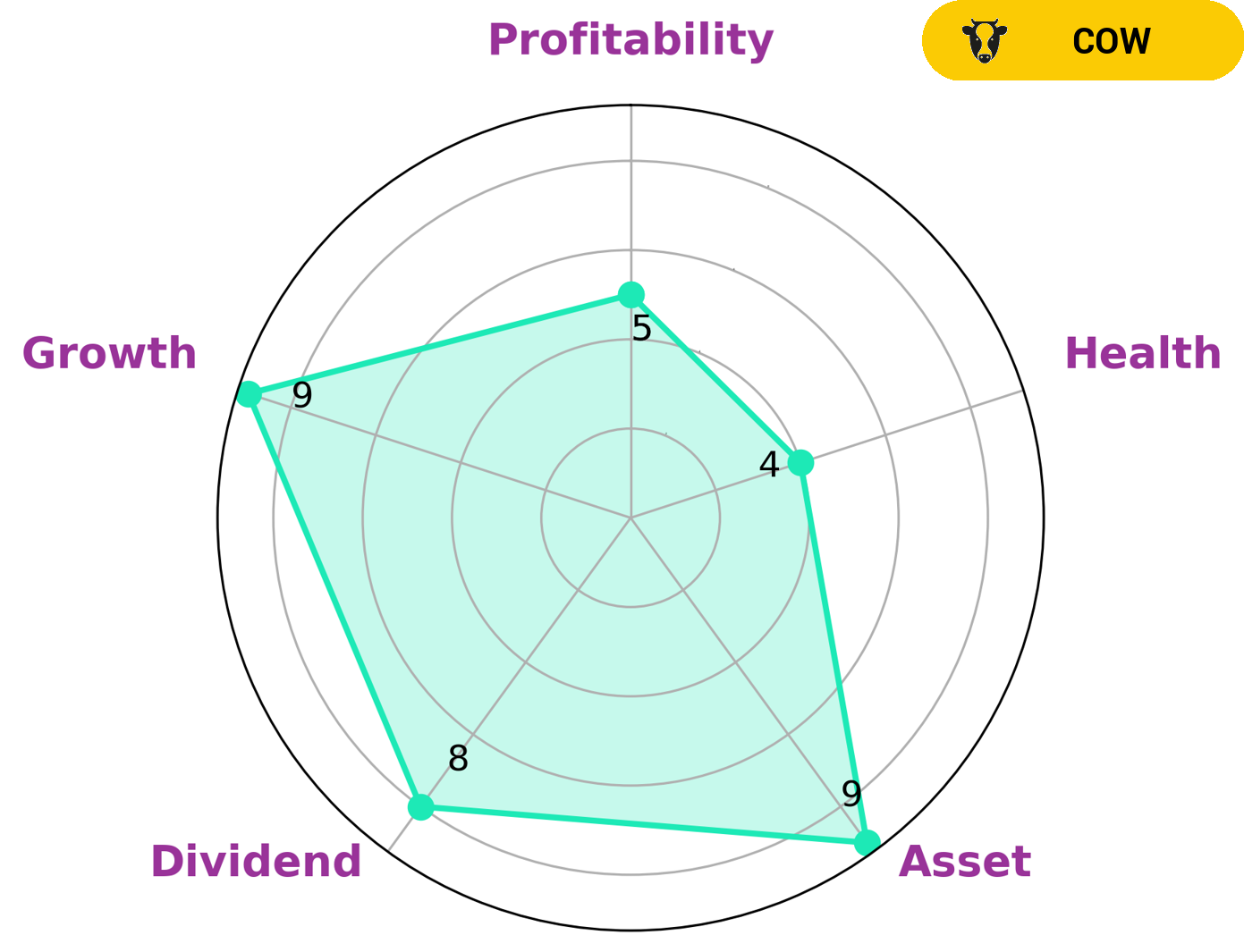

At GoodWhale, we have analyzed the financials of NEXPOINT RESIDENTIAL TRUST in order to form an opinion about the company. Based on our Star Chart, we have classified the company as a ‘cow’, which we conclude has the track record of paying out consistent and sustainable dividends. Such companies would be attractive to dividend investors who value ongoing income. Furthermore, our analysis of the company’s financials reveal an intermediate health score of 4/10 with regard to its cashflows and debt. This indicates that NEXPOINT RESIDENTIAL TRUST is likely to pay off debt and fund future operations. In addition, the company is strong in asset, dividend, and growth and medium in profitability. All this makes it a good choice for investors who are looking for a steady and reliable source of income. More…

Peers

The company is headquartered in Dallas, Texas and was founded in 2010. NexPoint Residential Trust Inc. has a portfolio of over 26,000 units across the United States. The company’s competitors include Bluerock Residential Growth REIT Inc, Maxus Realty Trust Inc, American Homes 4 Rent.

– Bluerock Residential Growth REIT Inc ($OTCPK:MRTI)

Maxus Realty Trust Inc is a real estate investment trust that primarily focuses on the ownership and operation of shopping centers. As of 2022, the company’s market cap totaled 11.88 million and its ROE was 11.97%. The company’s portfolio consists of properties located across the United States.

– Maxus Realty Trust Inc ($NYSE:AMH)

American Homes 4 Rent is an American real estate investment trust that invests in, acquires, and manages single-family rental properties. As of December 31, 2020, the company owned 53,545 homes in 26 states.

American Homes 4 Rent has a market cap of $11.04 billion as of 2022. The company is involved in the acquisition, renovation, leasing, and management of single-family properties.

Summary

NEXPOINT RESIDENTIAL TRUST is a good long-term investment option for investors looking for consistent income. The trust pays an annual dividend of 1.56 USD per share, with a yield of 2.2%. Analyzing the financials, the trust has a strong balance sheet and an attractive price-to-earnings ratio.

It also has a low payout ratio and consistent dividend payments. Overall, this trust is well-positioned to deliver consistent returns to investors over the next few years.

Recent Posts