Hung Hing Printing dividend yield calculator – Hung Hing Printing Group Ltd Announces 0.04 Cash Dividend

June 12, 2023

🌥️Dividends Yield

On May 25, 2023, Hung Hing Printing ($SEHK:00450) Group Ltd announced that it will be issuing a 0.04 HKD cash dividend per share. This is the fourth consecutive year that the company has issued an annual dividend per share, with the dividend yields over the last three years being 7.05% from 2020 to 2022. For those looking for a dividend stock, HUNG HING PRINTING may be a good addition to their portfolio. The ex-dividend date for this dividend is May 30, 2023, meaning that those who own the stock prior to that date will be eligible to receive the dividend payments.

HUNG HING PRINTING has been a consistent provider of dividend yields and could be a great option for those seeking out a profitable and reliable dividend stock. With their upcoming dividend payment on May 30, 2023, now is a great time for investors to add HUNG HING PRINTING to their portfolios.

Market Price

The stock of Hung Hing Printing Group Ltd opened at HK$1.1 and closed at HK$1.1 on Thursday, down by 0.9% from its last closing price of 1.1. With this announcement, shareholders can expect to receive the dividend payout in the near future. The announcement of the dividend is likely to increase investor confidence in Hung Hing Printing Group Ltd. and may attract more investors into the stock, thus boosting its performance in the stock market. It is expected that the dividend will provide an additional source of income for the company and its shareholders, and further strengthen its financial position in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hung Hing Printing. More…

| Total Revenues | Net Income | Net Margin |

| 2.95k | 66.04 | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hung Hing Printing. More…

| Operations | Investing | Financing |

| 455.95 | -3.28 | -135.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hung Hing Printing. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.99k | 795.1 | 3.36 |

Key Ratios Snapshot

Some of the financial key ratios for Hung Hing Printing are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.5% | -41.2% | 2.7% |

