Kompap Sa dividend yield calculator – Kompap SA Declares 1.0 Cash Dividend

June 11, 2023

🌥️Dividends Yield

On May 25 2023, Kompap SA declared a cash dividend of 1.0 PLN. This is a significant increase from the average dividends issued by the company over the last three years, which were 0.45 PLN, 0.45 PLN, and 0.5 PLN respectively, yielding a 6.99%, 6.99%, and 7.24% return respectively. With the average dividend yield now at 7.07%, KOMPAP SA ($LTS:0O75) could be an attractive addition to your portfolio of dividend stocks, providing steady, reliable returns for its investors. The ex-dividend date for this dividend is set to May 30 2023, so it’s important to purchase the stocks before that date in order to qualify for the dividend payment.

Stock Price

This marks the company’s first dividend since its initial listing on the Warsaw Stock Exchange earlier this year. The news sparked investor interest in the company’s stock, pushing the share price from an opening of €6.0 to a closing of €6.0. This reflects a small increase in investor confidence in KOMPAP SA‘s ability to deliver future returns. Consequently, shareholders have been rewarded with an attractive dividend payout, which will be paid out in the coming weeks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kompap Sa. More…

| Total Revenues | Net Income | Net Margin |

| 119.23 | 8.52 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kompap Sa. More…

| Operations | Investing | Financing |

| 21.76 | -7.62 | -7.96 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kompap Sa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 116.1 | 36.38 | 18.28 |

Key Ratios Snapshot

Some of the financial key ratios for Kompap Sa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.5% | 20.4% | 8.8% |

