K&s Corporation stock dividend – K&S Co. Limited to Declare Dividend for 2023 on March 20th.

March 24, 2023

Trending News 🌧️

K&S ($ASX:KSC) Co. Limited has announced that it will be distributing dividends to its shareholders on March 20th of 2023. The dividend announcement signals that K&S Co. Limited is in a stable financial position and is confident that its profits and operations will continue in the long-term. This dividend payment is seen as a sign of confidence in the company’s long-term prospects. The dividend is expected to be a significant payout for shareholders.

The exact amount of the dividend is yet to be determined, but K&S Co. Limited has indicated that it is likely to be a substantial amount. The company has also indicated that the amount will be in line with its other recent dividend payments. It is likely to be a significant payout and will provide shareholders with additional financial security for the next few years.

Dividends – K&s Corporation stock dividend

This is the third consecutive year that the company has issued an annual dividend per share. In 2021, the dividend was 0.1 AUD, while in 2022 it was 0.08 AUD and in 2023 it is expected to be 0.06 AUD. The resulting dividend yields for those years are 5.4%, 4.69%, and 4.51%, respectively, with an average dividend yield of 4.87%. For those interested in dividend stocks, K&S CORPORATION may be worth considering given its consistent dividend payment history and competitive average dividend yield.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for K&s Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 841.25 | 24.3 | 2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for K&s Corporation. More…

| Operations | Investing | Financing |

| 80.91 | -44.15 | -24.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for K&s Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 602.73 | 280.01 | 2.36 |

Key Ratios Snapshot

Some of the financial key ratios for K&s Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.6% | 18.0% | 4.4% |

| FCF Margin | ROE | ROA |

| 3.3% | 7.3% | 3.8% |

Stock Price

Currently, news coverage of the announcement has been mostly neutral. On Monday, K&S CORPORATION stock opened at AU$2.5 and closed at AU$2.6, marking a 3.6% increase from the previous closing price of AU$2.5. Investors appear to be optimistic about the dividend announcement, and have responded positively to the news. This positive sentiment could potentially drive further stock gains in the coming days. Live Quote…

