NHI dividend yield calculator – National Health Investors Declares 0.9 Cash Dividend.

June 12, 2023

🌥️Dividends Yield

National Health Investors ($NYSE:NHI) Inc. recently declared a 0.9 cash dividend on June 8 2023, making it a great option for those looking for dividend stocks. The company has consistently paid a dividend of 3.6, 3.6 and 3.8 USD in 2021, 2022 and 2023 respectively, resulting in an average yield of 6.18%. The ex-dividend date for the 2023 dividend is June 29. This indicates that those who purchase the stock prior to this date will receive the dividend.

National Health Investors Inc. is committed to paying its shareholders a steady dividend and is committed to long-term financial growth and stability. This makes it an attractive option for investors looking for stability and consistent dividends over the long-term. Furthermore, given the increasing demand for healthcare services due to a growing population, investing in National Health Investors Inc. may be a good way to grow your portfolio over the long-term.

Share Price

This dividend marks an increase from the previous year, signifying the organization’s commitment to creating value for its shareholders. The stock opened at $54.7 on Thursday and closed at $53.5, which represents a 2.6% decrease from the previous closing price of $54.9. NHI’s commitment to providing a healthy return to its shareholders is evident in its track record of dividend payments and should continue to be a major selling point for potential investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NHI. More…

| Total Revenues | Net Income | Net Margin |

| 289.25 | 92.49 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NHI. More…

| Operations | Investing | Financing |

| 177.71 | 172.48 | -374.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NHI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.53k | 1.24k | 29.21 |

Key Ratios Snapshot

Some of the financial key ratios for NHI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 51.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

