Netstreit Corp dividend calculator – NETSTREIT CORP Announces 0.2 Cash Dividend

March 20, 2023

Dividends Yield

NETSTREIT CORP ($NYSE:NTST) recently announced a cash dividend of 0.2 USD per share on March 1, 2023. This dividend is consistent with the company’s past performance, as they have paid out a steady annual dividend of 0.8 USD per share over the past three years, giving a dividend yield of 3.86%. For investors who are looking to invest in a dividend stock, NETSTREIT CORP is a great choice, with its ex-dividend date set for March 14, 2023. This means that investors who purchase NETSTREIT CORP prior to the ex-dividend date will be eligible to receive the dividend payout.

Stock Price

The stock opened at $20.1 and closed at $20.1, a change of 0.4% from the previous closing price of $20.2. Investors are likely to benefit from the dividend payout, although the stock price has not seen much of an increase. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Netstreit Corp. More…

| Total Revenues | Net Income | Net Margin |

| 96.28 | 8.12 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Netstreit Corp. More…

| Operations | Investing | Financing |

| 50.65 | -468.36 | 480.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Netstreit Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.61k | 547.27 | 18.07 |

Key Ratios Snapshot

Some of the financial key ratios for Netstreit Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 16.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

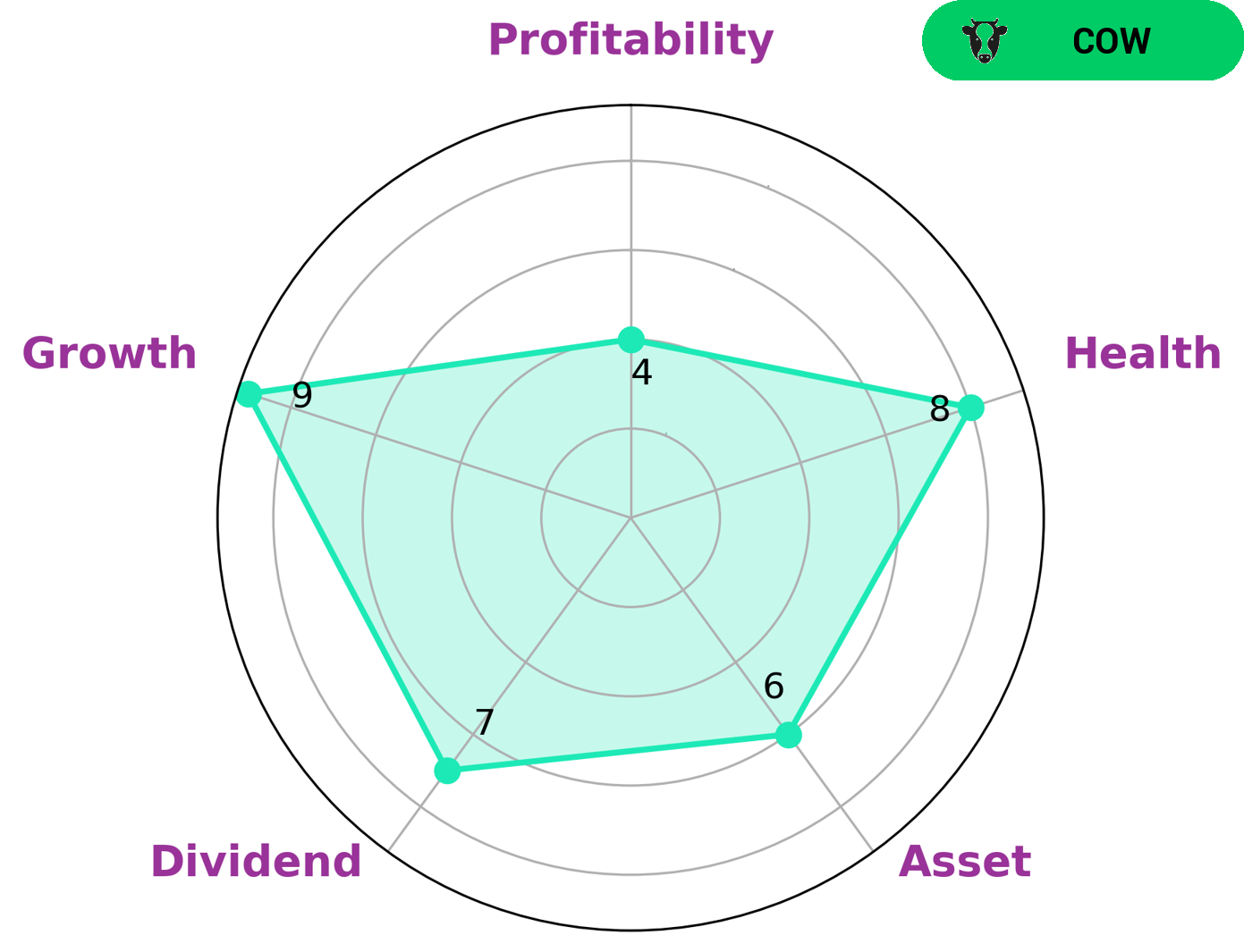

After carefully analyzing NETSTREIT CORP‘s financials, our Star Chart gave it a health score of 8/10 with regard to its cashflows and debt, showing that the company is capable to pay off debt and fund future operations. We also found that NETSTREIT CORP is strong in dividend, growth, and medium in asset, profitability. Based on this assessment, we concluded that NETSTREIT CORP is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes NETSTREIT CORP an attractive investment for those looking for a reliable source of income. It is likely to be of interest to income investors, as well as those who are looking for stability and reliable growth in their portfolio. More…

Peers

The competition between Netstreit Corp and its competitors is intense. Each company is striving to be the best in the industry and to provide the best products and services to their customers. This competition is good for the consumer because it allows them to choose from a variety of companies that offer different products and services. It also keeps the prices of the products and services down because the companies are always trying to outdo each other.

– Sasseur REIT ($SGX:CRPU)

Sasseur REIT is a Singapore-based real estate investment trust that owns and operates a portfolio of four premium outlet malls in China. The company’s market cap as of 2022 is 822.66M. The company’s outlets are located in the cities of Hangzhou, Hefei, Chongqing and Kunming, and cater to a range of international brands.

– BHG Retail REIT ($SGX:BMGU)

BHG Retail REIT is a real estate investment trust that owns, operates, and develops retail properties in the United States. As of December 31, 2020, the company owned and operated a portfolio of 84 retail properties, consisting of 65 shopping centers, 15 freestanding stores, and 4 development projects. The company was founded in 2010 and is headquartered in Boston, Massachusetts.

– Partners Real Estate Investment Trust ($OTCPK:PTSRF)

Partners Real Estate Investment Trust is a Canadian company that owns and operates a portfolio of income-producing real estate assets. The company has a market capitalization of $23.5 million as of March 2022. Partners REIT’s portfolio consists of retail, office, and industrial properties located across Canada.

Summary

NETSTREIT CORP is an attractive investment option for those seeking steady income. The company has paid out the same annual dividend per share at 0.8 USD for the past 3 years, resulting in an impressive dividend yield of 3.86%. Netstreit’s consistent dividend payout and attractive yield makes it a reliable and steady income generator, offering investors a dependable return on their investments.

Furthermore, their solid financial track record and strong balance sheet make it a safe investment option with low risk. With a steady and secure dividend, NETSTREIT CORP is an excellent addition to any investor’s portfolio.

Recent Posts