KNIU dividend yield – Kuehne + Nagel International AG Declares 3.117345 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On May 26th 2023, Kuehne + Nagel ($BER:KNIU) International AG declared a cash dividend of 3.117345 CHF per share. This makes them an attractive option for those interested in dividend stocks. The company has paid out an annual dividend per share of 1.95 CHF, 1.95 CHF, and 0.91 CHF in the last 3 years, leading to dividend yields of 3.45%, 3.45%, and 1.61% respectively with an average dividend yield of 2.84%. The ex-dividend date is set for May 11th 2023, meaning any shareholders who purchased the company’s stock on or before this date will be eligible to receive the dividend.

Price History

The stock opened at €52.5 and closed at €53.5, representing a 1.9% increase from its prior closing price of €52.5. The dividend announcement is a sign of confidence from the company that it can continue to deliver solid returns to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for KNIU. More…

| Total Revenues | Net Income | Net Margin |

| 35.99k | 2.32k | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for KNIU. More…

| Operations | Investing | Financing |

| 3.79k | -222 | -2.6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for KNIU. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.08k | 9.71k | 6.92 |

Key Ratios Snapshot

Some of the financial key ratios for KNIU are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.1% | 52.7% | 9.3% |

| FCF Margin | ROE | ROA |

| 9.8% | 48.9% | 14.8% |

Analysis

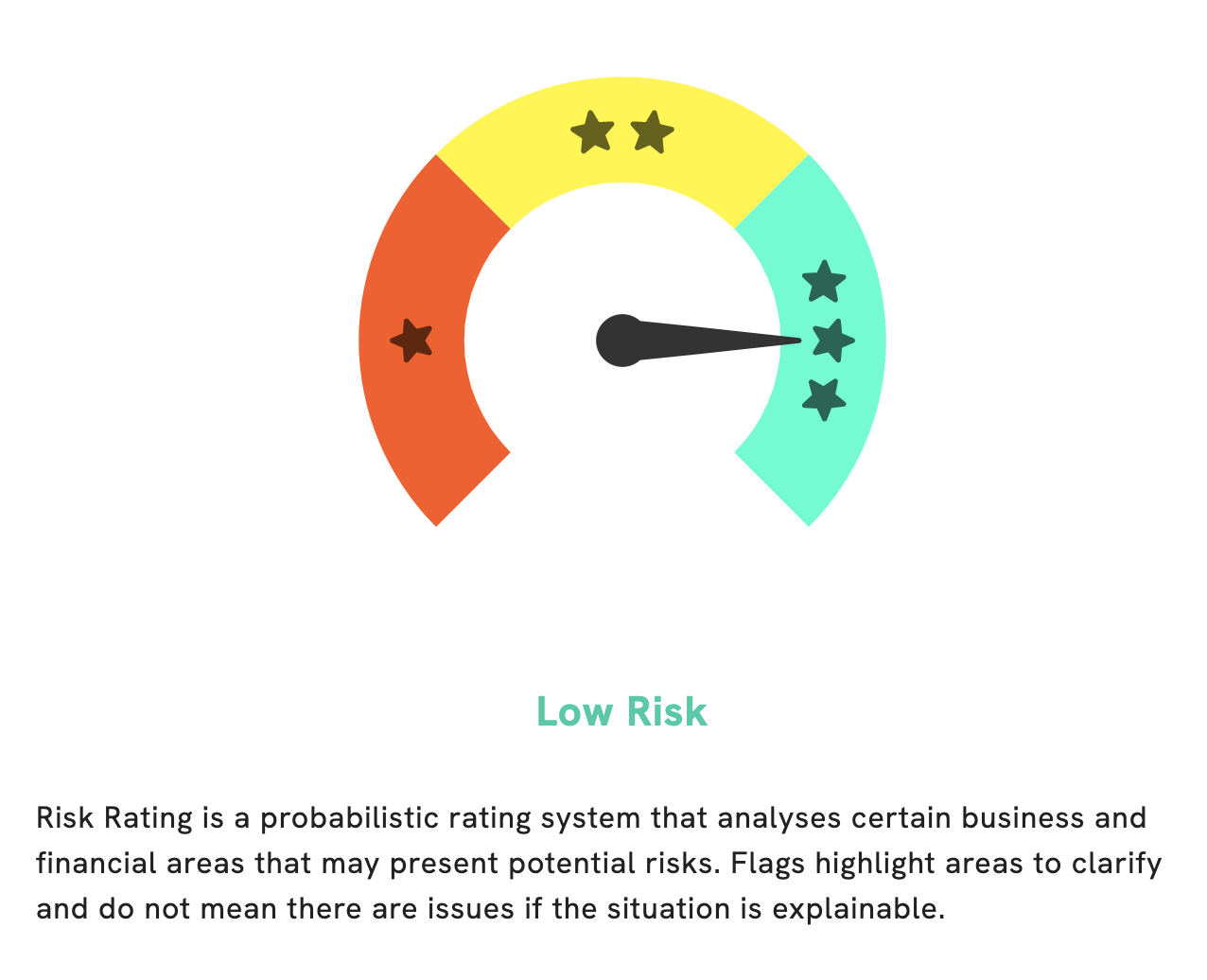

At GoodWhale, we took a deep dive into the fundamentals of KUEHNE + NAGEL INTERNATIONAL AG and have come to the conclusion that it is a low risk investment when it comes to financial and business aspects. We rate it as such based on our Risk Rating. We also detected one risk warning in the income sheet for KUEHNE + NAGEL INTERNATIONAL AG. If you’d like to learn more about this warning, please register with us and we’ll be happy to provide you with more information. More…

Peers

It has a large presence in Europe, Asia, and North America, and competes with other major international logistics companies such as Wiseway Group Ltd, Flomic Global Logistics Ltd, and Grand Power Logistics Group Ltd. These companies are all dedicated to providing customers with efficient and reliable logistics solutions for their transport needs.