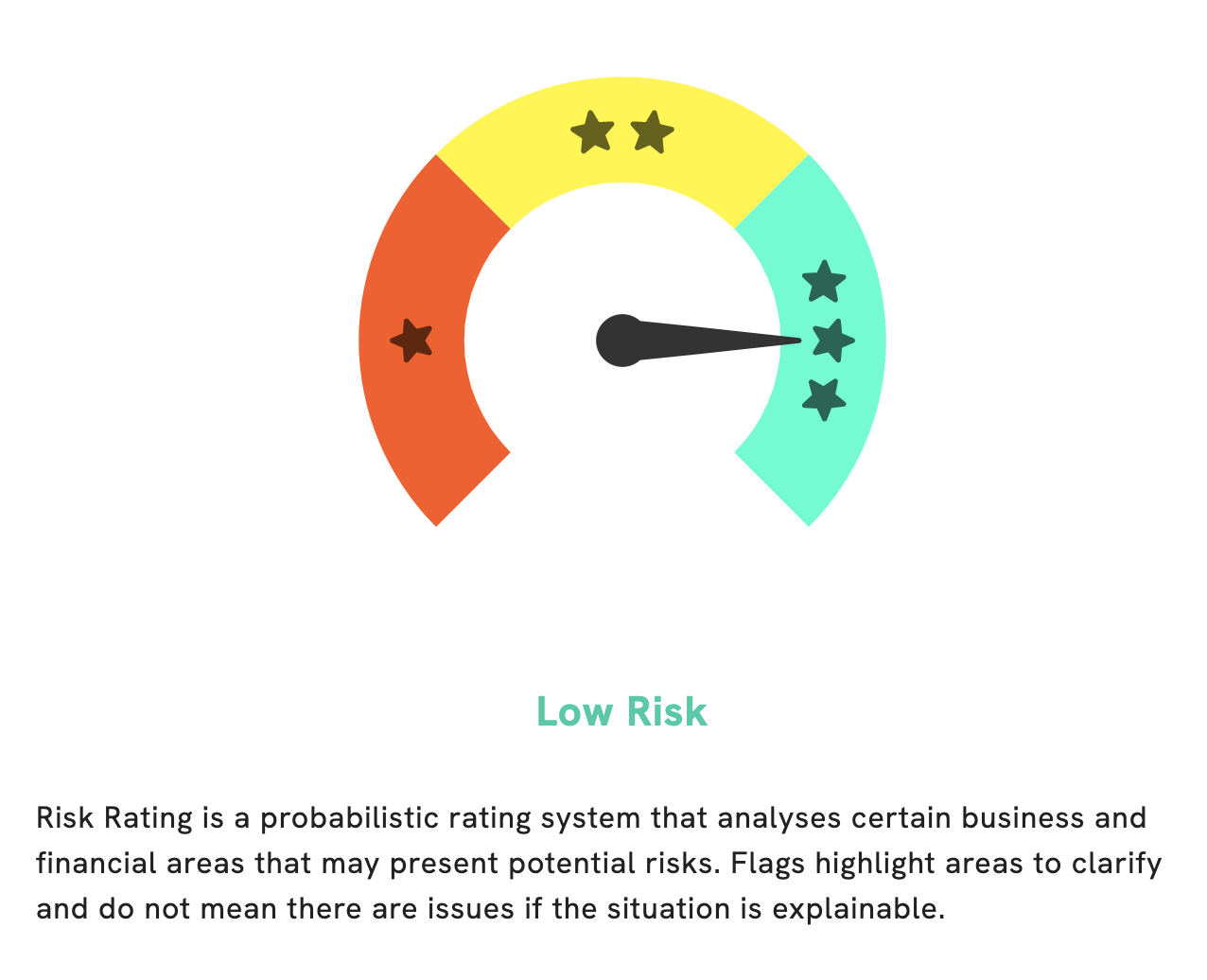

At GoodWhale we have conducted an in-depth analysis of NATIONAL HEALTH INVESTORS’ fundamentals. Based on our Risk Rating, NATIONAL HEALTH INVESTORS appears to be a low risk investment in terms of both financial and business aspects. However, we have detected 1 risk warning in the company’s balance sheet. If you would like to find out more about it, please register with us today. More…

Peers

The healthcare sector has seen a lot of consolidation in recent years as companies have been looking to increase their scale and efficiency. National Health Investors Inc (NHI) is one of the largest players in the healthcare real estate investment trust (REIT) space and competes with a number of other large companies, including Griffin-American Healthcare Reit III Inc, NorthStar Healthcare Income Inc, and Healthcare Trust of America Inc. NHI has been able to outperform its competitors in recent years by executing a strategy of diversifying its portfolio across a number of different healthcare subsectors. This has allowed NHI to weather the ups and downs of the healthcare sector better than its competitors and has resulted in better financial results for the company.

– Griffin-American Healthcare Reit III Inc ($OTCPK:GRAH)

Griffin-American Healthcare REIT III, Inc. is a real estate investment trust that focuses on owning and operating income-producing healthcare properties in the United States. As of December 31, 2020, the company’s portfolio consisted of 199 healthcare properties in 33 states. The company was founded in 2013 and is headquartered in Irvine, California.

– NorthStar Healthcare Income Inc ($OTCPK:NHHS)

NorthStar Healthcare Income Inc is a publicly traded real estate investment trust that focuses on investing in and owning net-leased healthcare properties across the United States. The company’s portfolio consists of skilled nursing, senior housing, hospitals, and other medical office buildings. NorthStar Healthcare Income Inc is headquartered in Dallas, Texas.

Summary

National Health Investors (NHI) is an attractive choice for investors interested in dividend stocks. The last three years have seen NHI pay out a dividend per share of 3.6, 3.6 and 3.8 USD with corresponding dividend yields of 6.37%, 6.39% and 5.79% in 2021, 2022 and 2023 respectively. The average yield on NHI’s dividend is 6.18%, making it one of the best options for dividend-seeking investors. Analysts are optimistic about the company’s future prospects given its healthy balance sheets and consistent dividend payments, making NHI a sound investment choice.

Recent Posts