| FCF Margin | ROE | ROA |

| 14.9% | 8.3% | 5.7% |

Analysis

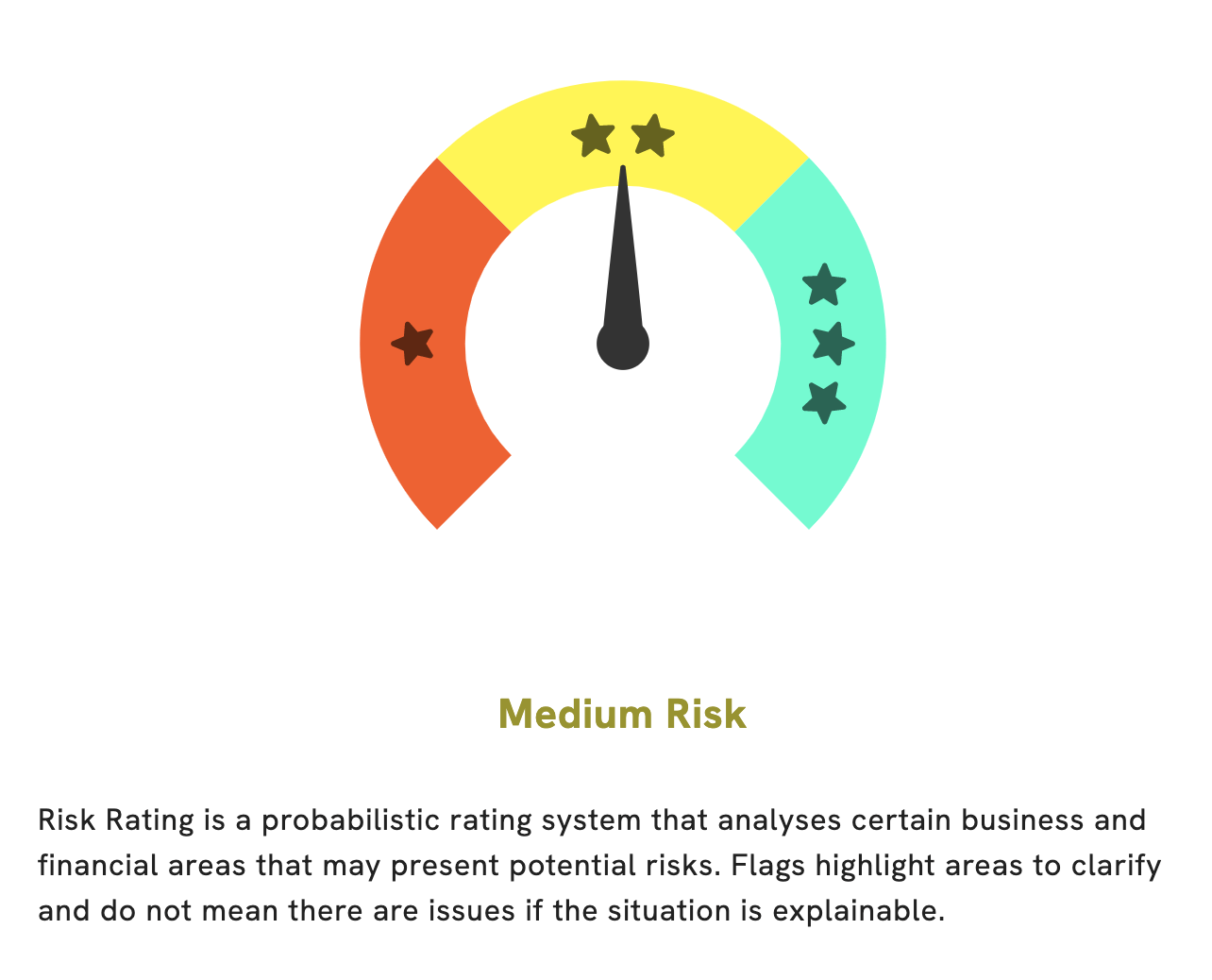

At GoodWhale, we have conducted a comprehensive analysis of KOMPAP SA‘s wellbeing. Our Risk Rating has determined that KOMPAP SA is a medium risk investment in terms of financial and business aspects. Upon further delving into the specifics of the company, we have detected two risk warnings in their income and balance sheets. If you’d like to know more about these issues, please sign up as a registered user on our website. More…

Peers

Sahathai Printing & Packaging PCL, Seshasayee Paper & Boards Ltd, and Zrp Printing Group Co Ltd are among the biggest players in the industry, and Kompap SA is always striving to stay ahead of the competition by offering innovative solutions and top-notch services.

– Sahathai Printing & Packaging PCL ($SET:STP)

Sahathai Printing & Packaging PCL is a leading provider in the printing and packaging industry in Thailand. With a market cap of 975M Thai baht as of 2023, the company has seen an impressive ROE of 11.03%, indicating that it has leveraged its assets and capital structure to generate strong returns for shareholders. Sahathai Printing & Packaging PCL provides printing and packaging services to a variety of industries, including food, beverage, automotive, and medical. The company specializes in offset printing as well as flexo printing and corrugated packaging solutions for its customers.

– Seshasayee Paper & Boards Ltd ($BSE:502450)

Seshasayee Paper & Boards Ltd is a leading paper and paperboard manufacturer in India. The company produces a wide range of paper and paperboards products for packaging, printing, writing, and copying applications. With a market cap of 16.87B as of 2023, the company has proven to be a profitable investment over the years. Furthermore, the company’s Return on Equity (ROE) is an impressive 21.74%, indicating that the company is utilizing its resources efficiently and generating strong profits.

– Zrp Printing Group Co Ltd ($SZSE:301223)

Zrp Printing Group Co Ltd is an international printing company that provides high quality printing services for a wide range of industries, such as publishing, packaging, and in-store marketing. With a market capitalization of 3.67 billion dollars as of 2023, Zrp Printing Group Co Ltd is one of the largest printing companies globally. The company’s Return on Equity is also impressive at 5.5%, demonstrating its strong profitability and financial performance. The company has invested heavily in research and development to ensure that it remains competitive in a dynamic global printing industry.

Summary

Investing in KOMPAP SA can be a sound decision, evidenced by the consistent dividends it has paid out in the last three years. Those dividends have yielded between 6.99% and 7.24%, demonstrating a stable and reliable return on investment. Further, the increasing dividend from 0.45 PLN to 0.5 PLN within the period suggests that KOMPAP SA is a growing company with potential to generate even higher returns in the future.

Recent Posts