National Fuel Gas Company Stock Goes Ex-Dividend in 2023 – Just Four Days Away!

March 31, 2023

Trending News 🌥️

The National Fuel Gas ($NYSE:NFG) Company stock is set to go ex-dividend this week, in just four days! After the ex-dividend date, the stock will no longer include the company’s dividend payout for eligible investors. National Fuel Gas Company is a diversified energy company with operations in both natural gas production and utility operations. Its natural gas production operations span the Appalachian region, while its utility operations serve the markets of northwestern Pennsylvania, western New York and eastern Ohio.

The company also has a well-established infrastructure of pipelines and storage facilities throughout the region. Investors who are eligible for the dividend payout should make sure to get their payments before the ex-dividend date, in order to maximize their returns from the stock.

Dividends

The company has issued annual dividends per share of 1.88, 1.86, and 1.8 USD for the last three years and has projected dividend yields of 2.77%, 2.78%, and 3.65%, respectively, from 2021 to 2023, providing an average dividend yield of 3.07%. Investors seeking dividend stocks should consider adding NATIONAL FUEL GAS to their list of potential investments.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NFG. More…

| Total Revenues | Net Income | Net Margin |

| 2.3k | 603.32 | 25.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NFG. More…

| Operations | Investing | Financing |

| 968.38 | -557.83 | -243.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NFG. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.13k | 5.6k | 27.64 |

Key Ratios Snapshot

Some of the financial key ratios for NFG are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.7% | 19.3% | 37.6% |

| FCF Margin | ROE | ROA |

| 5.9% | 23.4% | 6.6% |

Share Price

Monday was an exciting day for shareholders of National Fuel Gas Company, as their stock opened at $56.2 and closed at $56.3, up 1.0% from the previous closing price of $55.7. The company’s stock is set to go ex-dividend in just four days, meaning that owners of the stock as of close of trading on Friday will receive the next dividend payment. National Fuel Gas Company is a diversified energy company that operates in multiple segments, including natural gas production and exploration, natural gas pipeline and storage, midstream operations and utility operations. It also has interests in various oil and gas properties located in the United States and Canada.

The company has a long history of consistent dividend payments and is expected to continue to do so in the future. Overall, investors of National Fuel Gas Company can look forward to a consistently performing stock with an upcoming ex-dividend date on Friday. This is an opportunity for those who have owned the stock prior to the ex-dividend date to capitalize on the dividend payment while still benefiting from potential stock appreciation over time. Live Quote…

