Mayer Steel Pipe stock dividend – Mayer Steel Pipe Corp Declares 1.0 Cash Dividend

June 8, 2023

🌥️Dividends Yield

On June 2 2023, Mayer Steel Pipe ($TWSE:2020) Corp declared a 1.0 cash dividend. This will be the company’s fourth consecutive dividend payment, with the previous three payments being 3.0 TWD, 3.0 TWD, and 1.7 TWD. This gives yield percentages of 9.15%, 9.15%, and 6.02% respectively, with an average of 8.11%. This makes Mayer Steel Pipe Corp a viable option for dividend-oriented investors looking to get a return on their investments.

The ex-dividend date is set to be June 13 2023, and investors who purchase the stock before that date will be eligible to receive the dividend. With competitive yields in the industry, investors can rest assured that they are making a sound investment when they purchase stock in Mayer Steel Pipe Corp.

Market Price

The stock opened at NT$24.0 and closed at NT$24.1, representing a 0.6% rise from the previous closing price of 24.0. This decision was made after considering the company’s financial performance and future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mayer Steel Pipe. More…

| Total Revenues | Net Income | Net Margin |

| 6.66k | 254.03 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mayer Steel Pipe. More…

| Operations | Investing | Financing |

| 1.03k | -329.33 | -735.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mayer Steel Pipe. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.51k | 4.35k | 14.39 |

Key Ratios Snapshot

Some of the financial key ratios for Mayer Steel Pipe are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.0% | 22.9% | 6.2% |

