Investore Property dividend yield calculator – Investore Property Ltd Declares 0.01975 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On May 27th 2023, Investore Property ($NZSE:IPL) Ltd declared a 0.01975 cash dividend. This dividend marks a continuation of their trend in paying out an average annual dividend per share of 0.08 NZD over the past three years. This dividend also yields 5.06% per annum from 2023 to 2025, making it a worthwhile investment for those looking for reliable dividends. The ex-dividend date for this dividend is May 26th 2023, meaning those who purchase shares prior to this date can receive the dividend. INVESTORE PROPERTY could be a strong consideration for those seeking dividend stocks with a steady yield.

Their track record and consistent dividend payouts make them a reliable option for investors looking for steady returns from their investments. With the current dividend yield of 5.06% per annum, INVESTORE PROPERTY is offering an attractive option for those wanting to add dividend stocks to their portfolios.

Market Price

This announcement caused the stock to open at NZ$1.4 and close at the same price, slightly down by 0.7% from the previous closing price of NZ$1.4. This move follows the company’s trend of providing regular dividend payments to its shareholders. Shareholders can expect to receive a total of NZ$0.01975 per share on that date.

This dividend marks an important milestone for the company, as it demonstrates their commitment to returning value to their shareholders. Investors should expect to see continued progress in this area in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Investore Property. More…

| Total Revenues | Net Income | Net Margin |

| 70.99 | -150.2 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Investore Property. More…

| Operations | Investing | Financing |

| 31.47 | -36.3 | 2.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Investore Property. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 405.27 | 1.84 |

Key Ratios Snapshot

Some of the financial key ratios for Investore Property are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 72.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