| FCF Margin | ROE | ROA |

| 9.7% | 1.6% | 1.2% |

Analysis

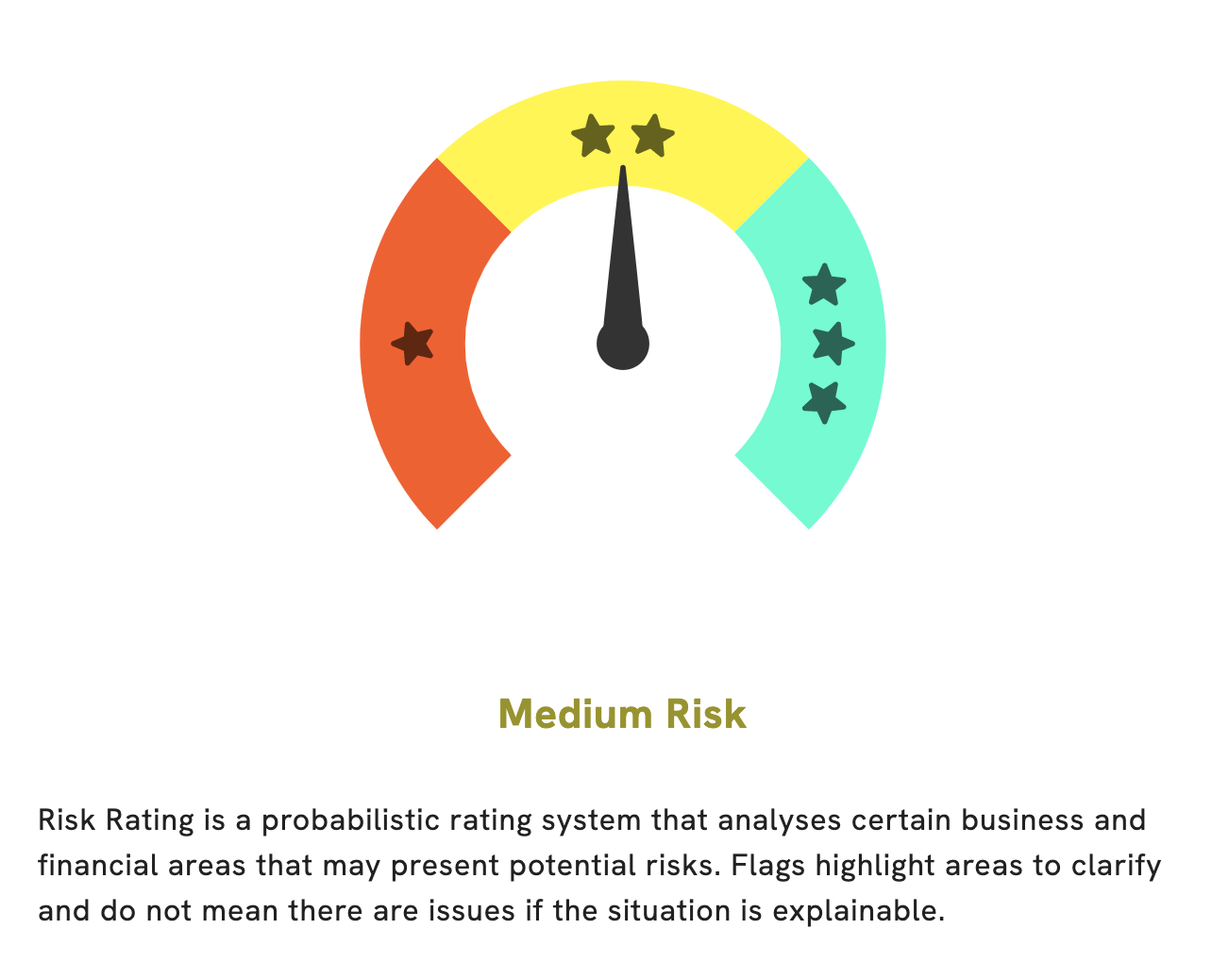

At GoodWhale, we have analyzed the financials of HUNG HING PRINTING. Our Risk Rating indicates that it is a medium risk investment in terms of financial and business aspects. Additionally, we’ve detected one risk warning in their income sheet. If you are interested in finding out more about the risk warning, become a registered user of GoodWhale and check it out. More…

Peers

The printing industry is highly competitive and the rivalry between Hung Hing Printing Group Ltd and its competitors A.Plus Group Holdings Ltd, Sun Hing Printing Holdings Ltd, and eprint Group Ltd is intense. All four companies are vying for the top spot in the printing industry and are constantly assessing each other’s strategies to stay at the forefront of their market.

– A.Plus Group Holdings Ltd ($SEHK:01841)

A.Plus Group Holdings Ltd is a Hong Kong-based company that provides integrated business solutions and services to small and medium-sized enterprises. As of 2023, the company has a market capitalization of 128M and a Return on Equity of 9.27%, indicating the company’s strong financial performance and growth potential. The company has a diversified portfolio of services, including corporate finance, investment banking, corporate advisory, and asset management, as well as venture capital investments. It is well positioned to capitalize on the increasing demand for its services in the region.

– Sun Hing Printing Holdings Ltd ($SEHK:01975)

Sun Hing Printing Holdings Ltd is a Hong Kong-based printing services provider that specializes in offset, digital, and large format printing. As of 2023, the company has a market cap of 384M and a Return on Equity of 22.28%. Sun Hing’s market cap demonstrates its size and importance in the printing industry, while its excellent ROE is a testament to the company’s financial performance and profitability. Sun Hing Printing Holdings Ltd has been utilizing its strong financial position to expand its operations and increase its market share.

– eprint Group Ltd ($SEHK:01884)

Eprint Group Ltd is a global leader in printing and packaging solutions. Established in 2002, the company has grown to become one of the world’s largest printing and packaging companies with operations in Europe, North America, and Asia. With a market cap of 269.5M as of 2023, Eprint Group Ltd has seen tremendous growth over the past several years. This impressive performance is reflected in the company’s Return on Equity (ROE) of 1.45%, which is quite impressive given the difficult nature of the industry. Despite the tough competition, Eprint Group Ltd has been able to maintain its position as a leading player in the global printing and packaging industry.

Summary

Investing in HUNG HING PRINTING can be a smart move for dividend investors. The company has issued a consistent and attractive dividend of 0.08 HKD per share over the past three years, resulting in an impressive dividend yield of 7.05%. This makes it an attractive option for those seeking to boost their income from stocks. With a reliable history of dividend payouts, HUNG HING PRINTING appears to be a reliable and profitable choice for investors looking to add dividend stocks to their portfolios.

Recent Posts