Analysis

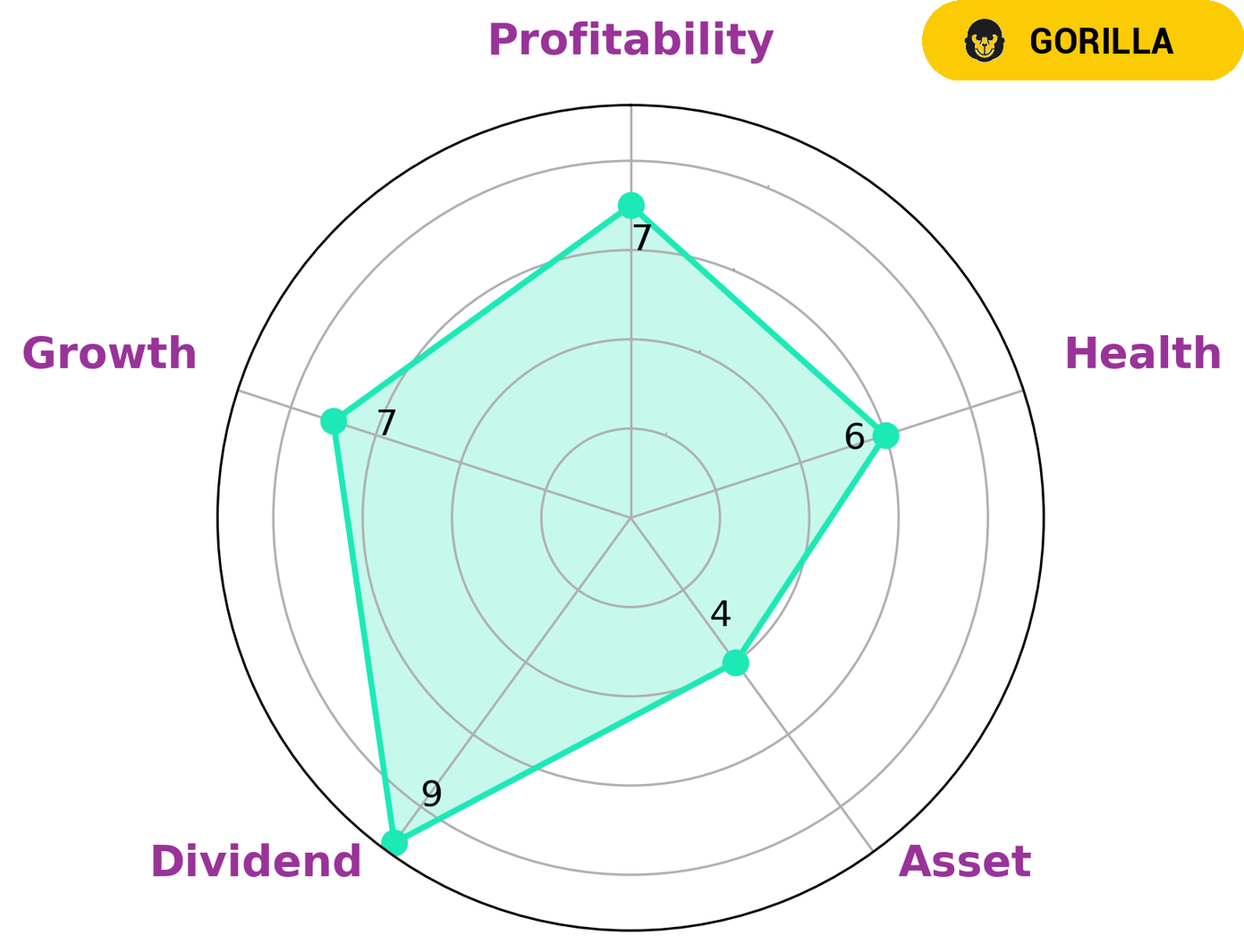

GoodWhale recently conducted an analysis of NATIONAL FUEL GAS and found it to be a strong investment. Our Star Chart shows that the company is strong in dividend, growth, and profitability, and medium in assets. The health score of 6/10 indicates that it has intermediate health, meaning that it is likely to be able to sustain its operations even in times of crisis. Furthermore, we classified NATIONAL FUEL GAS as a ‘gorilla’: a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. As such, investors looking for stable returns and long-term growth may be particularly interested in this company. More…

Peers

The company’s main business is natural gas and crude oil production, transportation and sale. The company operates in the United States, Canada and Argentina. National Fuel Gas Co’s main competitors are Transportadora de Gas del Sur SA, Oasis Petroleum Inc, YPF SA.

– Transportadora de Gas del Sur SA ($NYSE:TGS)

Transportadora de Gas del Sur SA is a gas transportation and distribution company operating in Argentina. The company’s market cap as of 2022 is 1.35B and its ROE is 10.03%. The company is engaged in the transportation and distribution of natural gas to industrial, commercial and residential customers in Argentina.

– Oasis Petroleum Inc ($NASDAQ:OAS)

Petróleos de Venezuela, S.A. (PDVSA) is a Venezuelan state-owned oil and natural gas company. It was created in 1976 from the nationalization of the Venezuelan oil industry. It is headquartered in Caracas and its operations are primarily focused on Venezuela’s Orinoco Belt region. The company has the largest proven reserves of crude oil in the world and is the largest producer of oil in South America.

PDVSA is a vertically integrated company that engages in all aspects of the oil and gas industry, including exploration and production, refining, marketing, and transportation. The company also has significant stakes in a number of joint ventures, most notably with Chevron, ExxonMobil, and Total.

PDVSA has a market cap of $2.94 billion as of 2022 and a return on equity of 22.79%. The company is the largest producer of oil in South America and has the largest proven reserves of crude oil in the world.

Summary

National Fuel Gas Co. (NFG) is a publicly traded energy company with a focus on natural gas. The company offers a variety of services, including electricity generation, gas storage, transmission, and distribution. NFG pays out dividends to shareholders, which are distributed four times a year. This means that shareholders who buy the stock prior to this date will be eligible to receive the upcoming dividend. An analysis of NFG’s financials indicates strong growth in revenue, earnings, and cash flow over the past few years.

Additionally, the company has a solid balance sheet, with a low debt-to-equity ratio and healthy cash holdings. All in all, NFG is a well-established and financially sound energy company that provides investors with an attractive dividend yield and long-term growth potential.

Recent Posts