Nanya Technology dividend – Nanya Technology Corp Announces Cash Dividend of 2.13037721

June 9, 2023

🌥️Dividends Yield

NANYA TECHNOLOGY ($TWSE:2408) Corp has announced a cash dividend of 2.13037721 per share on June 1 2023. This dividend will be paid out to shareholders on June 28 2023, with the ex-dividend date set for June 28 2023. If you are looking for an investment with potential for consistent and increasing dividends, NANYA TECHNOLOGY is one to consider. Over the past three years, they have issued annual dividends per share of 3.7, 3.7 and 1.3 TWD respectively, resulting in overall dividend yields of 5.79%, 5.79% and 1.62%.

The average dividend yield is 4.4%. NANYA TECHNOLOGY is dedicated to rewarding their shareholders with a steady return on their investment. With their reliable dividend history and current payout, they are sure to be a great option for those looking for a long-term investment that offers reliable and increasing returns.

Price History

The news came as the company’s stock opened at NT$72.6 and closed at NT$71.4, a decrease of 2.9% from its previous closing price of 73.5. As the memory chip market continues to grow, NANYA TECHNOLOGY is well positioned to take advantage of the positive trend and leverage its position as a leader in this industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nanya Technology. More…

| Total Revenues | Net Income | Net Margin |

| 43.43k | 6.38k | 14.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nanya Technology. More…

| Operations | Investing | Financing |

| 7.55k | -25.53k | -11.76k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nanya Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 197.76k | 25.45k | 58.41 |

Key Ratios Snapshot

Some of the financial key ratios for Nanya Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.4% | -39.4% | 15.7% |

