Melexis Nv stock dividend – Melexis NV Declares 2.2 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On May 25 2023, Melexis NV announced a 2.2 cash dividend as part of its 2023 financial results. If you’re looking for dividend stocks, MELEXIS NV ($BER:MEX) may be worth considering. Over the past three years, it has issued an annual dividend per share of 2.6, 2.6, and 2.2 EUR respectively, which yields an average of 2.79% over 2021 to 2023. The ex-dividend date for this announcement is May 10, 2023 – any shareholders who own the stock before this date will receive the dividend payout.

Melexis NV has a strong history of rewarding its shareholders with regular dividend payments. This latest announcement of a 2.2 cash dividend is a good sign that the company is still in a strong financial position and is willing to provide value to its investors. The company is likely to remain a reliable source of dividend income, and investors should keep an eye out for further updates on their future payments.

Share Price

Following the announcement, MELEXIS NV stock opened at €84.5 and closed at €84.5, down by 0.4% from the last closing price of 84.8. The overall market sentiment was still positive and investors remained upbeat on the company’s long-term prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Melexis Nv. More…

| Total Revenues | Net Income | Net Margin |

| 880.7 | 199.45 | 21.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Melexis Nv. More…

| Operations | Investing | Financing |

| 183.92 | -39.44 | -108.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Melexis Nv. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 640.79 | 108.77 | 11.93 |

Key Ratios Snapshot

Some of the financial key ratios for Melexis Nv are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.1% | 44.5% | 28.4% |

| FCF Margin | ROE | ROA |

| 15.0% | 30.8% | 24.4% |

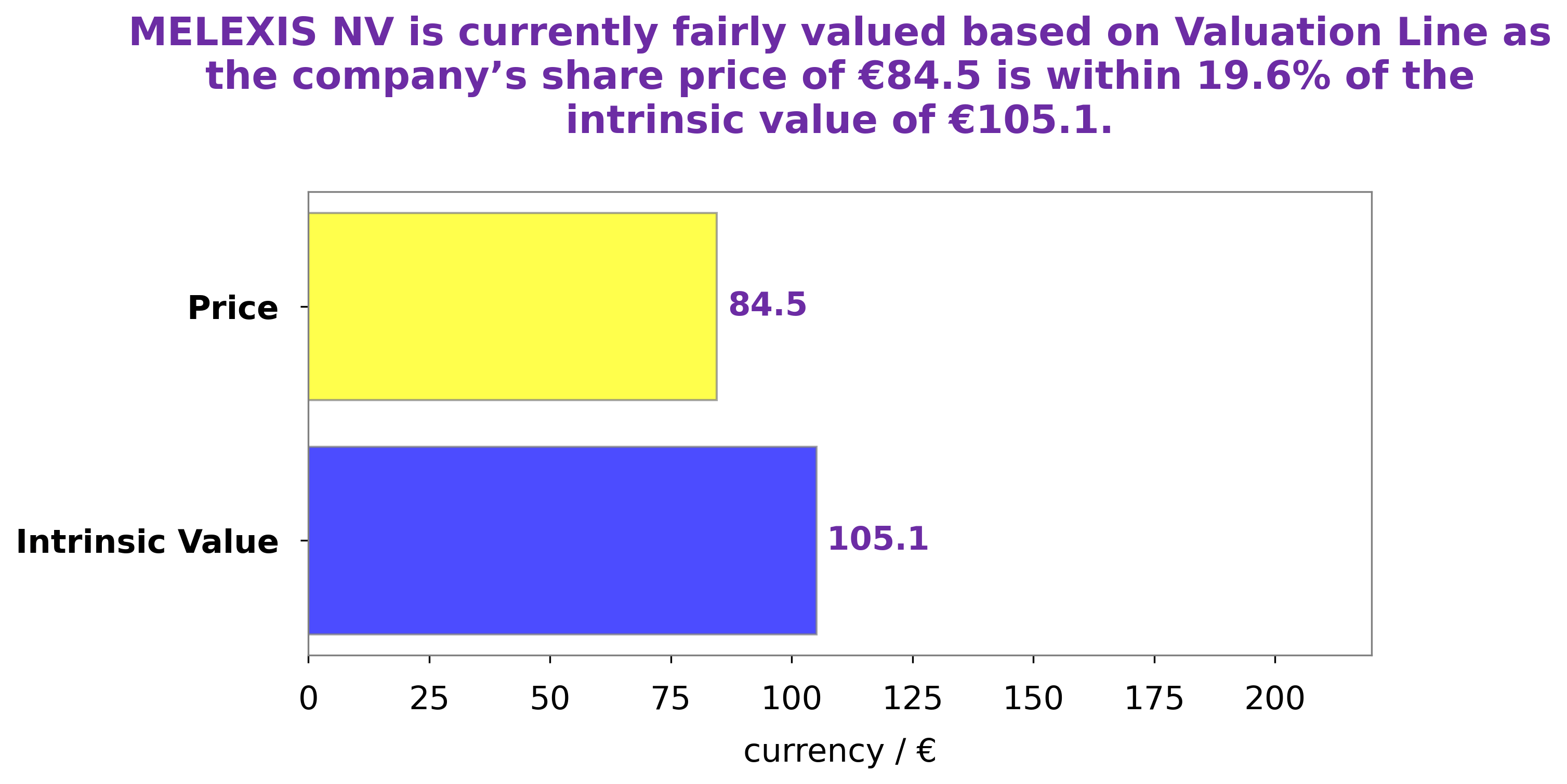

Analysis – Melexis Nv Stock Fair Value

At GoodWhale, we recently conducted an analysis of MELEXIS NV‘s wellbeing. Using our proprietary Valuation Line, we calculated that the intrinsic value of a MELEXIS NV share is around €105.1. At present, MELEXIS NV stock is trading at €84.5, indicating that it is a fair price but undervalued by 19.6%. We believe that MELEXIS NV is a sound investment and well worth considering. More…

Summary

MELEXIS NV is a semiconductor manufacturer based in Belgium, making it an attractive option for investors seeking dividend stocks. Over the past three years, MELEXIS NV has issued an average dividend yield of 2.79%, slightly higher than the general market average. MELEXIS NV also has a relatively low price-to-earnings ratio, indicating potential for future growth.

Fundamental analysis of the company’s financials suggests its dividend is likely to remain stable and its products remain competitive in the market. The stock is a safe choice for conservative investors looking for a steady stream of income.

Recent Posts