| FCF Margin | ROE | ROA |

| 13.7% | 8.1% | 3.4% |

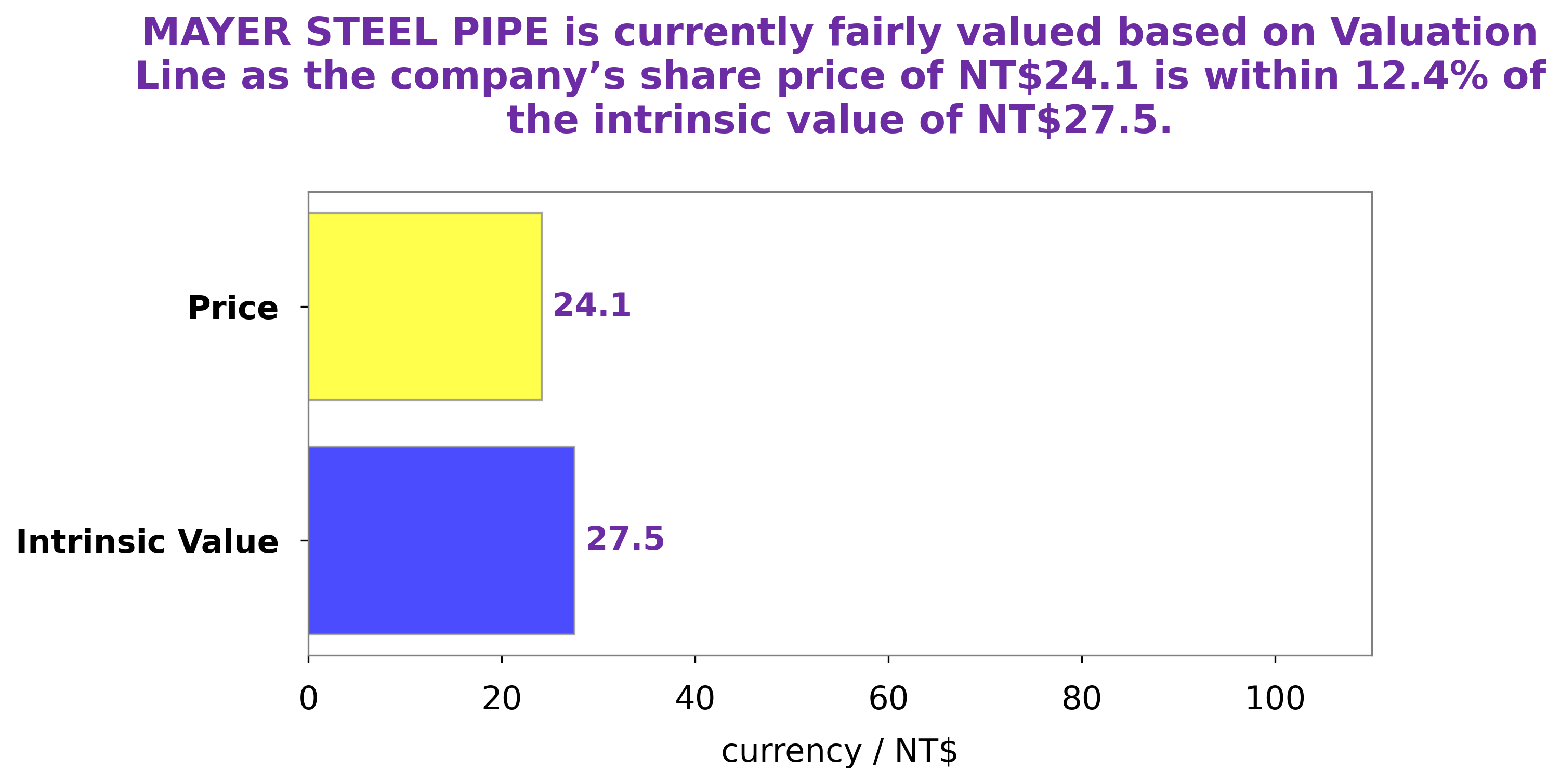

Analysis – Mayer Steel Pipe Intrinsic Stock Value

GoodWhale is proud to announce the results of our analysis of MAYER STEEL PIPE’s wellbeing. Our proprietary Valuation Line calculates an intrinsic value of NT$27.5 per share. With the current stock price at NT$24.1, this represents a 12.5% undervaluation for the MAYER STEEL PIPE. This is an excellent opportunity for investors to capitalize on this significant discount. We believe that investing in MAYER STEEL PIPE is a smart and low-risk venture, and we encourage our clients to take advantage of the current market conditions. With our expertise in financial analysis, GoodWhale looks forward to assisting our clients in making informed and profitable decisions for their investments. More…

Peers

Mayer Steel Pipe Corp is one of the leading steel pipe manufacturers in the world, competing against industry giants such as Sheng Yu Steel Co Ltd, Dai Thien Loc Corp and Yieh United Steel Corp. With its ability to offer superior products and services, Mayer Steel Pipe Corp has become a major player in the steel pipe industry.

– Sheng Yu Steel Co Ltd ($TWSE:2029)

Sheng Yu Steel Co Ltd is a Chinese steel manufacturer located in Shanghai, China. With a market cap of 8.14B as of 2023, it is one of the largest steel producers in China. Its Return on Equity (ROE) of 3.47% is indicative of its sound financial approach to business. Sheng Yu Steel Co Ltd produces a wide range of steel products and is committed to providing quality and cost-efficient solutions to its customers. It has become one of the leading steel providers in the region.

– Dai Thien Loc Corp ($HOSE:DTL)

Yieh United Steel Corporation is an international integrated steel manufacturer and exporter based in Taiwan. It produces a wide range of steel products including hot rolled coils, cold rolled coils, galvanized steel coils, and tinplates. The company also provides a range of services related to the steel industry such as production of steel products, research and development, technical consultancy, and trading services. As of 2023, Yieh United Steel Corporation had a market capitalization of 20.49 billion US dollars and a return on equity of 0.81%. This indicates that the company has been able to generate a relatively strong return on invested capital. Additionally, the large market cap indicates that the company has established itself as a major player in the steel industry.

Summary

MAYER STEEL PIPE is a good option for investors seeking consistent dividend income. The payments of 3.0 TWD, 3.0 TWD and 1.7 TWD correspond to yields of 9.15%, 9.15% and 6.02% respectively. Given the stability of these dividends, MAYER STEEL PIPE can be considered a reliable investment for those looking for consistent passive income.

Recent Posts