– Wiseway Group Ltd ($ASX:WWG)

Wiseway Group Ltd is a Chinese investment holding company operating in the transport and logistics space. The company has a market capitalization of 8.87M as of 2023 and a Return on Equity (ROE) of -39.82%. This market cap size indicates it is a small-cap company, and its negative return on equity suggests that Wiseway Group Ltd is not performing well in terms of profitability. Wiseway Group Ltd’s core business focuses on providing logistics and transport solutions for customers in the Chinese market.

– Flomic Global Logistics Ltd ($BSE:504380)

Flomic Global Logistics Ltd is a global logistics and supply chain management company with operations in over 50 countries. The company specializes in optimizing supply chain operations and improving logistics efficiency. As of 2023, Flomic had an impressive market cap of 1.81B, indicating a strong performance and a bullish sentiment towards the company. Furthermore, the company’s Return on Equity (ROE) of 32.53% shows that the company is effectively utilizing its equity to generate higher returns, further highlighting its impressive performance.

– Grand Power Logistics Group Ltd ($SEHK:08489)

Grand Power Logistics Group Ltd is a Chinese logistics company that provides global supply chain solutions and services. The company offers integrated solutions including logistics, freight forwarding, warehousing, customs brokerage, and value-added services. As of 2023, Grand Power Logistics Group Ltd had a market cap of 61.5M and a Return on Equity of -16.09%. This shows that the company has underperformed relative to its peers in terms of financial performance. Despite this, the company has managed to remain profitable, thanks to its diversified customer base and well-managed operations.

Summary

KUEHNE + NAGEL INTERNATIONAL AG is an attractive investment option for dividend investors. The company has issued a reliable dividend per share in the last 3 years, with an average yield of 2.84%. It has a strong balance sheet, with solid financials and a healthy return on equity.

Additionally, the company’s stock has outperformed its peers in the stock market, resulting in an impressive long-term return for shareholders. It is a great opportunity for investors looking for an established dividend-paying stock with ample upside potential.

Recent Posts