Analysis

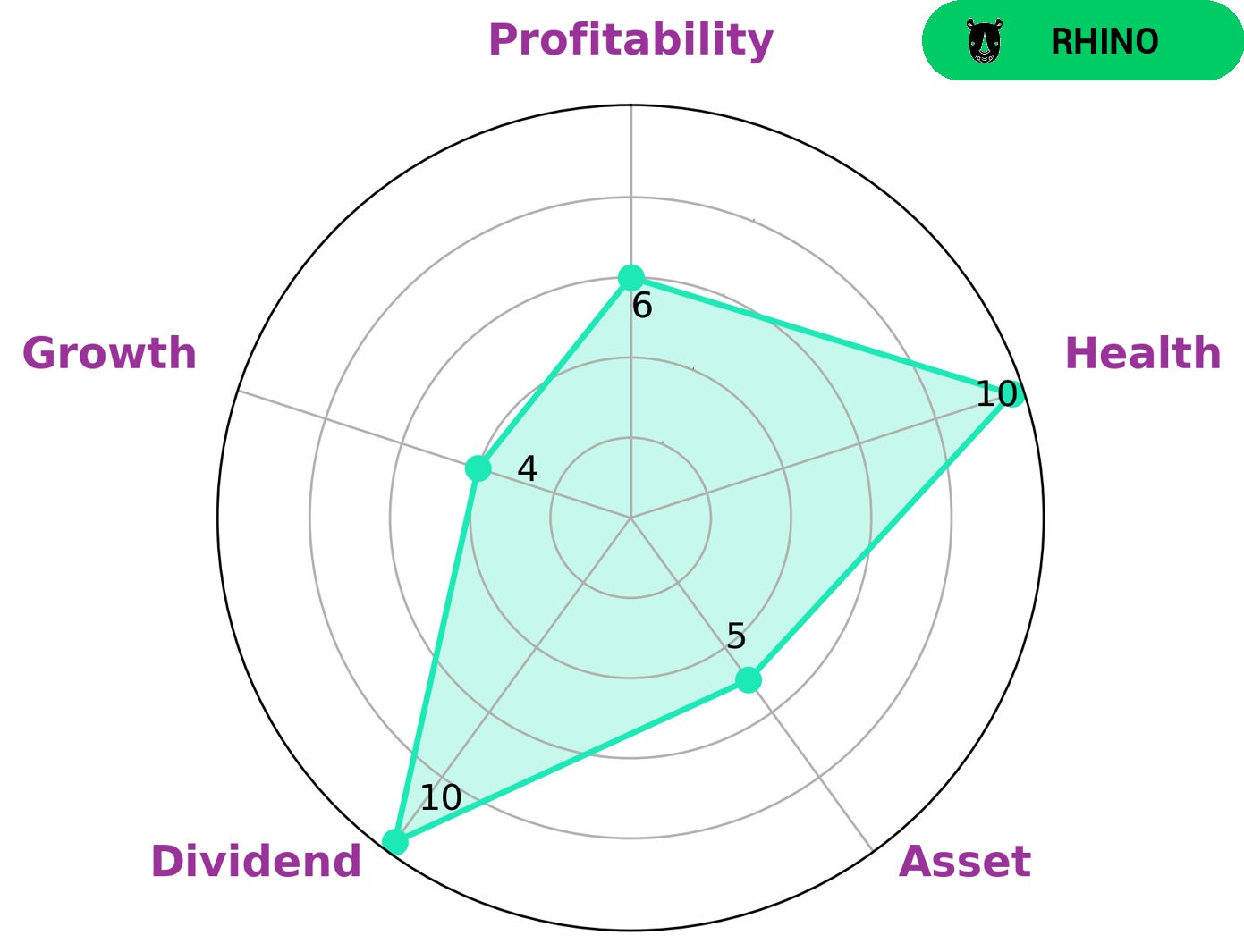

At GoodWhale, we are analyzing the financials of K&S CORPORATION to provide insight into the health of the company. According to our Star Chart, K&S CORPORATION is rated highly with a 10/10 cashflows and debt health score, indicating they are capable of navigating any challenging economic times without the risk of bankruptcy. We classify this company as ‘rhino’, a type of company which has achieved moderate revenue or earnings growth. As for investors, K&S CORPORATION is strong in dividend and medium in asset, growth and profitability. This indicates that investors who value steady dividends and less emphasis on other metrics like growth or profitability may be interested in this type of company. In addition, K&S CORPORATION’s high debt health score makes it a safe and secure investment for those looking for a low risk option. More…

Peers

K&S Corp Ltd is a leading maritime transportation company that provides shipping and logistic services worldwide. The company has a strong presence in Asia, Europe, and North America. K&S Corp Ltd is a publicly traded company listed on the New York Stock Exchange. The company’s competitors include Chinese Maritime Transport Ltd, See Hup Consolidated Bhd, and Being Holdings Co Ltd.

– Chinese Maritime Transport Ltd ($TWSE:2612)

China Maritime Transport Limited is a integrated logistics service provider in China. The Company is principally engaged in the businesses of maritime transportation, warehousing and container trucking. The Company operates its businesses through two segments. The Maritime Transportation Segment is engaged in the businesses of maritime transportation and related services, including providing maritime transportation services, maritime agency services, maritime container trucking services and container yard services. The Logistics Segment is engaged in the businesses of logistics services, including providing international logistics services, domestic logistics services, warehousing services and value-added logistics services.

– See Hup Consolidated Bhd ($KLSE:7053)

Hup Consolidated Bhd is a company that is involved in the manufacturing of steel products. The company has a market capitalization of 79.49 million as of 2022 and a return on equity of 18.28%. The company’s products include steel pipes, steel billets, and steel plates. The company has its headquarters in Kuala Lumpur, Malaysia.

– Being Holdings Co Ltd ($TSE:9145)

Tianhong Asset Management Co Ltd is a Chinese asset management company. It is headquartered in Beijing and was founded in 2003. The company manages assets for both institutional and retail investors. It offers a range of products including mutual funds, private equity, and fixed income. As of 2022, Tianhong Asset Management Co Ltd had a market cap of 10.34B and a return on equity of 16.85%. The company is one of the largest asset managers in China with over $200 billion in assets under management.

Summary

K&S Corporation recently announced that it will be declaring a dividend for the 2023 fiscal year on March 20th. This news generated a modest amount of positive media attention, and the stock price rose on the day of the announcement. For investors considering investing in K&S Corporation, this dividend announcement should be seen as a positive sign of the financial health of the company and could be a potential indicator of future dividend payments. As with any investment, potential investors should conduct their own due diligence on the company’s financials and future prospects before making any decisions.

Recent Posts