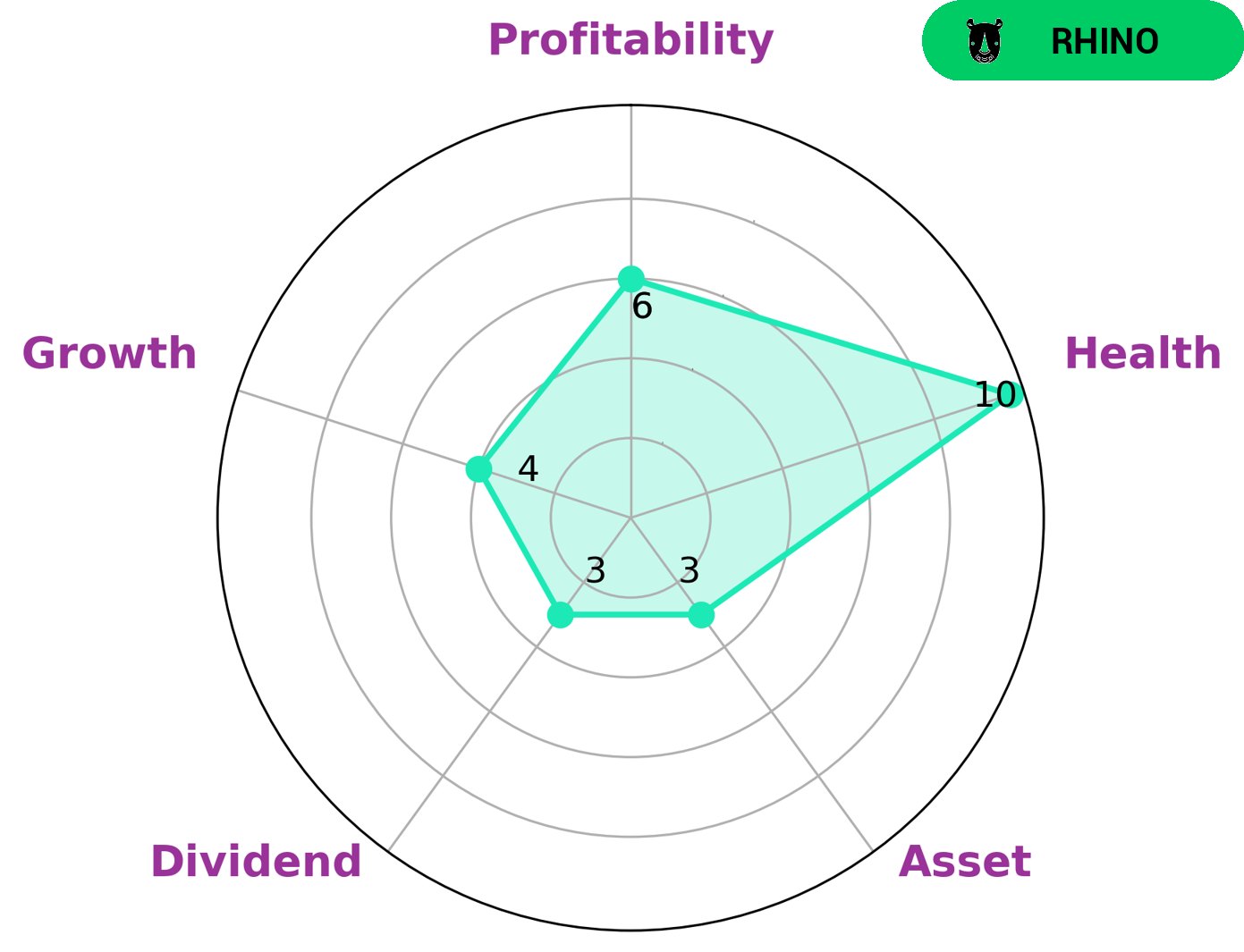

At GoodWhale, we have conducted an analysis of INVESTORE PROPERTY‘s fundamentals. According to our Star Chart, INVESTORE PROPERTY’s strengths lie in its growth, profitability, and dividends, while its weaknesses lie in its assets. As such, we have classified INVESTORE PROPERTY as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Given this information, we can surmise that INVESTORE PROPERTY is an attractive opportunity for investors looking for moderate growth in their portfolio. Furthermore, INVESTORE PROPERTY has a high health score of 10/10, indicating that the company is capable of sustaining its operations through times of crisis due to its strong cashflows and low debt. More…

Peers

It is one of the leading REITs in the country and competes with other major players such as HomeCo Daily Needs REIT, BHG Retail REIT and Vastned Belgium. All four companies have a strong presence in their respective markets, offering quality real estate investments to their customers.

– HomeCo Daily Needs REIT ($ASX:HDN)

HomeCo Daily Needs REIT is a real estate investment trust (REIT) that specializes in investing in daily needs retail properties in Australia and New Zealand. As of 2023, the company has a market cap of 2.83 billion dollars. This large market capitalization reflects the strong demand for HomeCo’s services and its ability to generate consistent returns for its investors. HomeCo Daily Needs REIT focuses on acquiring, owning, and managing retail properties in the daily needs sector in Australia and New Zealand. These properties are typically anchored by supermarkets and convenience stores, as well as pharmacies, specialty retailers, and other businesses catering to the needs of everyday life. The company’s portfolio consists of over 500 properties, with a total gross lettable area of over 1.7 million square meters.

– BHG Retail REIT ($SGX:BMGU)

BHG Retail REIT is a real estate investment trust that focuses on retail properties. As of 2023, the company has a market cap of 258.74M. BHG Retail REIT owns and operates a portfolio of primarily regional shopping malls and retail centers, which are located in select major metropolitan and regional markets in the United States. The company’s properties are primarily leased to national and regional retailers, as well as local and regional operators. In addition to acquiring, developing, and leasing retail properties, BHG Retail REIT also provides asset management and property management services.

– Vastned Belgium ($LTS:0ET5)

Vastned Belgium is a retail real estate company that specializes in the acquisition, development, and management of retail properties in Belgium. With a market cap of 150.32M as of 2023, the company has experienced significant growth in recent years, as investors have taken a keen interest in the potential of the Belgian retail market. Vastned Belgium’s portfolio consists of shopping centers, shopping streets, retail parks, and specialty stores throughout Belgium. The company is focused on providing a strong and sustainable return for its investors by continually investing in the acquisition and development of high-quality retail locations.

Summary

Investing in INVESTORE PROPERTY can be a reliable option for dividends. For the past 3 years, the company has paid an average dividend of 0.08 NZD per share. From 2023 to 2025, the dividend yield is estimated at 5.06% per annum.

This makes INVESTORE PROPERTY an attractive pick for dividend hungry investors looking for a steady return over the long term. With a reliable dividend track record and forecasted yields, INVESTORE PROPERTY is a sound investment choice.

Recent Posts