MHC.U dividend – Flagship Communities REIT Announces Cash Dividend of 0.0468

April 19, 2023

Dividends Yield

Flagship Communities REIT recently announced a cash dividend of 0.0468 on April 17, 2023. This is part of their three-year dividend strategy, where they have declared an annual dividend per share of 0.54 USD in 2022, 2023 and 2024, yielding an average of 3.18%. If you are looking for dividend stocks to invest in, FLAGSHIP COMMUNITIES REIT ($TSX:MHC.U) could be an appropriate option for you. It is important to keep in mind the ex-dividend date for this upcoming dividend is April 27, 2023.

Market Price

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MHC.U. More…

| Total Revenues | Net Income | Net Margin |

| 58.8 | 42.68 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MHC.U. More…

| Operations | Investing | Financing |

| 31.03 | -75.45 | 45.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MHC.U. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 799.27 | 441.52 | 18.24 |

Key Ratios Snapshot

Some of the financial key ratios for MHC.U are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 52.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

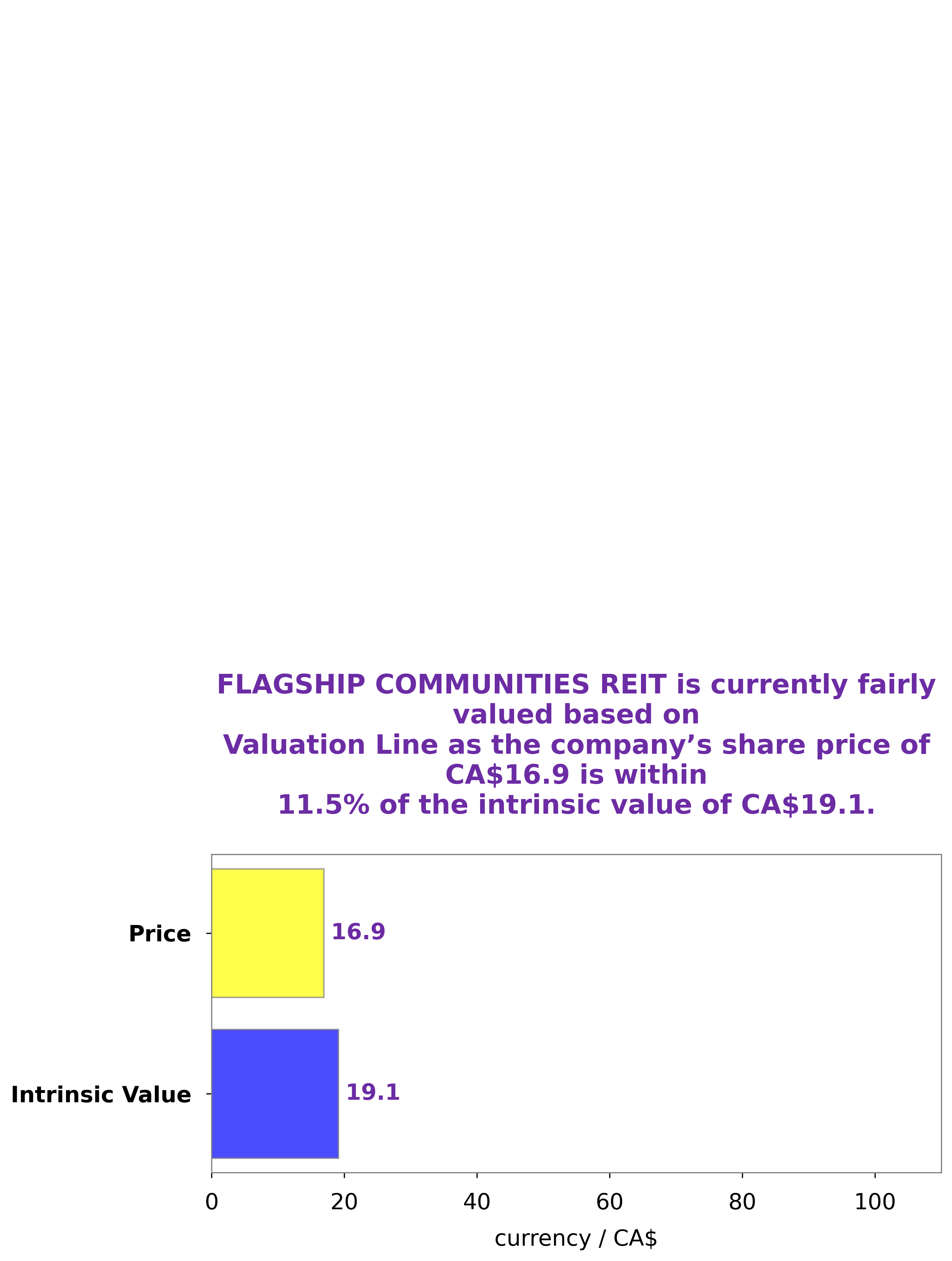

Analysis – MHC.U Intrinsic Value Calculator

GoodWhale has conducted an analysis of FLAGSHIP COMMUNITIES REIT’s fundamentals and has determined the fair value of its share to be around CA$19.1. This value is calculated through our proprietary Valuation Line, which considers a company’s fundamentals such as cash flows, balance sheets, growth potential and more. At the moment, FLAGSHIP COMMUNITIES REIT stock is being traded at CA$16.9, which is a fair price that is undervalued by 11.4%. We recommend investors to take advantage of this opportunity, as this stock has strong potential for growth. More…

Peers

It has a diverse portfolio of assets and has a strong focus on providing investors with attractive long-term returns. Flagship Communities REIT is one of the top players in the student housing REIT space, alongside US Student Housing REIT, Peakstone Realty Trust, and Prime US REIT. These four companies are some of the most prominent players in the student housing industry and have each established a presence in the market.

– US Student Housing REIT ($ASX:USQ)

Student Housing REIT (SHR) is a real estate investment trust that focuses on investments in student housing. As of 2023, SHR has a market cap of 56.1 million, making it one of the largest publicly traded student housing REITs in the United States. SHR owns, manages and develops student housing properties in strategic markets throughout the United States. Its portfolio includes a variety of properties, including on-campus student housing, off-campus student housing and purpose-built student housing. The company also provides asset management services and student housing related services. SHR is actively expanding its portfolio through acquisition and development of student housing properties, seeking to capitalize on the growing demand for high quality student housing.

– Peakstone Realty Trust ($SGX:OXMU)

Prime US REIT is a real estate investment trust (REIT) focused on the acquisition and ownership of office, retail and industrial properties located in major cities across the United States. As of 2023, the company has a market cap of 313.74M. This market cap reflects the total value of its outstanding shares of common stock which trade on the New York Stock Exchange. Prime US REIT has a diversified portfolio of high-quality properties in major cities and continuously seeks to acquire properties with strong potential for growth and long-term capital appreciation. The company’s goal is to provide its shareholders with a reliable, sustainable and growing dividend yield.

Summary

FLAGSHIP COMMUNITIES REIT is a promising investment option for those looking for a reliable dividend stock. Over the past three years, the company has distributed an average dividend per share of 0.54 USD, yielding 3.18% annually. This dividend payout is reliable and secure, making FLAGSHIP an attractive choice for income-seeking investors. Ultimately, FLAGSHIP COMMUNITIES REIT is an ideal choice for anyone seeking a dependable dividend stock.

Recent Posts