| FCF Margin | ROE | ROA |

| -41.5% | 2.4% | 2.1% |

Analysis

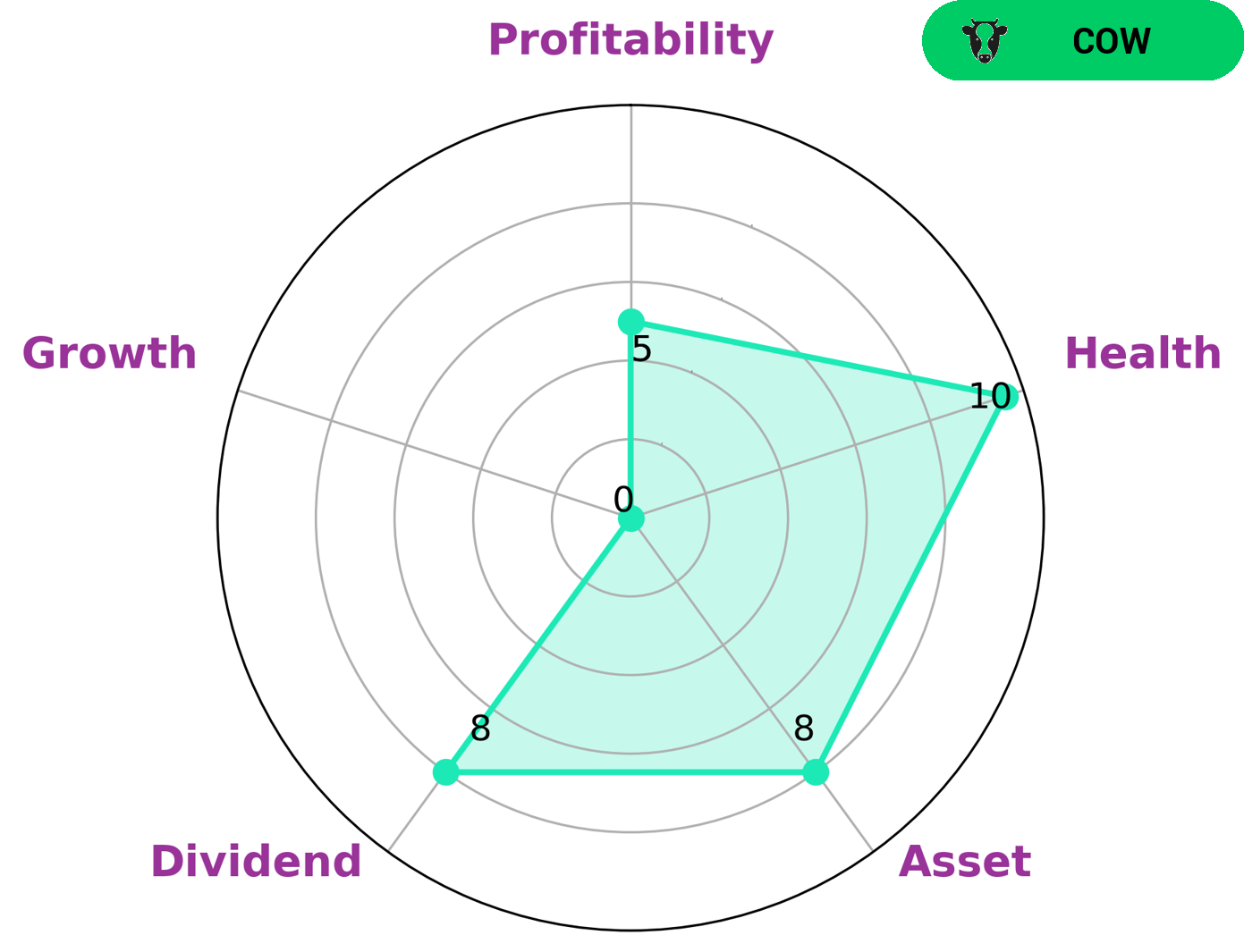

After analyzing NANYA TECHNOLOGY‘s fundamentals, the GoodWhale team found that the company was strong in assets and dividend health, had medium profitability, but was weak in growth. Our Star Chart analysis showed a health score of 10/10 with regard to cashflows and debt, meaning the company is capable of paying off debt and funding its future operations. We concluded that NANYA TECHNOLOGY is classified as a ‘cow’, a type of company with a track record of providing consistent and sustainable dividends. Given the company’s fundamentals and dividend history, we believe that conservative investors looking for steady returns may be interested in NANYA TECHNOLOGY. Investors who value safety and reliability may also find this company attractive as it appears capable of meeting its obligations. Furthermore, value investors may be drawn to the company given its low stock price and relatively high dividend yield. More…

Peers

It has a strong presence in consumer, industrial, enterprise, and automotive markets. Its main competitors are eGalax-eMIPIA Technology Inc, Syncomm Technology Corp, and Shinko Electric Industries Co Ltd. These companies are all well-established players in the semiconductor industry, providing innovative solutions to their customers.

– eGalax-eMIPIA Technology Inc ($TPEX:3556)

Galax-eMIPIA Technology Inc is a leading semiconductor and display technology provider based in Taiwan. The company develops, manufactures, and sells integrated circuit (IC) chips, display products, and related electronic products. It offers single-chip solutions, such as System-on-Chip (SoC) solutions and multimedia SoC solutions. It also provides system integration services for the development of high-performance applications such as 5G communication, artificial intelligence (AI), and augmented reality (AR). As of 2023, the company had a market cap of 4.24 billion and an impressive Return on Equity (ROE) of 15.29%. This strong financial performance indicates that the company’s strategies are performing well and that its operations are generating strong returns for its shareholders.

– Syncomm Technology Corp ($TPEX:3150)

Syncomm Technology Corp is a technology-based company that develops and manufactures high-performance wireless products and solutions. With a market cap of 1.19B as of 2023, the company is estimated to experience growth in the coming years. The Return on Equity (ROE) of 9.48% suggests that the company has been profitable, so far. This indicates that the investors are being rewarded for their investments as well as that the company is generating cash flow efficiently. The high ROE also suggests that the company is making good use of its assets and is able to generate more returns with a given amount of equity.

– Shinko Electric Industries Co Ltd ($TSE:6967)

Shinko Electric Industries Co Ltd is a leading electronics and electrical equipment manufacturer based in Japan. The company boasts a market cap of 727.86B as of 2023, making it one of the largest companies in Japan. On top of that, Shinko Electric has an impressive return on equity of 23.96%, indicating that the company is able to generate a substantial amount of revenue from its investments. Shinko Electric specializes in a wide range of products, from consumer electronics to industrial equipment. Its portfolio includes everything from semiconductors and LCDs to robots. The company also produces auto parts, medical equipment, and other engineering products. Shinko Electric has been able to stay competitive and maintain its high market cap and ROE through its long-term investments and innovative product development.

Summary

NANYA TECHNOLOGY is an attractive investment opportunity for those seeking consistent and increasing dividends. Over the past three years, the company has consistently issued dividends of 3.7 and 1.3 TWD per share, yielding an average dividend yield of 4.4%. This provides investors with a reliable and steady income stream while the potential for increasing dividends offers long-term growth prospects.

Recent Posts